Simple Crypto Tax Guide [2019 Edition]

Part of the end of 2017’s epic cryptocurrency bull market and the beginning of 2018’s equally shocking bear market was the regulatory pivot that occurred in major nations. Countries like the United States were (and are still) responsible for much of the crypto market’s volume and movement. The US acts as a sort of bellwether that shows how the world’s financial epicenter scrutinizes the notion of decentralized finance, so when it started getting serious about crypto taxation, everyone took notice.

November 2018 saw IRS Commissioner Charles Rettig exclaim, “Crypto is no longer cash. It is information data currency that the IRS has and will have more information about than you could ever imagine.” The statement could not have been construed as lenient for those who shirked their reporting duties until then. In fact, many people may still be negligent concerning their crypto gains and losses, but the immense complication involved in this endeavor is prohibitive.

Despite a still-evolving set of rules, it’s a terrible idea to put off this responsibility. If you’re a veteran of the crypto markets, your taxes will involve gathering data from far back and understanding how the where, what, when, and how of any single trade to determine its tax impact. The following guide outlines concepts that will be familiar to most traders and gives some guidance on how to incorporate these ideas into your report to the IRS.

A Multifaceted Asset Class

The taxability of any crypto token or transaction varies based on things like the kind of wallet you use, the profit or losses you obtained, the type of coin or token involved, the timeframe of the transaction, and the blockchain events you participated in. For any single investor, the various loose ends in their crypto portfolio will look vastly different from someone else’s, so the most common ideas are outlined below:

Capital Gains: When you sell a cryptocurrency for a profit, it’s taxed at the standard rate on capital gains depending on your tax bracket. Long-term gains (if you held the coin for a year or longer before selling) are between 0 and 20%, while short-term gains are taxed at your individual income tax rate (Line 21 of Schedule 1 of Form 1040). Unlike stocks, bonds and other assets, taxpayers won’t receive a Form 1099-B for their cryptocurrencies, so every crypto transaction must be reported individually on Form 8949.

Hard Wallets or Paper Wallets: Cryptocurrency that you’re currently holding in a Trezor or Nano S, for example, can largely be ignored since it hasn’t realized any profit or losses. Paper wallets, hardware wallets, or a similar method where you own and safeguard your private key are also exempt from annual FBAR (Foreign Bank Account Report) filings, as there aren’t any foreign financial institutions involved. Speaking of the FBAR…

FBAR: You’re recommended to file an FBAR in some cases. A lot of the time your crypto holdings can be ignored or considered non-declarable when it comes to US exchanges, like Coinbase or Gemini, but not Binance. Though Binance and other foreign exchanges aren’t yet defined as “foreign financial institutions” according to the law, you still should declare your assets there if they meet FBAR requirements of at least $10,000, or FACTA requirements of at least $50,000. Additionally, any gains on this income should be listed on Form 8949.

Losses and Hacks: An unfortunate reality of blockchain’s early years, companies like Quadriga, Bitgrail, and Mt. Gox have lost investor funds through hacks and fraud, and investors are wondering if they can claim and deduct these from income as casualty losses. In 2017 this was possible but 2018 saw the laws change in the US to disallow the deduction of casualty losses that didn’t happen in a “federally declared disaster”. For losses that fall outside the new rules, by way of their timeline or asset type, you can report them as a capital loss.

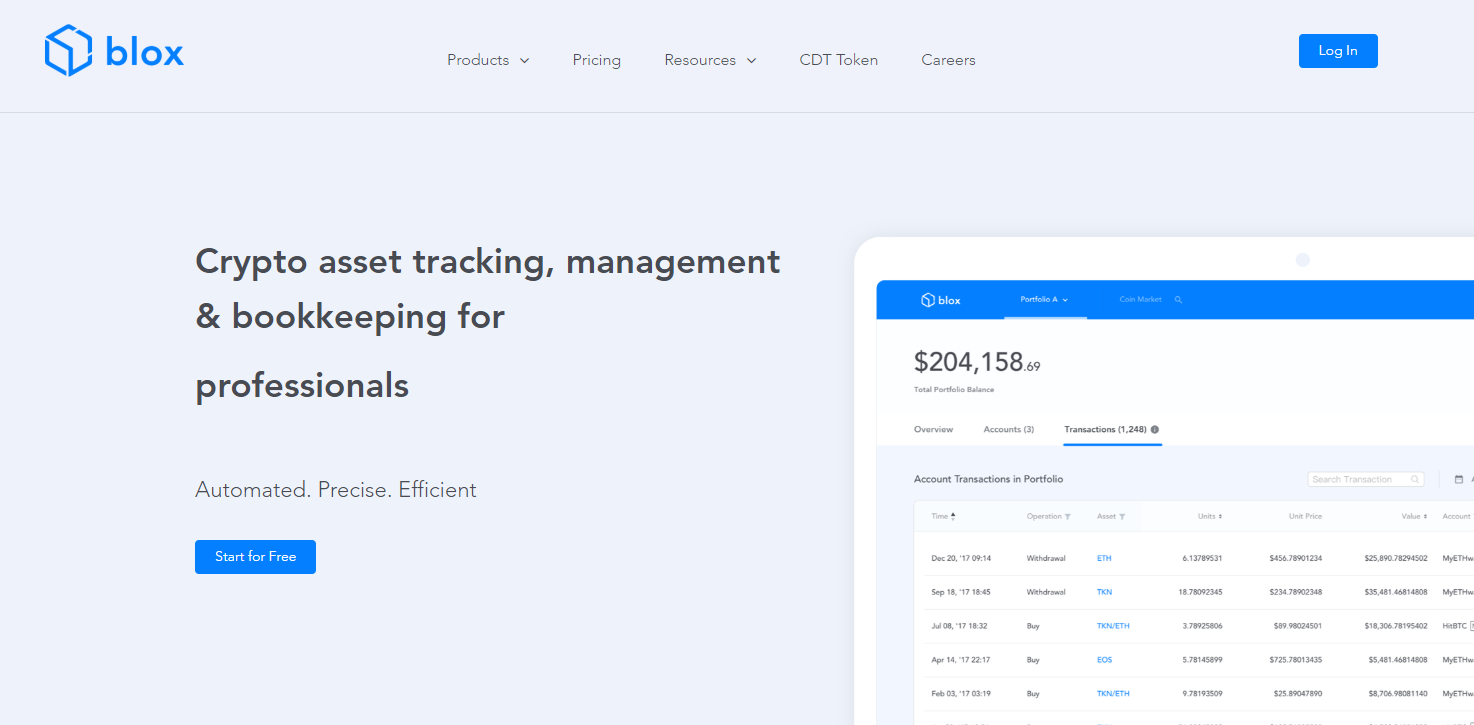

Capital Loss: If losses occurred, you’ll show the IRS how much money you lost trading after closing cryptocurrency positions and realizing a loss. Some hacks and fraud events in the past have been considered a capital loss as well, and these are used to offset your crypto gains and can deduct up to $3,000 off annual income. Determining how each transaction is defined by the IRS, and what impact (or benefit) it can have on your taxes is tough, and it’s recommended to have a tax professional handle it. Even better for the often-independent crypto investor is do-it-yourself cryptocurrency accounting software, which are often already compatible with most major exchanges and make it easy to get a comprehensive picture that includes all your digital assets.

A cryptocurrency accounting software like Blox can make all the difference when doing taxes for your digital assets

Defunct Exchanges: If you got your coins and tax-related data off an exchange before it went bust, good for you. If not, you’ll need to do some fancy tax footwork to estimate your gains and losses conservatively. Rather than take taking the loss and defining the coins you purchased at a $0 cost basis, there are some alternative options. If you’re willing to do a little moderate guesswork, you could put together a conservative history of your trading activity based on memory.

Illiquid Tokens and Coins: Belly up ICOs aren’t uncommon. If you managed to sell them while they were still fungible, you don’t need to worry about this notion. If not, holding these worthless tokens doesn’t represent a capital loss because you didn’t yet realize the loss. Selling these tokens is often impossible, as they’ve been universally delisted from exchanges, so a loophole is to sell them privately to a third party (a friend or relative), and then pay them back. You wouldn’t have made anything in this scenario, but realizing the loss means you can report it and get a deduction.

Forks and Airdrops: The IRS may be able to argue that the investor is liable for the forked coins they receive in some cases, but the burden of proof is high. Forked coins must have been accepted with some established value already, and if they had no value (like Bitcoin Ruby or Diamond) or if the market hadn’t yet determined their value then they’re non-taxable. Even if forked coins did have value, it could be argued that airdrops sent to an exchange wallet can’t be considered owned by the individual in question as they don’t have access to their private key. For airdrops that are valuable, sold to realize gains, and in a wallet that you own, capital gains reporting is required.

Buying Stuff with Crypto: The transfer of coins for another item or asset of value (a car or home, for example) is considered a realization of those coins’ value at that time and is taxed as such. What you’re reporting isn’t the purchase of the new asset but the “sale” of your crypto for that asset, even if the other asset is itself a cryptocurrency. This is why every single transaction must be recorded on the 8949 from. At the very least, this will make it easy for your tax advisor to make sense of what happened, and that means making your data history accessible.

While the tax reporting requirements for cryptocurrency holdings are undoubtedly obtuse and complicated, the risks from not filing are simply too large. Instead of finding yourself the unwitting victim of an IRS penalty, do your homework and consult with specialty services and professionals to ensure your crypto tax exposure is properly managed.

Salary Payments with Crypto: According to Alex Margolin editor of Papaya Global, more and more companies are set to offer crypto currency as part of their salary payments. He says ‘the problem of paying in crypto has always been one of compliance rather than technology, but if the % of the salary payment is kept below a certain amount you can stay compliant with many countries local payroll regulations.