Crypto Confusion: Why Isn’t Good News Moving the Market?

In the last several months, major announcements from institutions, regulators, and technological innovators have given the public newfound optimism regarding blockchain’s future, and yet the cryptocurrency market has reacted lethargically—if at all. Good news is no longer moving the market as it once did, though bitcoin and other cryptocurrencies have been historically sensitive to it. As a newer asset class, cryptocurrency has always had an unpredictable quality because no one knew what kind of future it would have, but this status quo is rapidly changing.

As crypto veterans are fond of saying, it helps to “zoom out” and think in broader terms about what is different now than just a year ago. Institutional support has increased dramatically, both from banks and the private sector in the form of investments, partnerships, development, and asset variety. Individual developers are getting onboard in massive numbers, with Consensys estimating that Ethereum has over 250,000 of them currently.

However, the overwhelming support for blockchain and cryptocurrencies as utilities has had the opposite effect on price. This may be a consequence of institutional support, even though many believed that larger entities joining the market would balloon the price of bitcoin and others. Unfortunately, this is not so. Many of the positively-skewed announcements in the last year about exchanges like CME and CBOE listing bitcoin futures and are actually bearish signals for long-term crypto holders.

With a greater variety of and investment in derivatives, the effect is a settled market where volatility is no longer the modus operandi. Hedge funds and other algorithmic-aided investment institutions have essentially suppressed the price of bitcoin because they are not only going long—they are shorting cryptos. Their participation is not in the underlying asset, and even if they bought bitcoin in bulk via services like Coinbase Custody, their algorithms can make huge amounts of money just by keeping this young market in range.

It is in these conditions that an average cryptocurrency trader finds themselves: the “tail end of a crypto bubble”, per Ethereum founder Vitalik Buterin. The maturation of blockchain is occurring at a contentious time for its financial component—coins and tokens. It is hardly a surprise then that even the most positive news has had little elating effect in the midst of a rapid deflation.

Studying Big Recent News in Bitcoin

The above factors contribute to the idea that if the market is not by now fully controlled by large entities, its value is completely detached from any news about the underlying technology or even cryptocurrency itself. Some of the biggest news in years—events that would, in a bull market, have reliably seen significant spikes—are all but ignored.

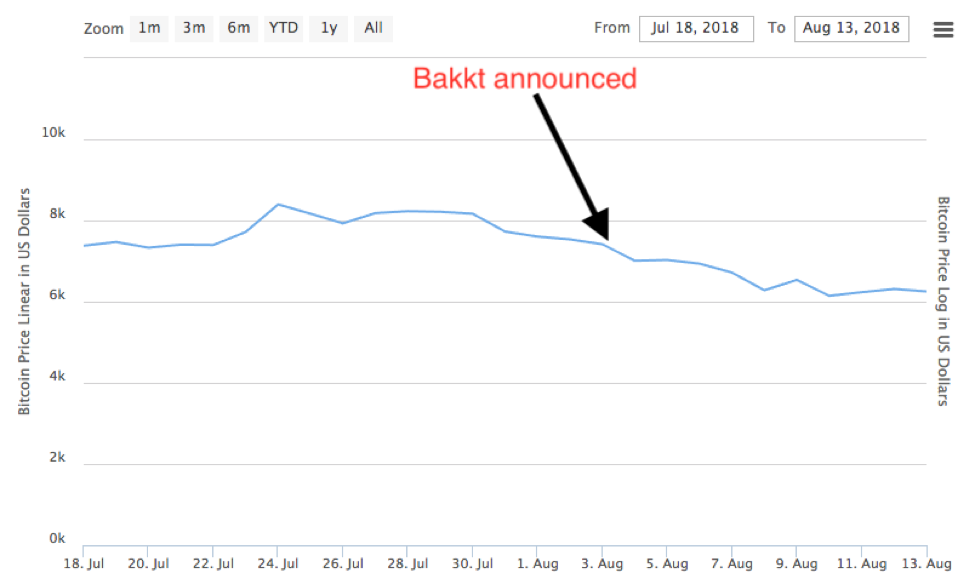

Take the recent joint announcement on August 3 by Microsoft, Starbucks, and New York Stock Exchange owner ICE (Intercontinental Exchange) to launch Bakkt—a global ecosystem for digital assets and payment. Bakkt is the real manifestation of blockchain and bitcoin’s biggest shared pipedream: a payment system that has fungibility with real applications (Starbucks and Microsoft products to begin with) and support for bitcoin itself. The news did not register at all on the charts, which continued to trend downwards after failing to break resistance around $8k.

Another encouraging announcement was made previously to that of ICE and its two corporate partners, and it came from the public sector rather than the private. The question of Bitcoin and Ethereum’s precise definition in the financial realm has been prevalent for some time now, but the SEC gave an indication in June that they won’t classify either as securities. This effectively exempts them from regulation and should have been an ardently bullish signal.

In the Bakkt and SEC examples, post-bubble market forces were enough to extinguish any bullish optimism on the price of the assets affected. This was the case with the increasing possibility of a Bitcoin ETF as well. Bitcoin exchange-traded funds have been proposed by many institutional entities, such as VanEck and SolidX, but the SEC’s decision was ultimately postponed until December. A Bitcoin ETF would be potentially good for price, as it would be settled in Bitcoin itself. The SEC postponing its decision is also potentially bullish, as it means the result of these proposals is not yet a foregone conclusion, though many believe that it is only a matter of time before the ETF arrives.

Estimating Based on Past Bubbles

In terms of past bubbles in the cryptocurrency market, some of which fell almost 90%, as in the case of November 2013 to January 2014 at -87%, it may be that the current market cycle needs to play out in its entirety in the same proportions before returning to the mean. Anticipating a similarly steep decline from $19,200, the true bottom may be anywhere from $2,500 to $4,800 depending on one’s source of analysis. Even big names in the sector such as BitMEX CEO Arthur Hayes, whose net worth is tied to the value of cryptocurrency, have given similar estimations.

Whether the market will again reach a point where upbeat news boosts the price of cryptocurrency, or where its manipulators allow it to, it still unclear. If a Bitcoin ETF is approved while Bitcoin is in its classic post-bubble bottom percentage-wise, it could trigger a significant price event, but this is still largely speculative. Investors should instead take hope from the fact that Bitcoin and other cryptocurrencies have unlimited upside and downside that’s quickly running out of room. Crypto and blockchain are already a part of the world and will continue to be, which should be the best news of all.