Market Update 1.30.19 – AMD Releases Q4 Results

Market News

AMD Releases Q4 Results

Advanced Micro Devices Inc. (AMD) released its fourth Quarter results on January 29 and confirmed market analysts’ fears of a broader slowdown. The graphics cards manufacturer, just like other companies, was negatively impacted by the crypto winter. The company reported a 14% drop in its quarterly revenue. Gross margins were down by 2% as compared to Q3 and the chip maker’s net income dropped from $122 million to a mere $38 million.

Despite the poor earnings report, the Chief Executive Officer Lisa Su remained positive. Su said that the company had delivered its second consecutive year of revenue growth, gains in market share, had expanded overall gross margins and had also improved its profitability through its high-performance product lines.

Read more about this story here.

Doc.com Makes Dubious Claims

Investigations have found that Doc.com, a health startup based out of Mexico City, has been making dubious claims regarding its industry relationships and its connection with crypto major Coinbase. It has been doing this as part of an effort to sell cryptos to investors.

Doc.com has developed an app that offers healthcare as well as psychology consulting for the underprivileged communities. The app also carries a built-in wallet that uses the company’s native cryptocurrency, MTC. On the company’s advisors and mentors page, the names of Mozilla’s CEO, John Lilly, and LinkedIn’s founder, Reid Hoffman, were included. Lilly denied any relationship with Doc.com.

Read more about this story here.

Blockchain Tech Will Help Payment Systems and Banks Marginally

JP Morgan’s analysts now say that Blockchain technology will be able to give benefits to payments systems and banks. Joyce Chang, the firm’s global research chair, stated that Blockchain technology was not going to reinvent global payment systems, but it would offer marginal improvements. Chang said that the biggest impact would probably be felt after three to five years and that that change would be felt most in trade finance.

According to a report recently led by Chang states that the application of Blockchain in trade finance is more common due to the potentially higher gains to be made by increasing efficiency by digitizing processes.

Read more about this story here.

Total Market Cap: Jan 30

The crypto markets saw slight gains in trading today, with market cap going up to $113.37 billion and trade volumes reaching $16.63 billion.

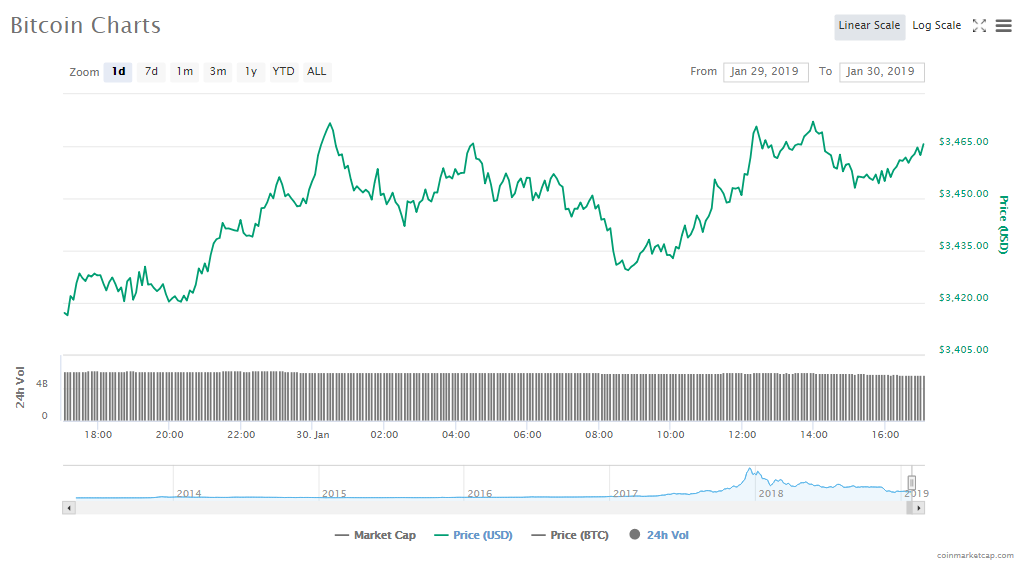

Bitcoin Price Analysis: Jan 30

Bitcoin has gained 1.21% to a current trading price of $3461.14 and has a value in the cryptocurrency market of $60.60 billion. Trade volumes are now $5.59 billion.

Ethereum Price Analysis: Jan 30

Up by 0.91%, the price of Ethereum is currently at $105.99 and its market cap is now $11.08 billion. Trading volumes are now at $2.65 billion.

State of the Top 10 Cryptocurrencies: Jan 30

EOS has taken back its position in fourth place, pushing Tether down to fifth place. The token’s price went up by 2.31% in the last 24 hours. However, the biggest gains have been made by Tron, which is up by 4.06%. EOS is in second place and Bitcoin SV has been the third largest gainer, with its price going up by 2% in the last 24 hours.

- Bitcoin’s price is $3461.14, gaining by 1.21%. The asset’s capitalization is currently $60.60 billion.

- Ripple’s price is $0.290145, gaining by 0.40%. The asset’s capitalization is currently $11.94 billion.

- Ethereum’s price is $105.99, gaining by 0.91%. The asset’s capitalization is currently $11.08 billion.

- EOS’s price is $2.28, gaining by 2.31%. The asset’s capitalization is currently $2.06 billion.

- Tether’s price is $1.01, sliding by 0.03%. The asset’s capitalization is currently $2.03 billion.

- Bitcoin Cash’s price is $111.32, gaining by 0.86%. The asset’s capitalization is currently $1.95 billion.

- Litecoin’s price is $31.16, gaining by 1.01%. The asset’s capitalization is currently $1.87 billion.

- TRON’s price is $0.027751, gaining by 4.06%. The asset’s capitalization is currently $1.84 billion.

- Stellar’s price is $0.083744, gaining by 0.36%. The asset’s capitalization is currently $1.60 billion.

- Bitcoin SV’s price is $64.42, gaining by 2%. The asset’s capitalization is currently $1.13 billion.