Bitcoin Halved Once More: What Does the Future Look Like?

Volatility. It’s what bitcoin is known for. We saw this again after the world’s top cryptocurrency fell with the rest of the world’s stocks, equities, and commodities before climbing all the way back to $10,000.00 per unit on by Thursday, May 7th.

But just days before the scheduled halving, BTC fell again. On May 11th, hours before halving, it hit $8,600.00. Now, on May 20th, it has already moved back to $9,700.

So, now that the dreaded or anticipated halving is over, what are there new short and long-term outlooks for the king of cryptos?

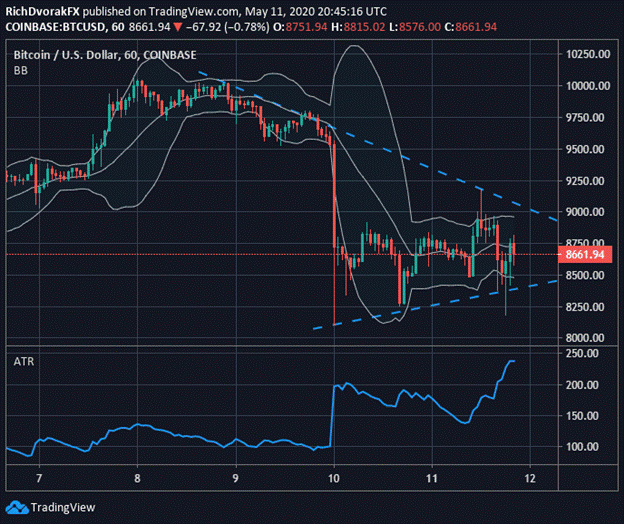

Right after the halving Chart created by @RichDvorakFX with TradingView

The chart shows accelerated price volatility brought on by the scheduled halving. Directly before the halving, BTC plummeted by over 10%. But within a day already recovering that loss. Bitcoin and gold and gold have both been strong through the first quarter and entering the second quarter. Bitcoin actually outpaced just about everything so far in May, trading 20% higher this year on balance.

So, the claims of BTC being a safe-haven for your money during the global pandemic are turning out to be true.

Short-Term Affect

With this halving, rewards were also halved. So, instead of miners making 12.5 bitcoins per block, they will only make 6.25.

So let’s back up a second and explain this. So, each time a new block is discovered, rewards are offered. Essentially, bitcoins are created. So, the blocks are each part of the blockchain. Meaning a string of immutable ledgers that that house all of the bitcoin transaction records. Basically, when minors are helping to handle thousands of transactions, a new ledger is needed at some point. This is where the new blocks come into play. For each new block created, the miner is rewarded. A block is limited to 1MB of data, which usually comes in around 3500 transactions. Prior to this halving, miners were rewarded 12.5 coins per block, before that it was 25 coins, and years ago, it was 50.

Now miners won’t be the most significant producers of bitcoin, and many are thinking that they won’t be able to keep up with operational costs with the rewards set at 6.5. Suddenly exchanges will contribute more BTC and most of the smaller mining operations or those that have slightly higher overhead for any reason will most likely close their doors. The loss of servers powering the transactions will result in a lot less hash power– the power provided by computers to solve hashing algorithms.

So, few coins being mined and at a slower pace is scary to some. But historically speaking BTC has always made a significant bull run shortly after hashing and then settled in at new, never seen before prices. So, for the short-term, we are likely to see continued volatility as the market adjusts. That said, when you look at it as betting your money against the market, which is essentially what you are doing. Like Theo Goodman stated in his article on bitcoin halving, past performance does not mean that similar future performance is guaranteed. So, invest with caution at the moment.

Long-term Affect

Here’s where it gets tricky. Some are expecting bitcoin to get back up past 20K but 2021, and other experts are putting the next ceiling or perhaps plateau way up at 100K. But, there is also a good chance that the coin could drop drastically. Back in April, BitMEX’s Ceo warned the world that bitcoin could plummet back down to the $3,000 range and stabilize there. This was following the march 12th BTC and equities market crash. If equities correct again. So, the medium-term economic fall out from the massive 2-trillion dollar stimulus package among other COVID-created factors could be what determines another equities ‘crash’. Now that bitcoin has shown that it has direct correlation with the stock market, let’s hope that a ‘reset’ doesn’t happen, else we could see BTC plunge below the 3k mark.

So, the best strategy at the moment might be to just watch and wait. Take it all in and start building new data sets based on the current situation. Either way, it’s going to be an interesting ride.