Market Update 8.03.18 – Philippines Issues Draft of ICO Regulations

Market News

Philippines Issues Draft of ICO Regulations

The Philippines Securities and Exchange Commission (SEC) released a draft of regulations for ICOs (Initial Coin Offerings) and has asked the public to provide feedback on these proposed rules. In the regulator’s Memorandum Circular, the SEC has mandated that any company wanting to launch an ICO, or any ICO selling their tokens to Filipinos, will need to first submit an application called the Initial Assessment Request to the SEC. This will help the Commission decide whether that token is a security or not.

Another mandate that the Philippines SEC has proposed is that ICOs need to submit their applications at least 90 days before they plan to launch their pre-sale period.

Find out more details of the story here.

US$ Not Japanese ¥ Dominating Crypto Trading

According to an in-depth study conducted by CoinDesk, there are methodology flaws in the way data is being reported by exchanges, because of which the importance of the Japanese Yen (¥) as a trading pair is being overstated. Analysis of the data collected between July 26 and July 30 shows that the US Dollar ($) is the dominant currency for trading in Bitcoin – by a large margin.

The reason why the Yen looks more dominant is because the currency trades in a large rang of derivative products rather than just actual Bitcoin.

Read the rest of the story here.

BTC Must be Reach $213,000 To Replace US$

According to the Zurich based financial services company and investment bank, UBS (Union Bank of Switzerland), Bitcoin’s price must hit almost $213,000 a token if it is to replace the current US Dollar as the main source of money. This new study by UBS shows that BTC cannot currently replace the US Dollar or even be considered a viable asset since its versatility is currently constrained by its inability to scale up. According to UBS, their current findings show that Bitcoin is currently too unstable and limited to be used as regular currency.

The report by UBS also suggests that while cryptocurrency have the potential to become an alternative asset class, their volatility will likely remain.

Read more here.

Total Market Cap: August 03

The cryptocurrency market’s trade volume continue to slide, it currently being at $12.62 billion. The market’s value also plunged to its current $258.67 billion.

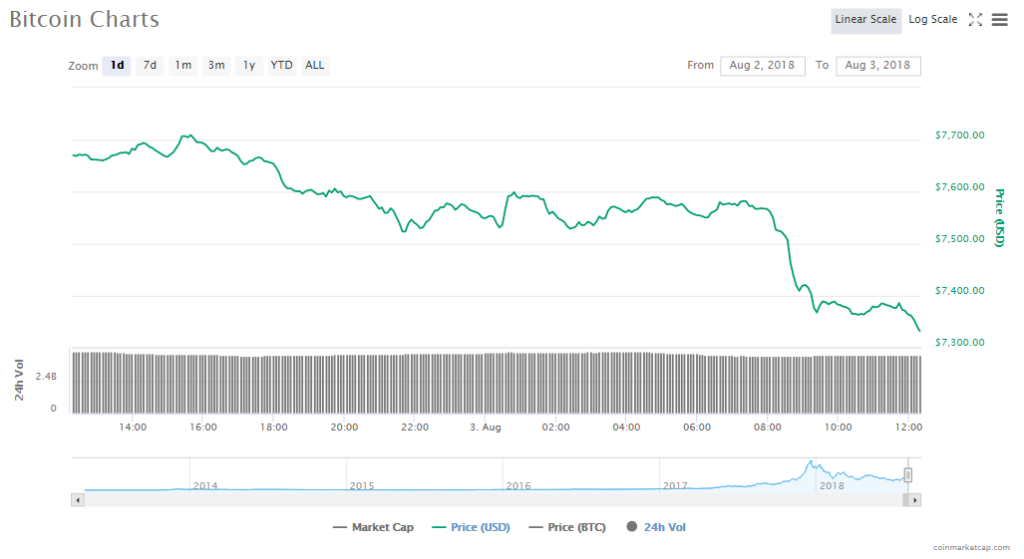

Bitcoin Price Analysis: August 03

While BTC slumped 4.27% to trade at $7332.29 per token. Volume of trading in the crypto also sank to $4.28 billion and its market value dropped to $126.12 billion.

Ethereum Price Analysis: August 03

Ethereum’s price dropped down by 4.77% to trade at $401.48. Trading volume also fell to $1.56 billion and market valuation for the crypto is now at $40.52 billion.

State of the Top 10 Cryptocurrencies: August 03

The downward spiral of the cryptocurrency market continues with all the top ten cryptos slumping. The three biggest losers today so far are IOTA, which plunged 14.22%, Cardano, which slumped 10.11% and Stellar, which nosedived 9.32%. Bitcoin’s price also dropped by 4.27%.

- Bitcoin slumped 4.27% to its current price of $7332.29. The virtual currency’s capitalization is $126.12 billion.

- Ethereum slumped 4.77% to its current price of $401.48. The virtual currency’s capitalization is $40.52 billion.

- Ripple slumped 2.79% to its current price of $0.429345. The virtual currency’s capitalization is $16.88 billion.

- Bitcoin Cash slumped 7.38% to its current price of $705.39. The virtual currency’s capitalization is $12.18 billion.

- EOS slumped 3.33% to its current price of $6.95. The virtual currency’s capitalization is $6.29 billion.

- Stellar slumped 9.32% to its current price of $0.248798. The virtual currency’s capitalization is $4.66 billion.

- Litecoin slumped 3.57% to its current price of $74.96. The virtual currency’s capitalization is $4.32 billion.

- Cardano slumped 10.11% to its current price of $0.125242. The virtual currency’s capitalization is $3.24 billion.

- Tether slumped 0.18% to its current price of $0.998168. The virtual currency’s capitalization is $2.41 billion.

- IOTA slumped 14.22% to its current price of $0.788230. The virtual currency’s capitalization is $2.19 billion.