What is Bitcoin Cash?

Bitcoin Cash (BCH) is a fork of the original Bitcoin project that focuses on cheaper and faster transactions. Like Bitcoin, Bitcoin Cash is a decentralized currency with no central bank.

BCH enlarged the block size of BTC from 1MB to 8MB to create speedier transactions. It promises to achieve the original oath of Bitcoin of “Peer-to-Peer Electronic Cash”.

While the premise of Bitcoin Cash adheres to much of the same blockchain format laid out in the original Bitcoin whitepapers by Satoshi Nakamoto, it is not the same.

The founders of Bitcoin Cash forked from Bitcoin on August 1, 2017. Once initiated, Bitcoin passed down its transaction history unto Bitcoin Cash. Block 478558 was the final adjoined block, making block 478559 the first Bitcoin Cash block.

Bitcoin Cash Basics

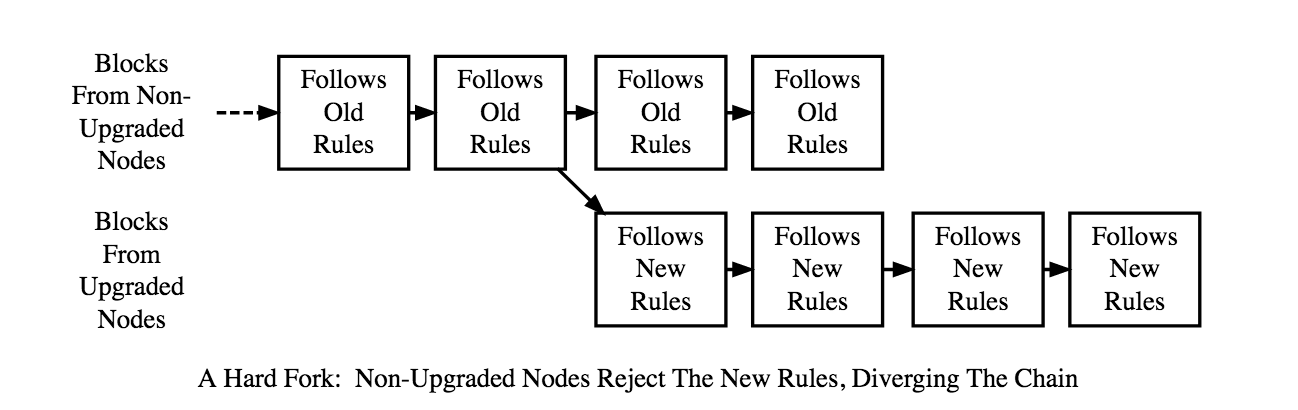

As stated previously, Bitcoin Cash is a hard fork of Bitcoin. A hard fork essentially means that the new protocol departs from the preceding blockchain version at a certain moment in time. This supports the rejection of nodes from the earlier version of BTC unto the latter version, BCH.

In general, the technology behind these two currencies does not differ much. The transaction potential is what gives the main difference between the two. Following blockchain convention, Bitcoin Cash continues with key features such as a distributed ledger, peer-to-peer network technology, cryptographic hash functions, and cryptographic hash function, among others.

Mining Bitcoin Cash

Miners are an integral part of the blockchain system. Simply put, mining is how the limited supply of 21 Million BCH is kept secure and transactions processed. Miners, often working in mining pools (groups of miners), race to solve a series of difficult equations in order to solve a block. After a series of processes, the miners are able to approve the transactions located within the block(s) and be rewarded for their time and technical skill by receiving a portion of the transaction fees.

However, the profits obtained by mining BCH come with fees incurred by the miners themselves, such as energy costs. According to CoinDance.com, “it is currently 1.5% more profitable to mine on the original chain”. CoinDance.com took into account three metrics when evaluating profitability: expense (price), task difficulty, and block reward (block subsidy +transaction fees).

With many articles out there claiming miners are moving to BCH from BTC and vice versa, it is tough to gage which information is correct. The significance of this component of blockchain is often undervalued in the cryptocurrency community, more specifically with beginners.

Advantages of Bitcoin Cash

Bitcoin is often said to have slow, costly transactions. Bitcoin Cash seeks to establish superior scalability in the blockchain with an 8 MB block size, 8x greater than Bitcoin’s 1 MB block size. Increasing the block size limit lends opportunity for Bitcoin Cash to expedite roughly 2 million transactions per day compared to Bitcoins 250,000 transactions per day.

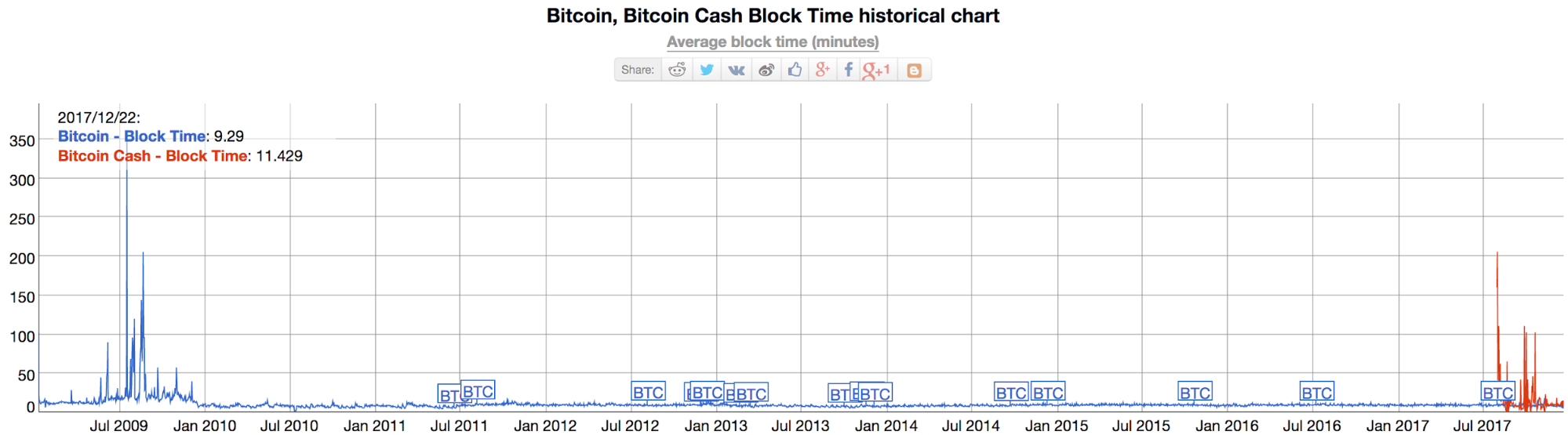

According to the Gigablock Testnet Initiative by Bitcoin Cash, “it is well understood that an increase in the network’s block size limit (presently 1 MB) would dramatically reduce fees and make confirmation times reliable once again.” Interestingly enough, at the time of writing, BTC’s block transaction time was slower than BCH’s. Yet, as promised, fees are lower.

The chart shows that Bitcoin Cash takes 11.429 minutes per block, while a block for Bitcoin takes 9.29 minutes. Seemingly extensive transaction times tend to be a major plague for both currencies, as high fees associated with Bitcoin are detrimental to its future success in the cryptocurrency world.

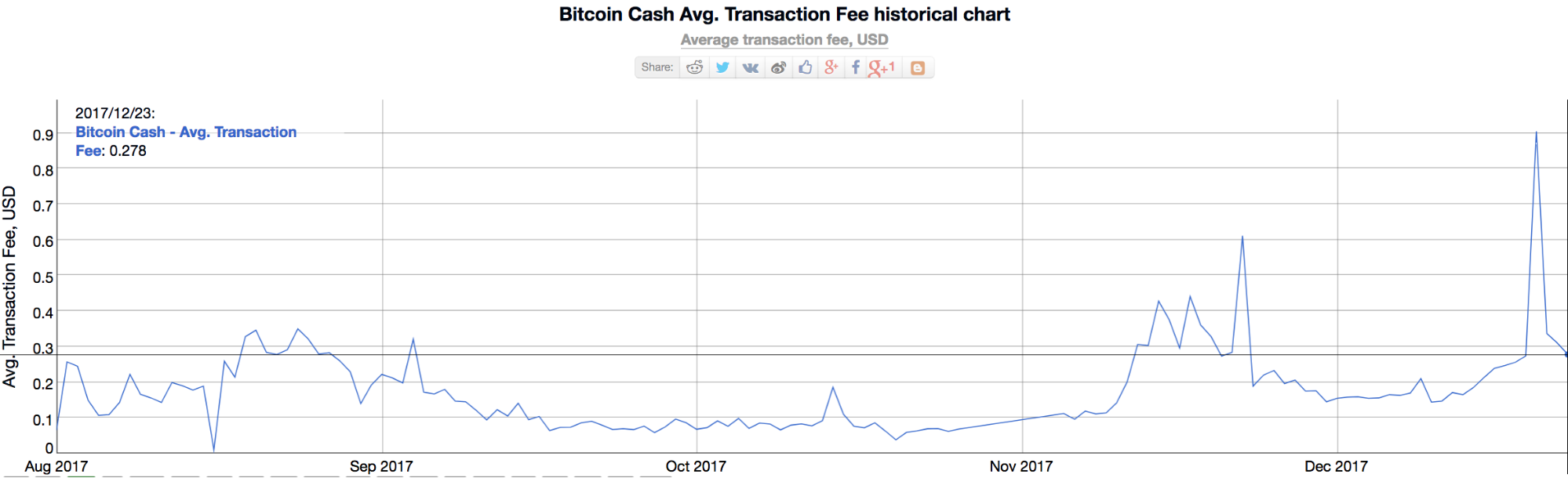

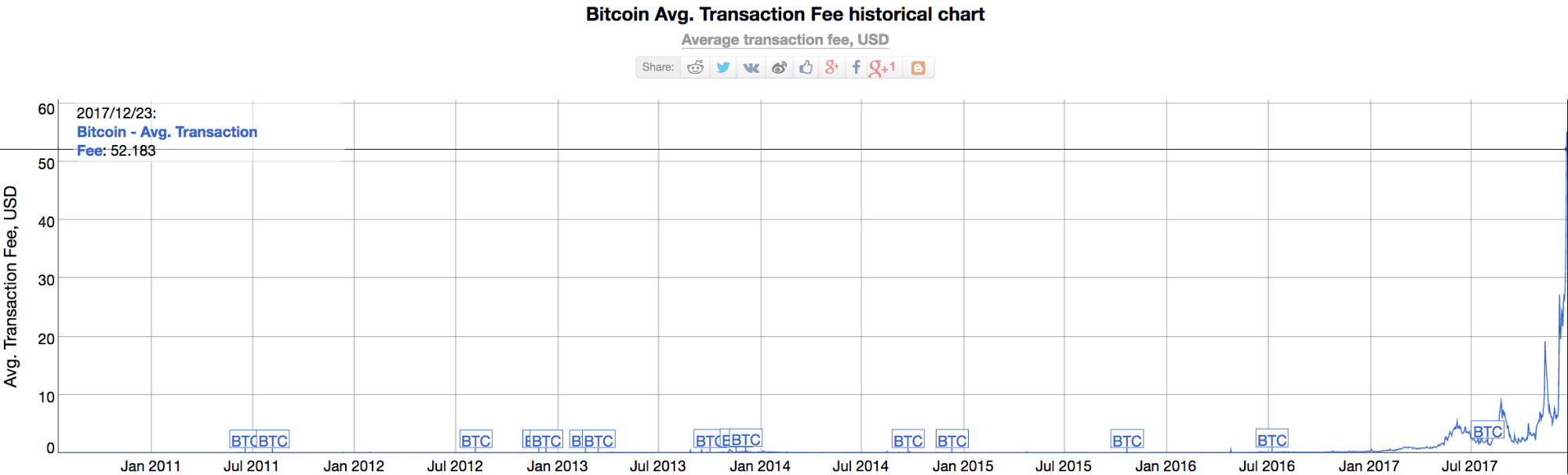

The above chart shows that at the time of writing, the average transaction fee for Bitcoin Cash was $0.278 USD. Below, we see that the average transaction fee for Bitcoin on the same date is $52.183 USD.

How to Buy Bitcoin Cash

Coinbase allows bank wire purchases, while both Coinbase and Bitstamp allow credit/debit cards to purchase BCH tokens. You are also able to deposit Bitcoin into online exchanges, and then trade BTC for BCH.

At the time of writing, Bitcoin Cash was trading at $2920.36. The market cap is seen at $50,366,868,746 with a circulating supply of 16,872,475 BCH.\

How to Trade Bitcoin Cash

As a popular cryptocurrency, Bitcoin Cash is available on a wide variety of exchanges. Creating a lot of hype in the cryptocurrency community with its recent addition to Coinbase on Tuesday, December 19th. The addition surged the price of BCH spiked to all-time highs.

Other exchange sites such as Kraken, Binance, Bitfinex, and Bitstamp facilitate the trading of BCH and are considered easily understood platforms across the general population and thus offer user-friendly experiences.

How to Store Bitcoin Cash

Wallets that support Bitcoin will usually support Bitcoin Cash. Here a few well-known wallets to make your search for the right wallet a bit easier:

Hardware wallets- Ledger, Trezor and Keep Key

Desktop- Bitcoin.com Wallet, Exodus, Jaxx

Online- Coinbase, Binance, Bitstamp

The use of different platforms for wallets is up to one’s own personal choice. For example, while hardware wallets offer more security from hackers, they come with slower trading accessibility. In comparison, online wallets such as Coinbase and Binance are accessible from all over the world if one has internet access, yet are prone to hackers. Recently, popular exchange site Youbit filed for bankruptcy due to its numerous successful hacks.

Conclusion

VISA can handle on average around 1,700 transactions per second (tps). In late 2014, Paypal averaged 115 tps. As seen in the previous section, at around 11 minutes per block and 6 blocks per transaction, Bitcoin Cash clearly pales in comparison to the two financial service giants. Until scalability becomes superior to current services out there and transaction fees lowered, mass adoption is highly unlikely.

However, we will be seeing a large number of hard forks entering the cryptocurrency market in an attempt to solidify themselves as the dominant force in the p2p cash world. Many of those hard forks as well may just be scams to try and lure eager investors into trusting their money with doomed to fail projects. This is why it is so important to do research and find credible sources when investing in new cryptocurrencies. As a result, it should be reminded that this is in no way financial advice and to proceed investment opportunities with caution.