Market Update 9.24.18 – Recent Bitcoin Bug So Terrible Developers Tried to Cover Its Secret

Market News

Recent Bitcoin Bug So Terrible Developers Tried to Cover Its Secret

This week saw a major Bitcoin bug that was worse than what developers initially thought of. The bug originally rocked the number one digital currency world, especially since its vulnerability could be utilized to shut down a huge chunk of the network.

While this sounded bad enough for many, it turns out developers for Bitcoin Core kept a second, bigger part of the bug a secret. As disclosed through an official Common Vulnerabilities and Exposures (CVE) report, an attacker could have actually used it to create new Bitcoin, which is believed to be above the 21 million hard-cap of coin creation. As a result, it inflated the inflating the supply and devalued current Bitcoins.

Many believe that this perversion of the rules would, at worst, think twice about trusting digital currencies. And due to the disastrous implications of the bug – and perhaps the panic it would create – developers tried to keep it a secret. They simply wanted to buy themselves enough time to resolve the issue.

Read the full report here.

Swiss Banks Preventing Mass Exodus By Giving Ease Access to Crypto Startups

The Swiss Bankers Association (SBA) has recently issued basic guidelines designed specifically for banks working with blockchain startups. According to official reports, the measure was intended to prevent a mass crypto exodus out of Switzerland.

The document states that banks see blockchain as an opportunity for the country to house financial and technology startups, and this is seen as a viable option despite “risks” like money laundering. Due to a significant increase of crypto-related companies based in the country, the SBA thought it was only right to provide a roadmap for banks to open their corporate accounts.

The guidelines divide blockchain companies into two large groups. The first ones are ICO and the second ones are those without it. Blockchain companies without ICOs should be treated like other small and medium-sized companies and, thus, are obliged to accept relevant Swiss regulations and apply them to their business models.

The second group includes blockchain startups with ICOs who issue tokens either in fiat or in crypto. Companies whose ICOs are funded via digital coins will have to comply with stricter rules and fall under the Swiss AML and KYC laws.

Read the full report here.

Report Says Cryptojacking Instances Soared 400% in a Year

Instances of cryptojacking malware have become a huge thing these days. In fact, it has already jumped more than 400 percent since last year, according to a new report. A collaborative group of cybersecurity researchers called the Cyber Threat Alliance (CTA) published the report, which detailed the many repercussions from cryptojacking. The latter is basically the illicit practice of hijacking a user’s computer to mine digital currencies.

Most notably, CTA points out in the research that the number of instances of illicit mining malware found has sharply spiked in the months from the close of 2017 to end of July 2018.

“Combined data from several CTA members shows a 459 percent increase in illicit cryptocurrency mining malware detections since 2017, and recent quarterly trend reports from CTA members show that this rapid growth shows no signs of slowing down.”

Read the full report here.

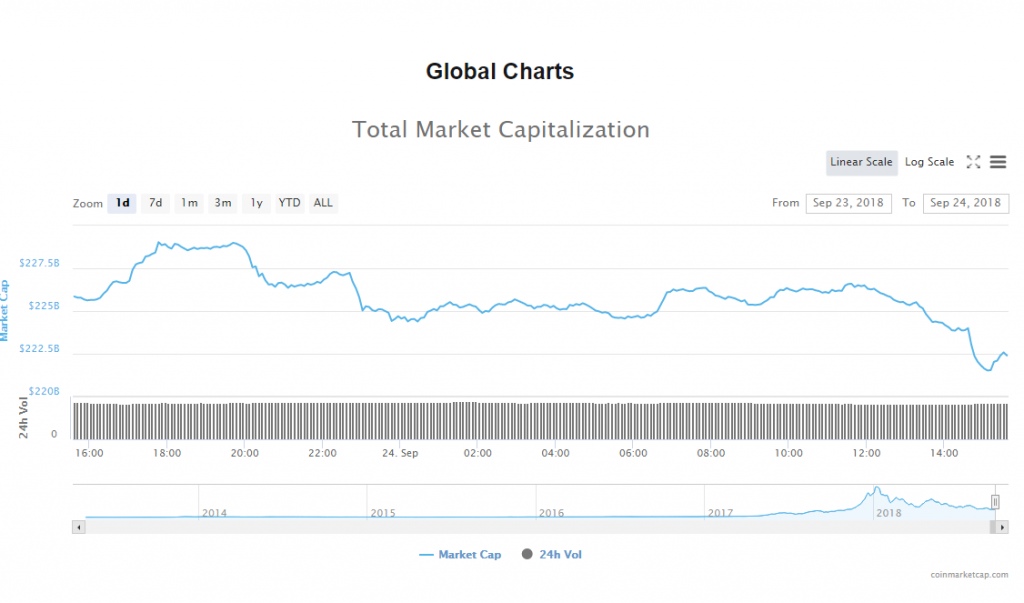

Total Market Cap: Sept 24

The volume of trade in the crypto market sat at $13.81 billion. The market’s capitalization, on the other hand, reached $222.53 billion.

Bitcoin Price Analysis: Sept 24

In the past 24 hours, Bitcoin fell 0.64% to trade at $6,677.98. The leading cryptocurrency’s trade volume trickled to $4.21 billion, while its market slid to $115.43 billion.

Ethereum Price Analysis: Sept 24

Ethereum’s price fell 2.07% to trade at $235.74. As for the altcoin’s trading volume, it reached $1.77 billion; whereas its market capitalization hit $24.08 billion.

State of the Top 10 Cryptocurrencies: Sept 24

In the past 24 hours, all prices were down, except for Tether’s. Monero dethroned Dash at the 10th spot.

- Bitcoin’s market price fell 0.64% to $6,677.98, and its value in the market is $115.43 billion.

- Ethereum’s market price fell 2.07% to $235.74, and its value in the market is $24.08 billion.

- XRP’s market price fell 3.20% to $0.560237, and its value in the market is $22.3 billion.

- Bitcoin Cash’s market price fell 3.54% to $472.28, and its value in the market is $8.2 billion.

- EOS’ market price fell 3.10% to $5.78, and its value in the market is $5.24 billion.

- Stellar’s market price fell 2.02% to $0.265682, and its value in the market is $5 billion.

- Litecoin’s market price fell 4.38% to $58.66, and its value in the market is $3.43 billion.

- Tether market price jumped 0.35% to $1, and its value in the market is $2.8 billion.

- Cardano market price fell 4.09% to $0.086729, and its value in the market is $2.45 billion.

- Monero dethrones Dash at the 10th spot, but its market price fell 5.32% to $120.07, and its value in the market is $1.97 billion.