Coinmama Review: What You Must Know Before Getting Started

Originally founded in 2013 in Israel, Coinmama has become a go-to destination for users looking to purchase some of the most popular cryptocurrencies on the market. Today, the company is registered in Slovakia, and has expanded its coverage to more than 180 countries as well as almost half of the United States. Coinmama focuses on providing users an easy option to purchase cryptocurrencies while avoiding the complex processes involved in using many popular exchanges. With a fast verification and registration model and an easy-to-use interface, Coinmama is a strong alternative for any user, regardless of their experience level.

| Coinmama Key Information | |

| Company Location: | Israel |

| Mobile App: | No |

| Fiat Deposit: | Yes |

| Fiat Withdrawal: | Yes |

| Transfer Limits: | $5,000 daily purchase/$20,000 monthly purchase |

| Supported Fiat: | USD, EUR |

| Payment Methods Accepted | Credit card, Bank transfer |

| Supported Crypto: | Bitcoin, Ether, Litecoin, Ripple, Bitcoin Cash, Cardano, QTUM, Ethereum Classic |

| Supported Countries: | 180 countries worldwide including Europe, 26 States in the US, large areas of Africa and Asia, with some local exceptions. |

| Fees: | 5.90% Trading Fee, 5.00% credit card processing fee |

| Website (URL): | Start trading at Coinmama.com |

Login and Signup

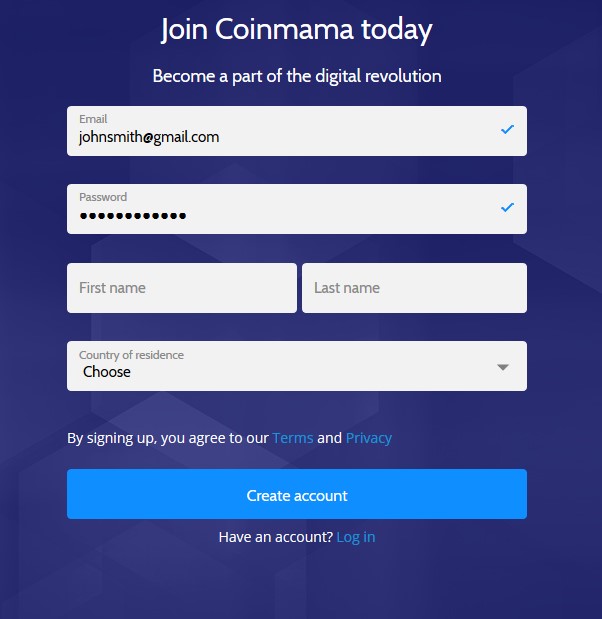

To get started purchasing cryptocurrencies on Coinmama, you’ll have to register an account. The process takes a few minutes and includes a verification step to validate your identity and remove the caps on how much you can purchase every day and every month. To start the sign-up process, simply click on Sign Up and enter the details requested including your email, password, and country of residence.

Once you’ve completed the initial registration and confirmed your email, you’ll have to complete the verification process, which includes providing more contact details such as your phone number, address, and address. Additionally, you’ll have to upload a photo ID for identity verification, as well as a photo of yourself holding your ID and a note. After you’re approved, you’ll be able to start making purchases.

How Coinmama Works

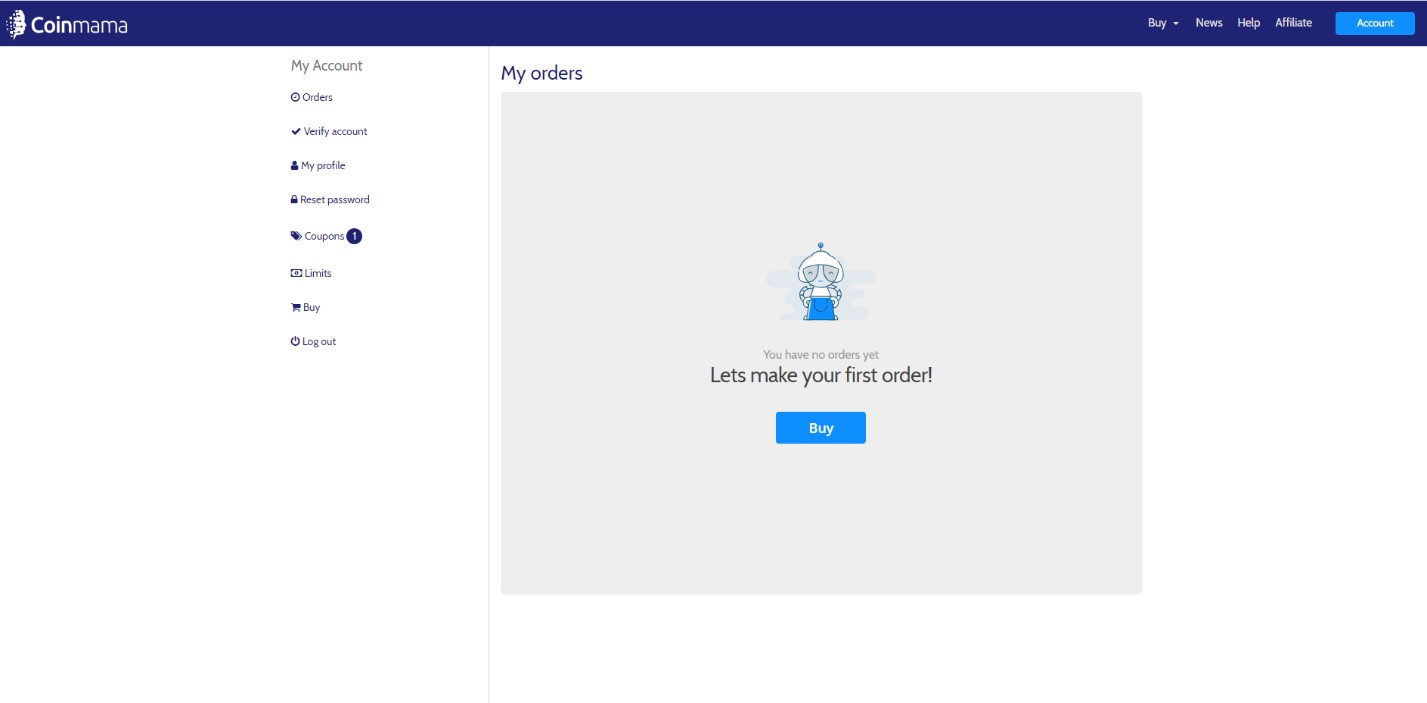

After you’ve finished signing up and verifying your account, you’ll be able to purchase one of Coinmama’s eight high-performing cryptocurrencies. When you first access your account, you can immediately make your first order.

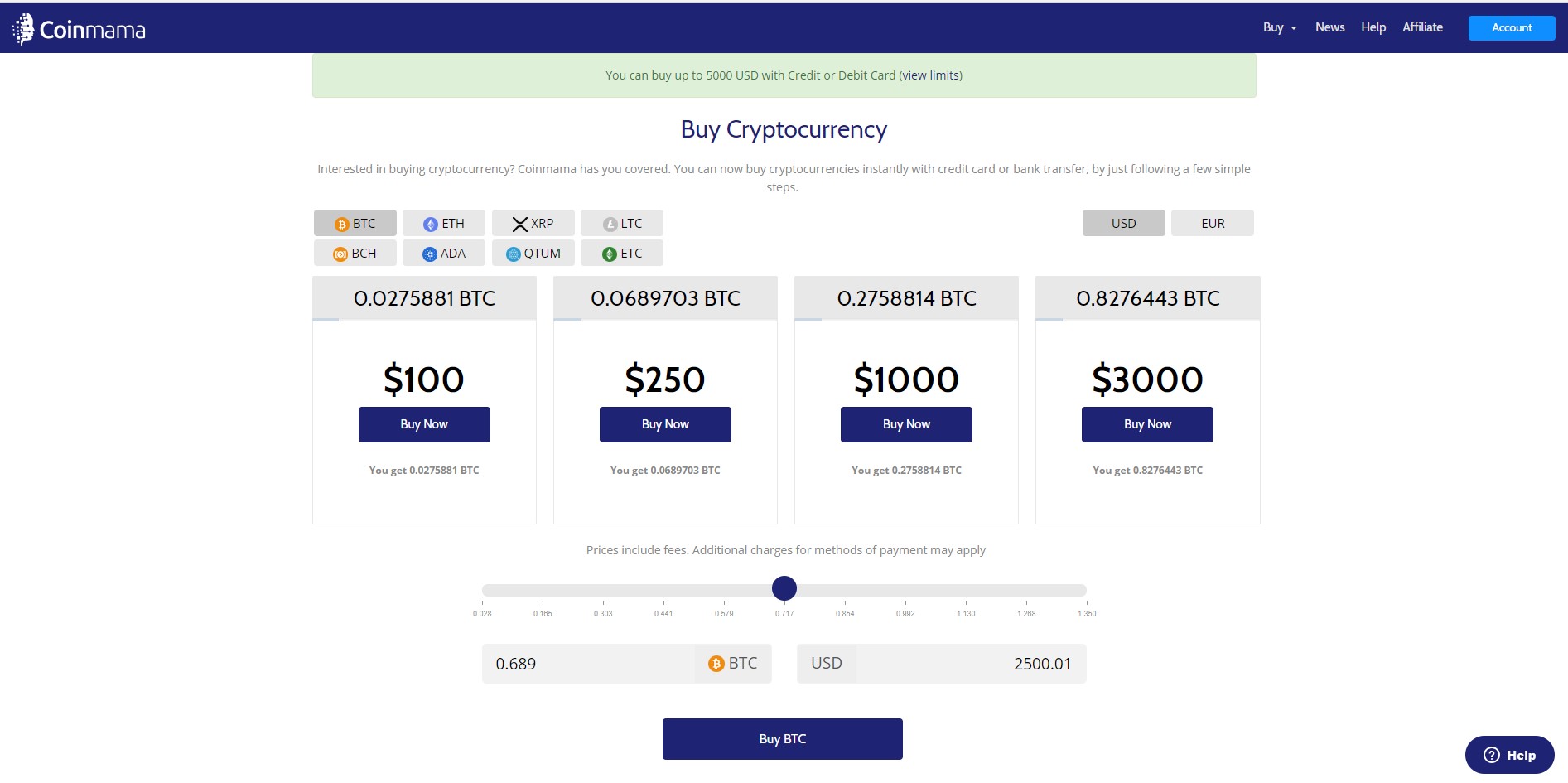

To start, simply press “Buy” and you’ll be taken to the platform’s purchasing page. Here, you’ll choose which cryptocurrency you wish to purchase, as well as the fiat currency you will pay with. You can also choose from one of the preset options for purchasing that Coinmama provides—$100, $250, $1,000, or $3,000—or choose your own specific amount with the slider provided below.

It’s important to know that while there is no current centralized standard for cryptocurrency prices, Coinmama calculates their crypto spot rates based on TradeBlock XBX rates and adds a 5.90% fee. If you have completed the initial verification, you have a daily limit of $5,000 in purchases, and a monthly $20,000. However, users who provide additional documentation and meet certain purchasing thresholds can be activated for higher tiers that offer larger order limits.

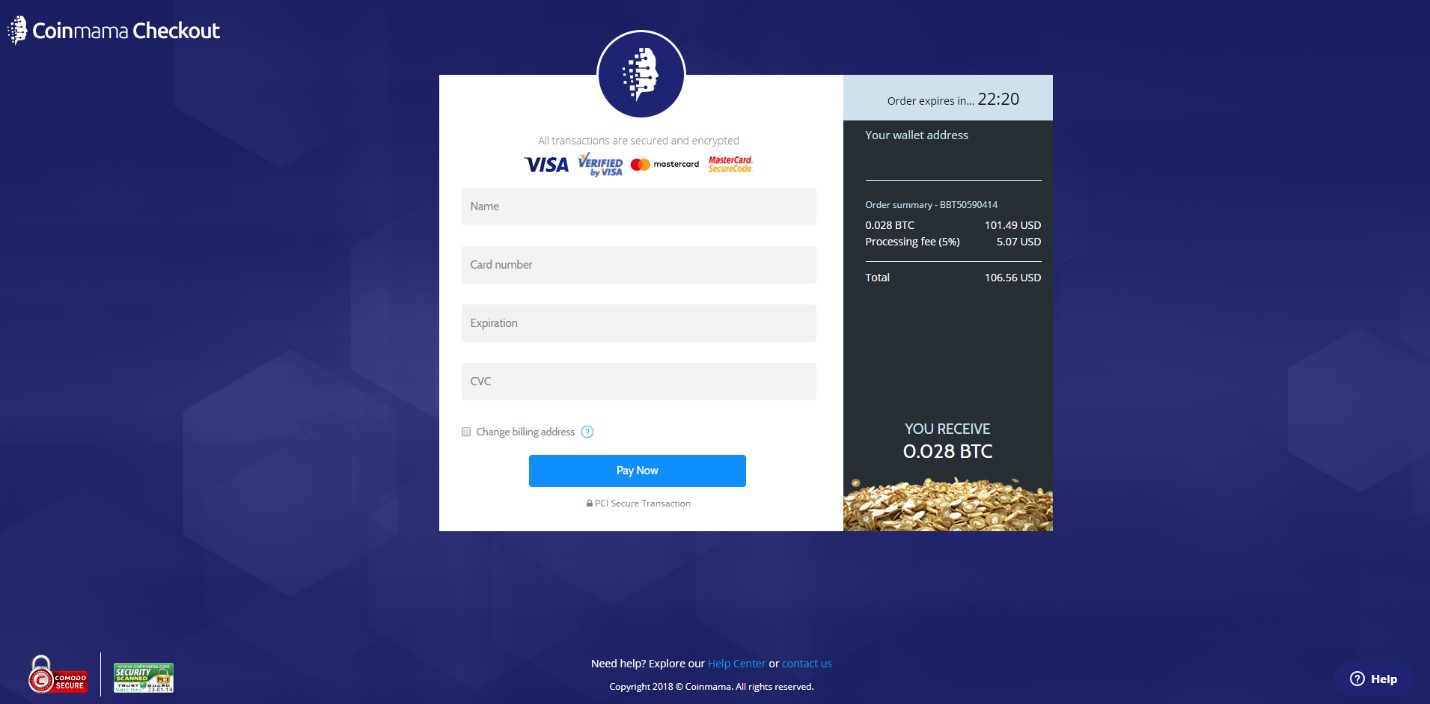

After you’ve selected the amount you want to purchase, you’ll be taken to the payment confirmation screen. Keep in mind that once you’ve chosen your amount and started the payment process, you’ll have 30 minutes to complete your purchase at the rate selected, or you’ll have to restart the order at the new rate. When you’ve completed filling in your payment details, simply press Pay Now, and you’ll receive your funds into your account once the order has been verified.

If you’re in the European Union, you’re also able to pay for your cryptocurrency with a SEPA (Single Euro Payments Area) bank transfer. To complete this type of purchase, simply select SEPA Transfer after you’ve input your wallet account and visit your bank’s website to complete the process (you can also do this in person at your local branch). Be aware that SEPA transfers usually take longer to complete than credit purchases—up to 24 hours. However, these transfers have 0.00% fees.

To keep track of your purchases, you can visit “My Orders” in your account to see both the orders that have been completed and those that are still pending.

Countries Supported

Coinmama announces on its website that it operates in over 180 countries currently, including all of the European Union, as well as several states in the US. However, the company’s website does list several restricted countries, many of which include regions that have economic sanctions placed on them. Currently, the list of countries banned by Coinmama include:

- Cuba

- Iran

- Lebanon

- Nigeria

- North Korea

- Palestinian territories

- South Sudan

- Zimbabwe

- Somalia

- Crimea

- Syria

Additionally, Coinmama is not available in 24 US States including those like New York, Georgia, the District of Columbia, and Vermont. Moreover, the company’s services are restricted in other US territories that include American Samoa, Guam, Puerto Rico, Minor Outlying Islands, The Northern Marianas Islands, and the Virgin Islands.

Supported Cryptocurrencies and Liquidity

You can purchase any of the eight cryptocurrencies on Coinmama. The platform lists bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, Ethereum Classic, Qtum, and Cardano. Because the company is not an exchange, its liquidity situation is somewhat different from other popular hubs for purchasing. Even so, users can purchase up to their limit every 24 hours.

Deposit/Trading/Withdrawal Fees

Coinmama charges 5.90% Trading Fee . The company additionally charges a 5.00% fee on all credit or debit card transactions, regardless of the purchase amount. However, European users who wish to avoid paying the fee can simply complete their purchases with a SEPA transfer, which carries a 0.00% fee on all transactions. It’s also worth noting that while Coinmama’s credit card fees are flat, some credit card processors may view crypto purchases as cash advances and charge additional fees to transactions.

Transfer Limits

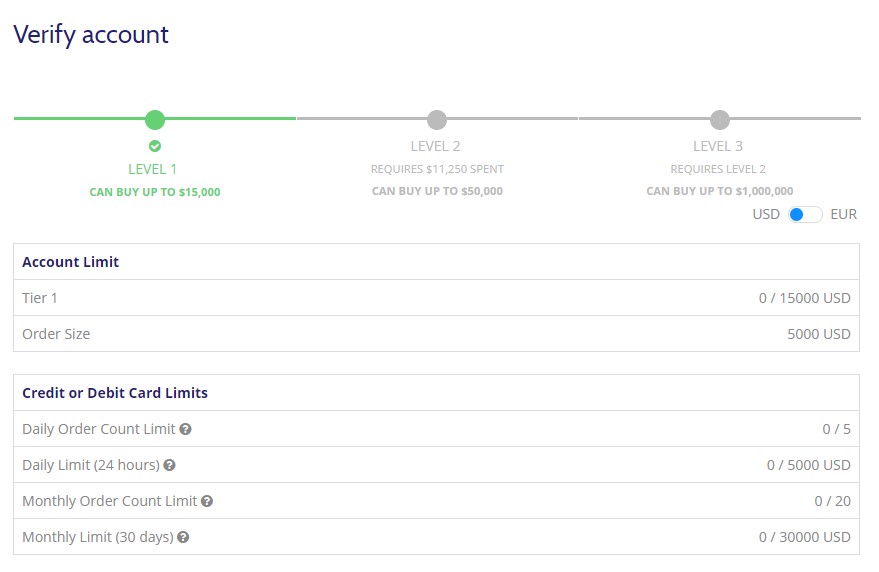

Compared to other exchanges, Coinmama has some of the highest limits when it comes to daily and monthly purchases. The company sets a limit of $5,000 daily (which is reset every 24 hours from when the first transaction is completed, and not day-to-day) and a total of $20,000 monthly. Users who complete the first tier of verification (one photo ID and a selfie with your ID) can spend up to $15,000 on Coinmama, while unlocking the second and third verification levels gives you a significantly expanded cap.

To unlock the second verification level, which increases your spending limit to $50,000 you must present at least two valid photo IDs, as well as a utility bill to prove your residence. Level three requires filling out a form and gives your account a cap of $1 million. You should keep in mind that these limits are on your total expenditures, and do not affect your daily or monthly spending limits.

Payment Methods Accepted

Users who wish to purchase cryptocurrencies from Coinmama can do so either via credit or debit card, or with a SEPA transfer if they reside in the European Union. The company does not accept crypto-to-crypto payments and does not offer exchange functionalities. Coinmama accepts credit and debit cards from VISA and Mastercard.

Security: Is It Safe to Use?

Coinmama remains one of the safer options for purchasing cryptocurrency, as the company has never been hacked, and it is careful about what user data it stores on its servers. The company does not provide any wallet services—users must enter their own addresses when purchasing their desired cryptocurrency—and stores credit and debit card numbers on separate, isolated servers. The company is also registered with FinCEN, which tracks and prevents cyber crimes in the United States.

Company Reputation

Since its creation in 2013, Coinmama has remained one of the top destinations for users looking for quick and easy cryptocurrency purchasing. The lack of news regarding financial irregularities, attempted attacks, and other hacks mean Coinmama’s reputation remains largely pristine. Its regulatory framework and willingness to meet compliance standards also makes it a secure choice.

Conclusion

Coinmama is an ideal service for users looking to make a quick cryptocurrency purchase but not necessarily to start their trading career. Thanks to a quick and painless buying procedure and a fast verification process, users can go from registering to buying coins in mere minutes. More importantly, with a strong regulatory framework and an emphasis on compliance, the company has remained one of the more secure alternatives to purchase bitcoins and other popular cryptos, and its fees make it an even more appealing choice. Regardless of your experience level when it comes to cryptos and trading on the market, Coinmama gives you a safe and reliable way to always hold your preferred crypto assets.

1 comment

Want to invest