AvaTrade Review

This is a Trusted and Regulated Broker!

AvaTrade Review 2020

9.3/10

$100

Minimum DepositAvaTrade is a brokerage firm and trading platform that supports forex pairs and contracts for differences (CFDs) on a wide range of financial instruments, including cryptocurrencies. The platform was established in 2006 under AvaFX brand. In 2012, the company rebranded and replaced its old name with AvaTrade.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

| AvaTrade Key Information | |

| Broker site : | https://www.avatrade.com/ |

| Established Date: | 2006 |

| License: | Central Bank of Ireland, ASIC, Japanese FSA and FFAJ, BVI Financial Services Commission, and South African FSB |

| Languages supported: | 30 languages, including English, German, Spanish, Italian, Russian, French, Arabic, Chinese, Polish, Nigerian, Japanese, Korean, Magyar, etc |

| Cryptocurrencies: | BTC, ETH, XRP, LTC, BCH, XLM, DASH, BTG, NEO, and EOS |

| Payment methods: | Credit/Debit Card, Wire Transfer, e-wallets (Skrill, Neteller, WebMoney, Poli (Australia), Boleto (Brazil) |

| Withdrawal Time: | Up to 5 days |

AvaTrade is a brokerage firm and trading platform that supports forex pairs and contracts for differences (CFDs) on a wide range of financial instruments, including cryptocurrencies. The platform was established in 2006 under AvaFX brand. In 2012, the company rebranded and replaced its old name with AvaTrade.

While the broker was registered in the Virgin Islands, its central office is located in Dublin, Ireland. Besides, it has regional offices in Paris, Milan, Sydney, Tokyo, Beijing, Madrid, Abuja, Ulaanbaatar, Madrid, Santiago, and New York, Mexico City, South Africa, among others.

AvaTrade operates several subsidiaries that are regulated in their respective jurisdictions. Thus, AVA Trade EU Ltd is licensed by the Central Bank of Ireland (MiFID compliant), and AVA Trade Ltd is regulated by Virgin Islands’ BVI Financial Services Commission. Other branches operate under the supervision of the ASIC (Australia), FSB (South Africa), and FFAJ (Japan). US and Iranian citizens cannot access the platform.

The brand is quite popular among the forex and crypto communities, as the broker has collected multiple awards over the years.

In June of last year, Ava extended its partnership with legendary football club Manchester City, which is the winner of Premier League 2017/2018.

Here is the broker’s short overview:

AvaTrade provides an extended list of tradable assets, which comprises cryptocurrencies, forex pairs, company shares, commodities, ETFs, and even bonds. Here is what you can trade on the platform:

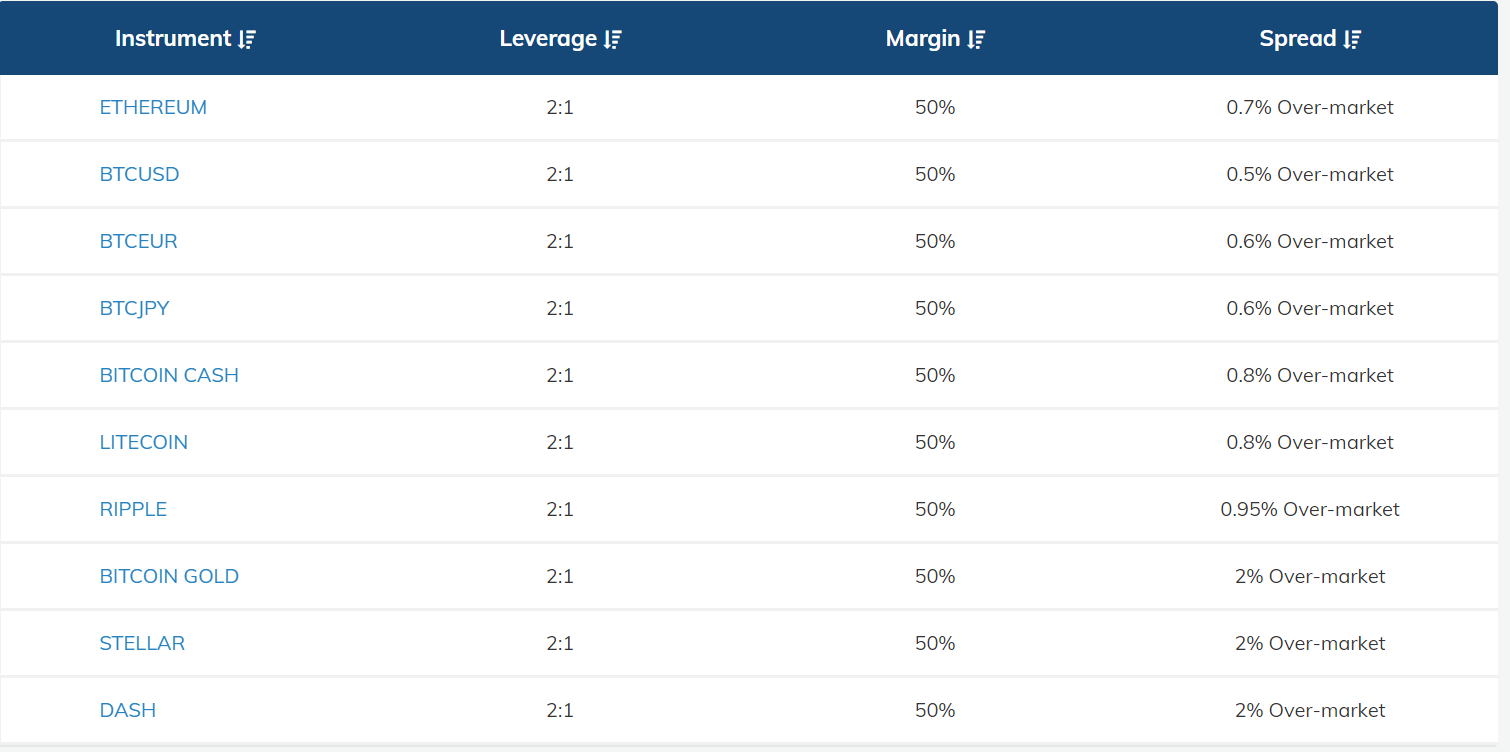

- 14 crypto instruments, including 13 pairs and an index. Traders can bet on three Bitcoin pairs, including BTC/USD, BTC/EUR, and BTC/JPY. Besides, they can get exposure to Ethereum, Bitcoin Cash, Ripple, Bitcoin Gold, Litecoin, Stellar, Dash, NEO, EOS, and MIOTA. The crypto index tracks 10 largest cryptocurrencies by market cap. The leverage for retail customers is 2:1.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

- The forex list includes majors (EUR/USD, AUD/USD), minors (AUD/CAD, GBP/JPY, EUR/GBP), and exotic pairs. In total, Ava supports 55 foreign exchange pairs. The maximum leverage for retail traders ranges from 20:1 to 30:1. Advanced traders can increase the leverage to as high as 400:1.

- Over 620 stocks, including US stocks (Google, Apple, Wal Mart, Twitter), UK stocks (Barclays, BP, Vodafone, HSBC), Spanish companies (BBVA, Telefonica), German stocks (BMW, Siemens, Deutsche Bank, Bayer, Allianz), French stocks (Peugeot, Danone, Orange), and Italian companies, among others. Note that the majority of stocks are available via the Metatrader 5 (MT5) platform.

- 18 commodities, including energy, metals, and agricultural commodities.

- 20 stock indexes.

- 2 bonds.

- 5 exchange-traded funds (ETFs).

Besides this, you can trade forex options on 42 fiat pairs.

AvaTrade Account Types

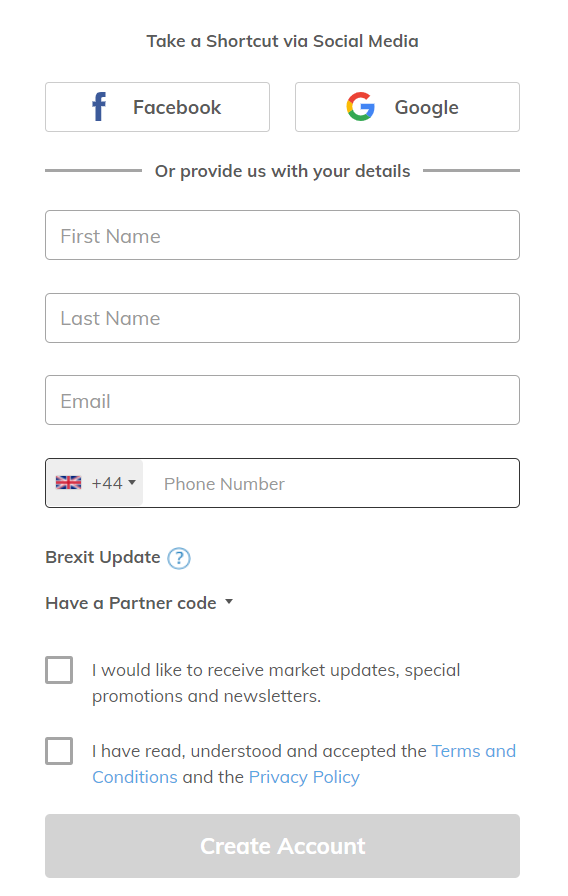

Several years ago, AvaTrade used to offer multiple account types with different minimum deposit requirements. However, currently, there is only one live account that is available to everybody. In order to start trading with the live account, you have to deposit at least 100 USD, euro or pounds.

On a side note, the registration process is straightforward.

The Islamic account type is available for Muslims who want to trade under the Sharia law, which suggests interest-free trading.

The demo account type is designed for beginners who want to practice with virtual money. Unfortunately, you can enjoy the demo account for only 21 days. The good news is that you may get $100,000 virtual cash.

AvaTrade Platforms and Fees

AvaTrade offers a proprietary trading platform (Web Trader) that comes in multiple versions. Also, traders can choose from MT4 and MT5 as well.

AvaTrade’s flagship web trading platform has a lot of interesting features, including basic ones like one-click trading, technical indicators, and multi-chart options. The platform can be accessed through the downloadable version, WebTrader version, Mac version, and the mobile trading modes for both iOS and Android devices (AvaTradeGo – Mobile APP).

MT4 and MT5 are the most popular platforms, especially among forex traders.

Besides the mentioned platforms used for standard trading, users can download AVAOptions for options trading and Zulu Trade or DupliTrade for automated trading.

It’s worth mentioning that AvaTrade has some of the tightest spreads in the CFD market and very low commissions.

For crypto traders, the spread ranges from 0.5% for BTC/USD to 2% for altcoins like Stellar, NEO, and Dash.

Deposit/withdrawal conditions

Depositing with AvaTrade is quite easy. You can replenish the live account by credit card (VISA, MasterCard), wire transfer or e-wallet (Neteller, Skrill, WebMoney). However, the e-wallets are not accessible for withdrawals.

Before applying for any withdrawal, you should pass the ID verification procedure, which is mandatory for any regulated broker out there.

The minimum deposit with the card is $100. For wire transfers, you should deposit no less than $500.

The bad news for crypto enthusiasts is that you cannot fund your account with Bitcoin or any other digital currency. However, the fact that there are no deposit/withdrawal fees offset this drawback.

Customer Support

The customer support service with AvaTrader is responsive and to the point. You can contact them by one of the following communication methods:

- Email – [email protected].

- Live chat directly from the official page.

- Phone – international contacts: +353766705834.

AvaTrade Pros and Conclusion

Here is a list of advantages that makes AvaTrade a leading broker for forex, crypto, and CFD traders:

- There is a great choice of crypto instruments. Also, those who want to diversify their crypto exposure can trade the crypto index.

- The broker is highly regulated in several jurisdictions across the world.

- Ava offers its own platform, along with MT4, MT5, and automated trading platforms.

- The maximum leverage for pro traders is one of the highest in the CFD industry – 400:1.

- Beginners can browse through Ava’s education page, which comprises the blog, an ebook, video tutorials, professional strategies, and many explainers.

- The website is available in 30 languages.

The fact that AvaTrade got so many awards and is always present in the list of top brokers says it all. We think that this is one of the most reliable brokers. Thus, our rating for AvaTrade is 4.6 out of 5.00, thanks to its wide range of platforms, asset index, and customer support.

Looking for somewhere else to trade?

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.