Coinbase Review: For Hassle-Free Crypto Buying and Selling

As one of the earliest pioneers in the centralized exchange space for cryptocurrencies, Coinbase stands out as a highly most popular destinations for cryptocurrency enthusiasts seeking to enter the nascent market. With a rapidly expanding user base and a massive following, Coinbase is one of the top destinations for crypto trading.

| Coinbase Key Information | |

| Company Location: | United States |

| Mobile App: | Yes (iOS, Android) |

| Fiat Deposit: | Yes |

| Fiat Withdrawal: | Yes |

| Transfer Limits: | $7,500 Weekly for credit card, $25,000 for ACH transfer |

| Supported Fiat: | USD, EUR, GBP |

| Payment Methods Accepted | Credit card, bank deposit, wire transfer |

| Supported Crypto: | Bitcoin, Ether, Litecoin, Tether, 386 currency pairs |

| Supported Countries: | US; Canada; Singapore; EU excluding Germany, France & 8 more |

| Fees: | 1.00% seller’s fee |

| Website (URL): | Start trading at Coinbase.com |

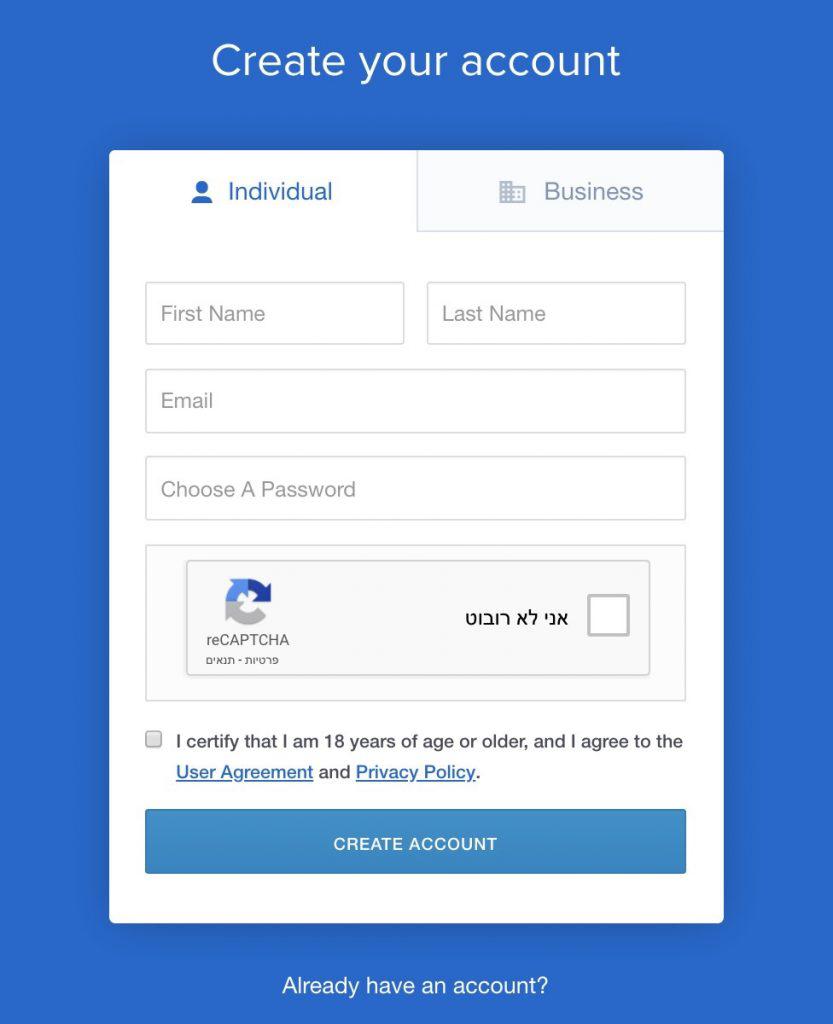

Login and Signup

To register a Coinbase account, you simply need to press “Sign Up” and provide your basic personal details and verify that you are 18 years or older. For business users, whether institutional traders, corporate clients, or merchants seeking a plugin for accepting cryptocurrency payments, the process requires more detailed information pertaining to the business itself, its activities, and other very firm-specific particulars.

After creating your account, you will be asked to verify it via email, where you will receive a confirmation link. After completing this step, users are asked to take additional steps for identity verification. Because it is regulated, Coinbase strictly complies with Know Your Customer and Anti-Money Laundering directorates. To meet these requirements, users are required to verify their identity, which may not be ideal for users that are privacy conscious or seeking greater anonymity.

The verification process varies by jurisdiction. For US-based customers, users must upload an image of a valid driver’s license or state issued ID. Passports are not an accepted form of ID due to state-by-state restrictions. In addition, US-based users must supply a valid residential address and the final 4 digits of their social security number for verification.

UK customers have a slightly different process. An ID document, driver’s license, or passport are all considered valid forms of ID for the compliance process. In addition, users will be asked verification questions to check a user’s identity against national databases.

For the remainder of the jurisdictions that are eligible for using Coinbase, two forms of ID must be uploaded which can include any combination of a passport, driver’s license, or national identity card. The entire identity verification process might take as little as a few days to a over a week depending on the documentation supplied and the compliance backlog. After verifying a user identity, users are tasked with supplying their payment method to buy cryptocurrency or depositing cryptocurrency to begin trading on the platform.

How It Works

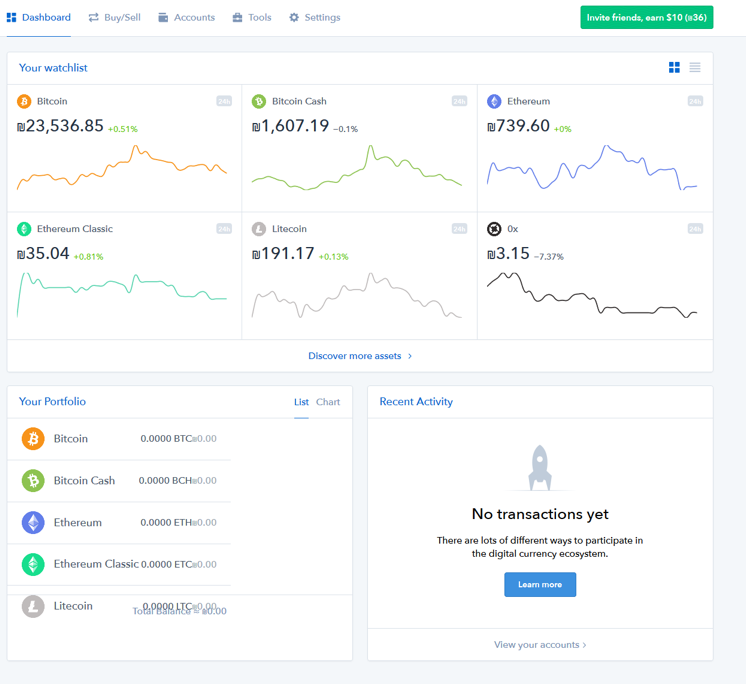

Once a user has completed their application and verification, they will be directed to the Coinbase Dashboard. From here, they can view real-time rates for cryptocurrencies supported by the platform along with their portfolio holdings and recent account activity.

By selecting Buy/Sell, a customer can use their preferred payment method to begin transacting in cryptocurrency. Users can select the cryptocurrency they wish to buy or sell, the payment method for purchases, and the deposit destination for sales, before inputting the amount of cryptocurrency or fiat currency they wish to buy or sell.

The window on the righthand side of screen will display the payment method, where the crypto funds or fiat funds will be deposited, and finally the amount of crypto that will be bought or sold along with the accompanying Coinbase fees. After all the pertinent details are checked, users can hit the blue button to buy or sell. Furthermore, users can opt to set up recurring transactions by selecting “Repeat this buy” and setting a schedule for the increments of these purchases, whether daily, weekly, bi-monthly, or monthly.

For more advanced users that wish to trade more frequently and take advantage of charting tools and different order types like market, limit, and stop orders, accessing the Coinbase Pro platform delivers greater trading functionality. From here users have more options for trading in cryptocurrency pairs and benefiting from price charting, technical analysis tools, market depth charts, the order book, and other tools. There are even tax reporting tools available for Coinbase Consumer and Coinbase Pro accounts to help users comply with local laws.

Supported Countries

Although its primary market is North America between US and Canadian-based users, Coinbase also supports certain European countries along with Australia and Singapore. It’s important to note that these last two jurisdictions and Canada are strictly limited to buying cryptocurrencies and are unable to sell them in exchange for fiat currencies.

European countries that are eligible for buying and selling cryptocurrencies on Coinbase include most of the EU excluding Estonia, Germany, France, Lithuania, and Romania. Non-EU countries that are supported include Jersey, Lichtenstein, Monaco, Norway, San Marino, and Switzerland.

Supported Cryptocurrencies

While Coinbase was one of the first exchanges to provide fiat-to-cryptocurrency conversion, the number of coins and cryptocurrency pairs listed on the platform remains relatively small compared to other competitors in the space. Cryptocurrencies offered are currently limited to bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), and recent addition 0x (ZRX). While there was talk in the past of adding Ripple (XRP) to the mix, no new developments in this area have been reported.

Coinbase has experienced very few liquidity issues since the hurdles that were encountered late in 2017 and early 2018. Since the downturn that encircled most cryptocurrencies during the first half of 2018, the exchange has reportedly faced no liquidity issues, however, another high-volume period for the cryptocurrency ecosystem might see those circumstances change.

Deposit/Trade/Withdrawal Fees

Depending on the service that customers use (Coinbase Consumer or Coinbase Pro) along with the payment methods, fees can vary widely.

For Coinbase Pro users, price takers will be assessed a taker fee of 0.30% for up to $10,000,000 in 30-day trailing volumes. That fee is sharpened up to 0.20% for $10,000,000 to $100,000,000 in volume and 0.10% for over $100,000,000 in volume during the trailing 30-day period. However, for market-makers, or those individuals who place bids and offers, the fees are 0.00%. Deposit and withdrawal fees for cryptocurrency are free as well as fiat withdrawals using an ACH transfer. Wire transfers in USD are charged $10.00 for a deposit and $25.00 for a withdrawal. SEPA deposits and withdrawals encounter a €0.15 fee for each transaction. Additionally, digital assets sent to wallet addresses outside the exchange will incur mining fees for the processing and confirmation of the transfers.

Coinbase Consumer users will encounter several fees for executing transactions through this portal. The first is a 0.50% (50 basis point) spread which is added to the quoted Coinbase exchange rate for the digital asset being purchased. In addition, the actual spread may differ from the quoted spread depending on the lag time between receiving a quote an executing an order, but this depends on market volatility. Apart from the spread, Coinbase charges a fee for the transaction operates on a sliding scale.

Transactions for up to $10.00 worth of cryptocurrency are assessed a $0.99 fee. Transactions between $10.01 to $25.00 cost $1.49, and $25.01 to $50.00 costs $1.99. Finally, transactions ranging from $50.01 to $200 cost $2.99.

Variable fees may also be included, but some may be waived depending on payment type and geographical location. The standard buy/sell rate for most locations is 1.49% in Europe, the UK, and Singapore. In Europe, the standard rate begins at 1.49%, with instant buys with a credit or debit card costing 3.99% while bank transfers incur no fees for purchases but a €0.15 fee for withdrawals.

Users from Australia, Canada, Singapore and using a credit or debit card to purchase cryptocurrency will incur a 3.99% fee.

US users face a base rate of 4.00% for all transactions, but a portion of this amount will be waived depending on the method of payment and does not pertain to US dollar deposits and withdrawals. They will encounter a 1.49% fee for using a bank account or Coinbase wallet to fund a purchase, and 3.99% for credit/debit card purchases. However, users should note that using a credit card might incur even more fees than this amount from the issuer. For payouts after a sale, bank account holders or Coinbase wallet holders will encounter a 1.49% fee.

Transfer Limits

Like many exchanges, Coinbase has no cap on the amount of cryptocurrency that can be deposited within the exchange. According to the latest available update from Coinbase, US-based exchange customers will now be able to purchase up to $7,500 worth of cryptocurrency weekly via a credit card. ACH transfers for up to $25,000 for verified can be made daily, and there is no limit to the amount of money that can be transferred via wire transfer.

After opening a Coinbase Pro account, the initial limit for withdrawals is capped at $10,000 per day for both fiat currency and cryptocurrency, but this limit can be lifted with a request to increase the limit in an account. By visiting the limits tab page of an account profile, a user can make a request to increase an account’s withdrawal limit.

Payment Methods Accepted

One of the most advantageous attributes of the Coinbase platform is the numerous payment methods that users have at their disposal. The company accepts debit and credit card payments, ACH transfers (US-based clients), SEPA transfers (Euro-based clients), and wire transfers. However, it should be noted that certain credit card issuers will not allow customers to buy cryptocurrency with credit cards, assess additional fees, or treat cryptocurrency purchases as cash advances which incur a higher rate of interest.

Security: Is It Safe to Use?

Since its inception, Coinbase has experienced no security failures that have compromised user accounts. Coinbase regularly ensures information security for users by confirming that they are accessing accounts from verified devices, offering 2-factor authentication to grant users added security for their accounts. Furthermore, the website and exchange are protected by SSL and TLS protocols to ensure a safe, reliable, and secure experience.

The one area where users should be vigilant has to deal the exchange wallet. Because this is not a personal wallet with a personal private key, users can add an extra layer of security by keeping their crypto holdings off the exchange. However, Coinbase also mitigates this risk by holding most user funds in cold storage.

Company Reputation

Since its founding in 2012, Coinbase has been one of the top destinations for US-based investors seeking to enter the cryptocurrency ecosystem. The company claims that over $150 billion worth of cryptocurrency has been traded on the platform that boasts over 20 million users at last count.

However, this unbridled success in terms of turnover figures and a strong user base has not been without criticism. Some of the harshest critiques have come in the form of the opaque practices and listing requirements that are undertaken by the exchange. Customers have complained about exchange downtime, outages, and maintenance during periods of high volatility and low liquidity which have prevented users from accessing accounts, transferring coins, or even placing trades.

Brian Armstrong, CEO of Coinbase

Moreover, customer complaints about slow and un-attentive customer service have encircled the company. While they provide email and phone support, waiting times for responses are reportedly very long depending on the prevailing volume and volatility conditions present in cryptocurrency markets.

Finally, during periods of high activity, customers have complained about cryptocurrency withdrawals taking inordinate amounts of time, adding to concern about the company’s opaque practices. Nonetheless, this might have been more symptomatic of blockchain networks being bombarded with transfer activity which resulted in slower confirmation times.

However, since these issues arose, the company has worked hard to burnish its image by regularly updating its Incident History list hosted on the website. These entries provide clarification about the incidents and the steps taken to resolve problems. Apart from instilling a greater sense of reliability, it goes a long way towards burnishing the company’s credentials as an honest, transparent exchange that is willing to accept and admit its missteps.

Conclusion

Coinbase stands out as one of the more robust options for cryptocurrency trading. Between its simple interface for simply buying and selling to its more advanced exchange platform for trading cryptocurrency pairs (both fiat-to-crypto and crypto-to-crypto) and numerous deposit options, Coinbase stands out for its ease of use. However, for more privacy conscious users and those seeking to exchange only cryptocurrencies, the limited number of pairs available might make Coinbase a less attractive outlet for trading cryptocurrencies.