Market Update 2.24.19 – CasperLabs Builds PoS Blockchain

Market News

CasperLabs Builds PoS Blockchain

A new blockchain company named CasperLabs is looking to launch with the goal of building a brand new blockchain based on a version PoS (proof-of-stake). The latter, for the sake of context, refers to the experimental consensus protocol commonly associated with Ethereum.

Vlad Zamfir, the Ethereum Foundation researcher, is expected to act as the individual spearheading the consensus protocol structure of the aforementioned firm. This official report only confirms earlier discussions of the executive’s association with the company. CasperLabs, on the other hand, wants to plan a significant portion of Zamfir’s highly anticipated research on PoS.

Read the full report here.

Bank Frick Launches Crypto Trading Platform

Bank Frick, which is a Liechtenstein-based bank, is planning to launch its very own institutional crypto trading platform. It is going to be called DLT Markets. As per the bank’s official announcement, the latter is going to provide institutional investors with not only a secure but also regulated multi-exchange access to the cryptocurrency asset class.

The CEO of the bank named Edi Wogerer said that the so-called “spin-off” would give institutional clients a unique access to what is deemed to be an indispensable combination of bank regulated and a fintech company. Roger Wurzel is reportedly the new CEO of the aforementioned subsidiary. It is worth noting that he previously worked at Bank Frick, particularly covering the bank’s business development area.

Bank Frick is located in Balzers and came to existence sometime in 1998. Interestingly, the bank is majority owned by none other than the Kuno Frick Family Foundation. In a press release publised last April 2018, it managed to come up with a net profit of around 6.3 million Swiss francs, which is about $6.3 million. The year in question is 2017.

Read the full report here.

Stanford Builds Mechanism For ETH Smart Contract

Researchers hailing from the Stanford University and Visa Research are reportedly developing what appears to be a privacy mechanism. The latter, in particular, is designed specifically for Ethereum (ETH) smart contracts. According to a research paper, which describes the overall idea behind the mechanism, the researchers manage to create what is called “Zether.”

In a nutshell, it is a payment mechanism that is guaranteed to be fully decentralized and comes with utmost confidentiality. Apparently, it is going to be extremely consistent with not only Ethereum but as well as other smart contract platforms. The brand new smart contract built by the developers can be executed by two methods. One is individually and the second one is by using other smart contracts. Ultimately, it is going to help in maintaining account balances encrypted. From there, it is going to perform processes, such as transfer, withdrawal, and deposit of funds via crypto proofs.

Read the full report here.

Total Market Cap: February 24

The volume of trade, in particular, in the digital currency market reached $34.26 billion. The market’s capitalization, on the other hand, reached $142.35 billion.

Bitcoin Price Analysis: February 24

Considering the past 24 hours, the world’s leading digital currency called Bitcoin fell 4.27% to trade at $4,156.32. The crypto’s volume trickled to $9.94 billion, but the market settled around $72.97 billion.

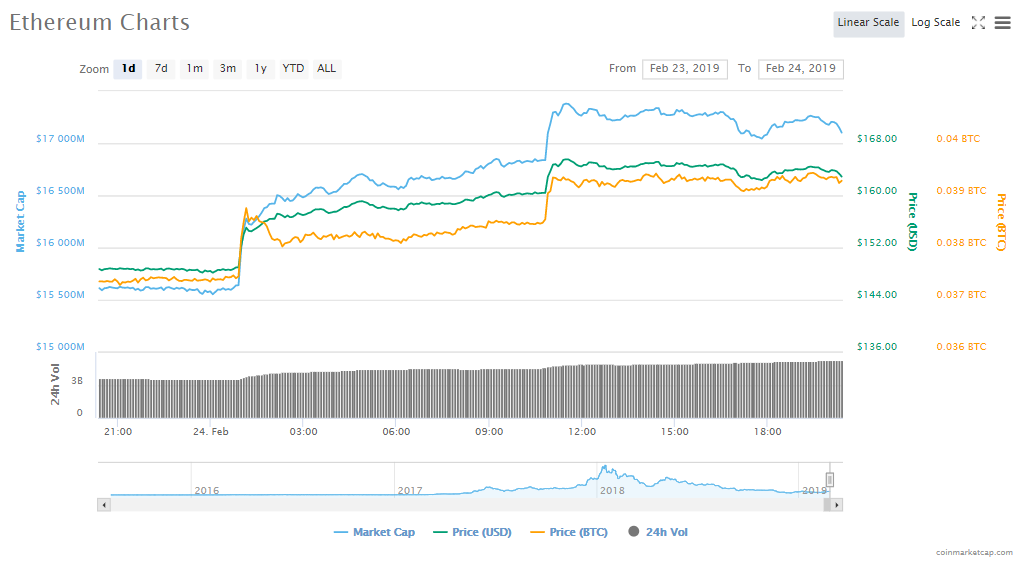

Ethereum Price Analysis: February 24

ETH’s price jumped 9.75% to trade at $163.28. As for the crypto’s volume of the trade, it was successful in reaching $5.26 billion. But as far as the market capitalization is going to be the topic, it hit $17.14 billion.

State of the Top 10 Cryptocurrencies: February 24

In the past 24 hours, all prices were up except for Tether’s. Meanwhile, Binance Coin continues to dethrone Cardano at the 10th spot.

- Bitcoin’s market price jumped 4.27% to $4,156.76, and its value in the market is $97 billion.

- Ethereum’s market price jumped 9.75% to $163.28, and its value in the market is $17.14 billion.

- XRP’s market price jumped 4.66% to $334341, and its value in the market is $13.83 billion.

- EOS’s market price jumped 13.49% to $4.38, and its value in the market is $3.97 billion.

- Litecoin’s market price jumped 6.32% to $52.36, and its value in the market is $3.17 billion.

- Bitcoin Cash’s market price jumped 7.87% to $154.82, and its value in the market is 2.73 billion.

- Tether’s market price fell 0.13% to $1.01, and its value in the market is $2.03 billion.

- Stellar’s market price jumped 4.39% to $094636, and its value in the market is $1.81 billion.

- TRON’s market price jumped 6.77% to $0.026759, and its value in the market is $1.78 billion.

- Binance Coin dethroned Cardano at the 10th spot after its market price jumped to 2.52% to $10.89. As for its value in the market, it is $1.54 billion.