Polymath (POLY) Review: Tokenizing Securities on the Blockchain

| Name | Polymath |

| Ticker | POLY |

| Token Type | ST-20 |

| Total Supply | 1,000,000,000 |

| Category | Security Token Platform |

| ICO Price | $0.40 |

| Website URL | https://polymath.network |

| White Paper URL | https://polymath.network/whitepaper.html |

Polymath’s goal is to do build a protocol that allows for compliant trading of security tokens on the Ethereum blockchain. In other words, what Ethereum did for tokens, Polymath will do for securities.

Update: Polymath will be listing their first security token by the end of August 2018.

Article Summary

- The Idea and the Team Behind Polymath

- Polymath Partnerships

- App Token Versus Security Tokens

- The Wall Street Connection

- The Polymath Price History

- The Polymath Technology

- The Polymath Platform

- The Polymath Security Token

- Where to Buy Polymath

- Where to Store Polymath

- The Roadmap and Future of Polymath

With over $1.5 billion raised in Initial Coin Offerings (ICOs) since the beginning of the new token market, it has started to gain both the attention – and concern – of governments and regulators. The next step, many say, is to be able to trade traditional securities on the blockchain.

That’s exactly what Polymath aims to do. Why? It’s instant, with lower fees and 24/7 trading availability. The securities token platform also aims to guide issuers through the complex legal and technical process of a successful token launch.

Headed by Silicon Valley-based crypto entrepreneur Trevor Koverko, current investor in ShapeShift.io, Luminex, and Royalty Exchange and an early leader in the blockchain community, it has received wide attention within financial circles internationally.

Polymath is currently one of the only securities token exchanges in the world and it relies on the blockchain system to offer these types of exchanges.

Polymath Partners

Polymath has a number of strategic partners and investors in the blockchain and artificial intelligence (AI) community.

It is currently working on a collaborated project with CrowdfundX, a fintech company focused on AI-powered digital marketing, to offer CrowdfundX’s digital marketing services to token issuers on the Polymath platform. It also has a partnership with Trustroot, a blockchain protocol that protects individuals and businesses from fraud and theft within the cryptocurrency community. Those who launch securities on Polymath’s platform will have access to Trustroot’s security services. It also announced a partnership with Pegasus Fintech, a blockchain and token accelerator. Pegasus will use Polymath’s smart contracts to create and manage compliance security tokens.

It is also partnering with MintHealth, a decentralized health Platform-as-a-Service (PaaS) that brings together health plans, provider groups and wellness plans to provide better clinical outcomes and lower costs. The MintHealth Security token (MHST) will be the first security token issued in healthcare whose goal it is to incentivize patient engagement via Polymath’s protocol.

In June it announced that it entered into an agreement to list Polymath-powered security tokens on the OpenFinance Network (OFN). OFN is a collaborative platform intended to certify and validate participants and their assets in financial transactions.

App Tokens Versus Security Tokens

From Polymath’s perspective, the world can be divided into two types of tokens: app tokens and security tokens.

App tokens such as bitcoin and Ethereum, are launched in unregulated crowd sales. They do not require any identification or authorization for purchasing or selling.

Security tokens, on the other hand, represent financial assets, and require regulation – usually KYC (Know Your Customer) and AML (Anti-Money Laundering) accreditation. Contributors buy these tokens in anticipation of future profits.

From Polymath’s perspective, the wider population does not understand the concept of app tokens. To make matters more complicated, issuers of these tokens are often reminded of the risk and legal scrutiny towards these token sales. Unfortunately, some ICOs have even cancelled their offerings after realizing the risks associated with regulators, and others have been forced to face the risk of prosecution.

Polymath wants to put an end to this frustrating experience and empower securities by enabling them to effortlessly migrate to the blockchain.

The Wall Street Connection

Polymath’s website declares that it “envisions a future where token holders replace shareholders in the global economy.” In other words, it wants to put the entire stock market on the blockchain.

Polymath’s goals are to bridge the gap between financial securities and the blockchain by simplifying the technical and legal challenges of a token launch. It also aims to guide issuers through successful ICOs. Other advantages of moving securities trading to the blockchain include:

- 24/7 trading all 365 days of the year

- accessibility to 2 billion unbanked users

- blockchain liquidity

- negligible transaction fees

- programmable shares (KYC, dividends, voting)

- crypto fundraising

How does Polymath envision itself being able to carry out its goal? As stated in their white paper, the platform:

“provides a decentralized protocol for trading security tokens. Polymath enables both individuals and institutions to authenticate their identify, residency and accreditation status to participate in a wide range of security token offerings (STOs).”

Once the issuers are able to release offerings that comply to regulations, issuers can be matched with developers who can translate these offerings into ERC20 compatible tokens. (ERC20 sets the current standard for all Ethereum tokens and ensures new tokens released through Ethereum ICOs are ERC-20 compliant).

The Polymath Price History

The token initially sold for $0.40 and rose to $1.63 in February. It peaked again to $1.16 in May.

The Polymath Technology

Polymath has developed a platform that offers legal accommodation of securities tokens through KYC authorization as part of its protocol.

To issue these securities on the platform, however, you’ll need Polymath’s native token – Poly. Issuers must pay a small fee in Poly tokens to create their security. In exchange, investors must pay a transaction fee and complete KYC/AML verification to start using the Polymath network and trade using this new security token.

Developers and lawyers can earn Poly by being a stakeholder or by using the platform to create or review initial offering contracts. The more complicated the regulatory requirements, the higher the payout. More popular contracts will receive small recurring payments. This incentivization rewards the registration of financial securities, a long-term benefit of registration, and the decentralization of the current process – all in one shot.

Users must be a verified member to earn or purchase the digital currency, which can be completed by providing Ethereum addresses which matches those of KYC documents filled out during the sign-up process.

The token was released at a base value of $0.789 and rose to $1.34 within a couple of days. (As of the publication of this post, its current value is $0.602). Polymath will have a standard token system called ST-20.

The Polymath Platform

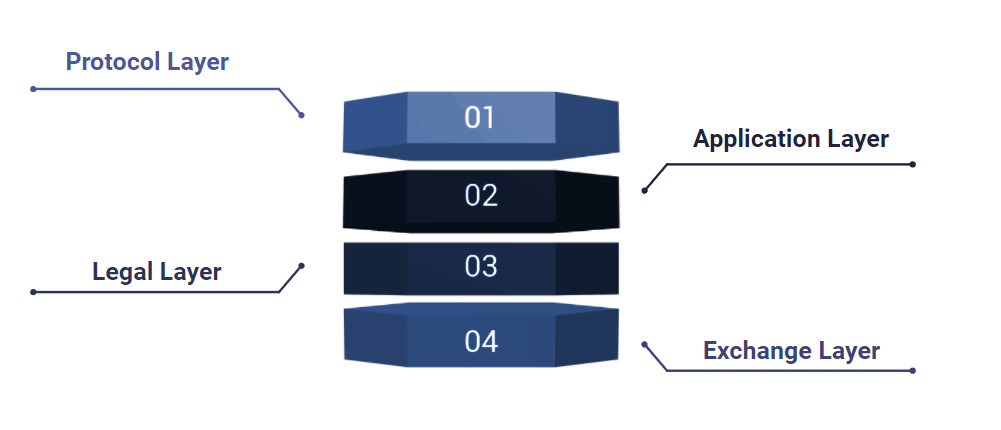

The platform consists of 4 layers: the protocol layer, the application layer, the legal layer, and the exchange layer.

Here is a brief description of each layer:

• The Protocol Layer – This component of Polymath runs using Ethereum-powered smart contracts and identifies users via KYC/AML accreditation. It includes a decentralized shareholder registry along with a permission model that restricts the type of securities each individual user can hold.

• The Application Layer – This component allows users to create their own securities-based token using a security-token-wizard.

• The Legal Layer – This component uses a set of tools to examine whether the tokens meet regulatory compliance standards necessary for a successful securities token (ST).

• The Exchange Layer – Consider this layer a closed-ended KYP compliant on/off ramp that offers instant liquidity options.

The Polymath Security Token

Polymath’s ST20 token simplified the current process of creating and investing in security tokens. Tokens using this open -source standard won’t be traded to anyone not meeting Know Your Customer (KYC) or Anti-Money Laundering (AML) requirements as well as the securities laws necessary for their jurisdiction. This is done through the use of smart contracts and Polymath’s whitelisting technology.

ST-20 tokens will only be traded on exchanges sanctioned by the Securities Exchange Commission.

Update: Polymath will be listing their first security token by the end of August 2018.

Where to Buy POLY

The main way to purchase POLY is through Upbit and Bittrex. It can be purchased in Upbit with KRW, BTC, and ETH. It can be purchased in Bittrex with BTC and ETH.

POLY is also available on the following exchanges:

- Huobi (Trade POLY with BTC on Huobi)

- Kucoin (Trade POLY with BTC on Kucoin)

- Ethfinex (Trade POLY with ETH on Ethfinex)

- Bitbnx (Trade POLY with INR on Bitnbnx)

- Koinex (Trade POLY with INR on Koinex)

Where to Store POLY

POLY can be stored in any wallet that supports ERC-20 tokens such as Coinomi, MetaMask and Myetherwallet.

For maximum security, however, you should store your POLY on hardware wallets such as Ledger Nano S and Trezor.

Roadmap and Future of Polymath

Polymath has discovered a need for a verification process in a protocol where traders are known and identifiable, yet the trading is fast and decentralized.

With estimates of the app token market cap reaching $1 trillion by 2027 and the security token market cap reaching $10 trillion, Polymath has a bright future ahead. It also has aggressive goals for 2018: the launch of a new security token every week.

As it is one of the only platforms seeking to merge traditions securities-based assets with the blockchain, investing in their Poly tokens now could be a wise investment for the future.