Kyber Network (KNC) Review – A Fully Decentralized Liquidity Network

| Name | Kyber Network |

| Ticker | KNC |

| Total Supply | 280,000,000 |

| Initial Price | $0.46 |

| Category | Decentralized Exchange |

| Website URL | https://kyber.network/ |

| White Paper URL | https://whitepaper.io/document/43/kyber-network-whitepaper |

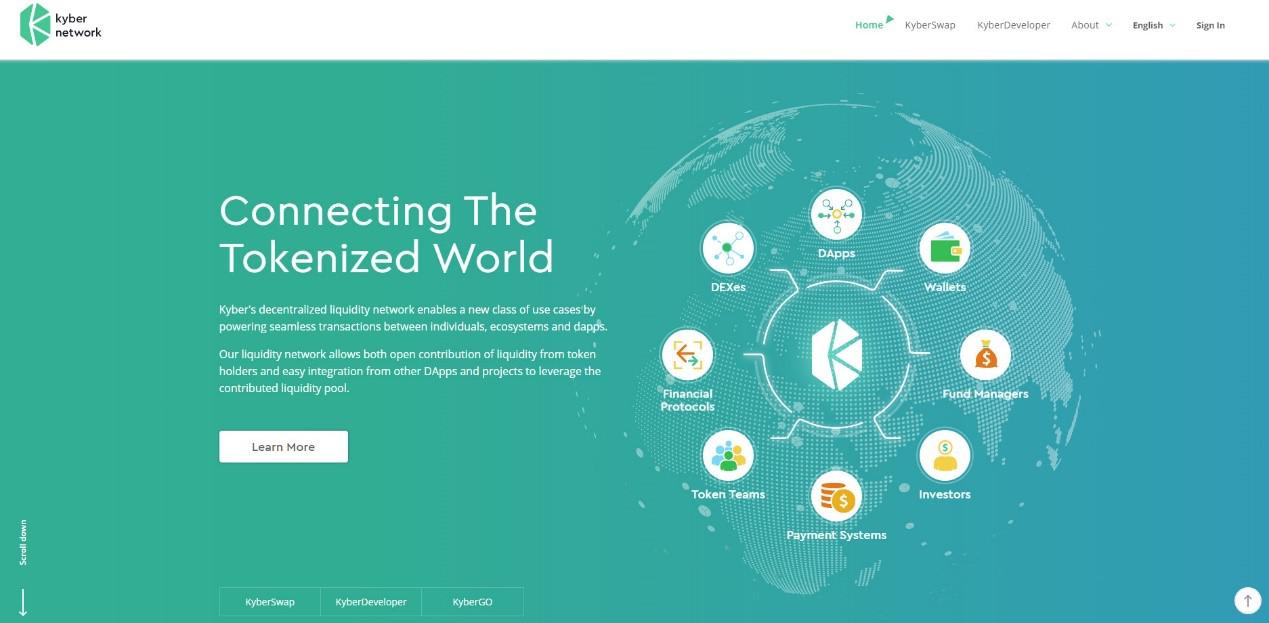

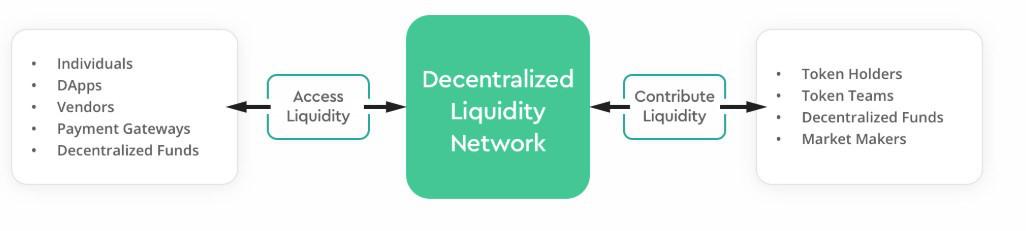

Kyber is committed to making tokens useful across many different ecosystems. Its goal is to become the network used for a variety of inter-token use cases. It does this through developing a network that offers open contribution of liquidity from token holders in addition to easy integration by DApps and projects, allowing for a more integrated ecosystem.

The Idea Behind Kyber Network

Along with the cryptocurrency and blockchain space, we have seen a proliferation of the number of tokens, but these tokens cannot be used across different ecosystems.

Kyber Network is a decentralized Ethereum-based solution that focuses on the interchangeability and fluidity of digital asset conversion. It does this by providing a secure platform that offers flexibility and choice for token exchange and payment.

As the Kyber Network website explains:

Kyber Network was developed according to 3 core design beliefs:

- It should be platform agnostic. Meaning that it can be used with any application or protocol.

- It should have instant settlement and users must be able to make transactions without uncertainty. This will enable adoption in the world of commerce and finance.

- It must be easy to integrate. Kyber runs on-chain and with full transparency of operations. One of the team’s major priorities is to design the technology to be developer-friendly and compatible with other systems.

The Kyber Network team includes Loi Luu, the CEO and co-founder, who previously developed Oyente, the first open-source security analyzer for Ethereum smart contracts. He also founded SmartPool, which works towards the decentralization of mining pools in cryptocurrency. He is a regularly invited speaker to events such as DevCon2, EdCon and Scaling Bitcoin.

His co-founder, Yaron Velner, has a Phd in computer science from Tel Aviv University, focusing on game theory. He has also worked as a software engineer for over 10 years, including a position as a technical lead at EZchip semi-conductors.

Among the advisory board is Vitalik Buterin, the founder of Ethereum.

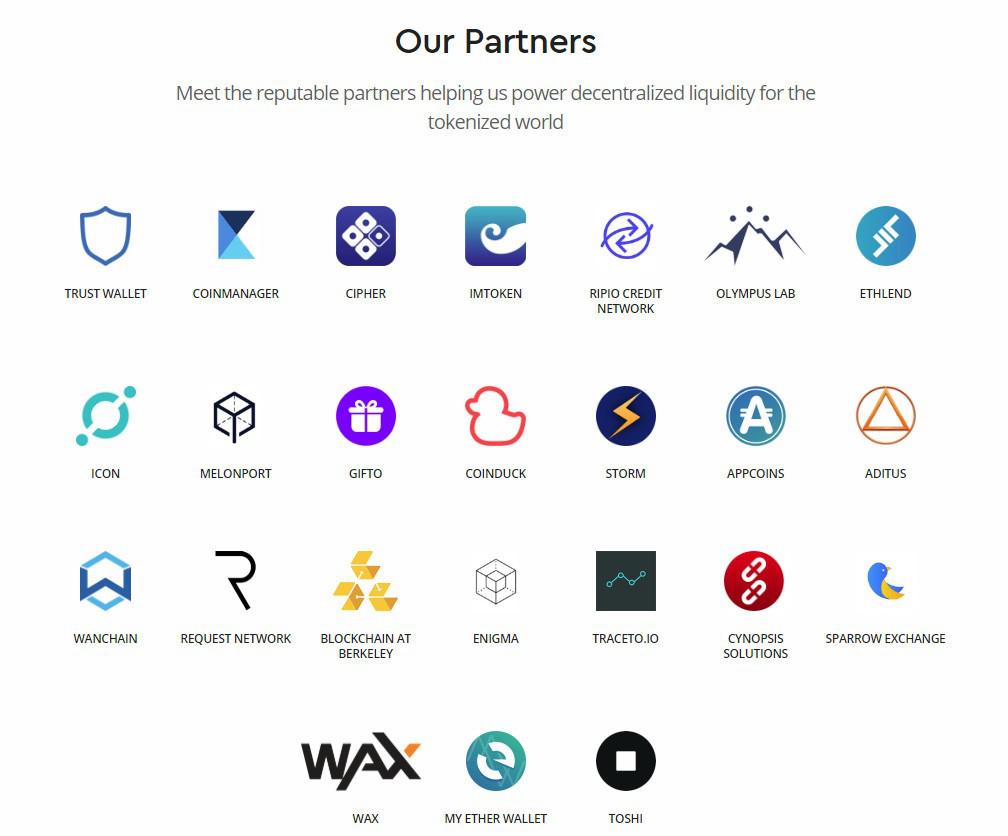

Kyber Network Partnerships

Kyber Network has a number of important strategic partnerships.

In October of last year Kyber Network joined forces with AppCoins, a digital token that lets users earn tokens via engaging with app advertising. Tokens are spent by users through in-app purchases. The tokens will be compatible for all app stores, giving Kyber Network large exposure to the mobile marketplace.

In November of last year, they partnered with StormX, a blockchain-based platform that manages gamified micro-tasks between buyers and sellers using smart contracts.

At the end of the year the company partnered with RCN, a global credit protocol aimed at giving the world greater access to digital payment alternatives. Kyber

Network will deliver the conversion services that RCN needs for both credit exchanges and wallet providers to integrate into the RCN network.

Kyber Network Price History

KNC launched its token in November 2017 at an initial price of $0.46. The token hit a peak of $5.84 on January 9, 2018. The price then fell before rising again to $2.72 at the end of April.

The Kyber Network Technology

Kyber’s liquidity network is created by enabling their use on a variety of platforms and ecosystems.

Kyber Network consists of four separate interfaces:

Kyber Swap

A retail platform, Kyber Swap enables users to buy or sell many different tokens. Since transactions are instant and convenient, it makes it an ideal network for the retail industry.

Kyber Developer

This interface includes developer tools and documentation that allows any blockchain or decentralized project to integrate into Kyber’s liquidity pool. Among the platforms that have already integrated with Kyber are: MyEtherWallet, imToken, Easwap, MoatFund, Betoken and Galion.

Kyber Reserve

Reserves provide liquidity to the network by contributing their idel token assets to the liquidity pool. These tokens can be used across any platform integtrated into the network, increasing liqudity further. Reserves earn the spread in every transaction.

Since security of reserver is of prime concern to Kyber Network, a transparent fund management model is used. This fund records all trades completed by reserve managers to ensure transparency. In addition, funds can only be delivered to predefined addresses, limiting the possibility of allowing for unverified transactions to take place. Reserve managers also are prevented in creating false or unfair exchange rates by the sytem.

Kyber GO

Kyber GO’s goal is to become the best retail platform for token sales. Development teams don’t have to put time and resources into building their own token sale platform.

The KNC Token

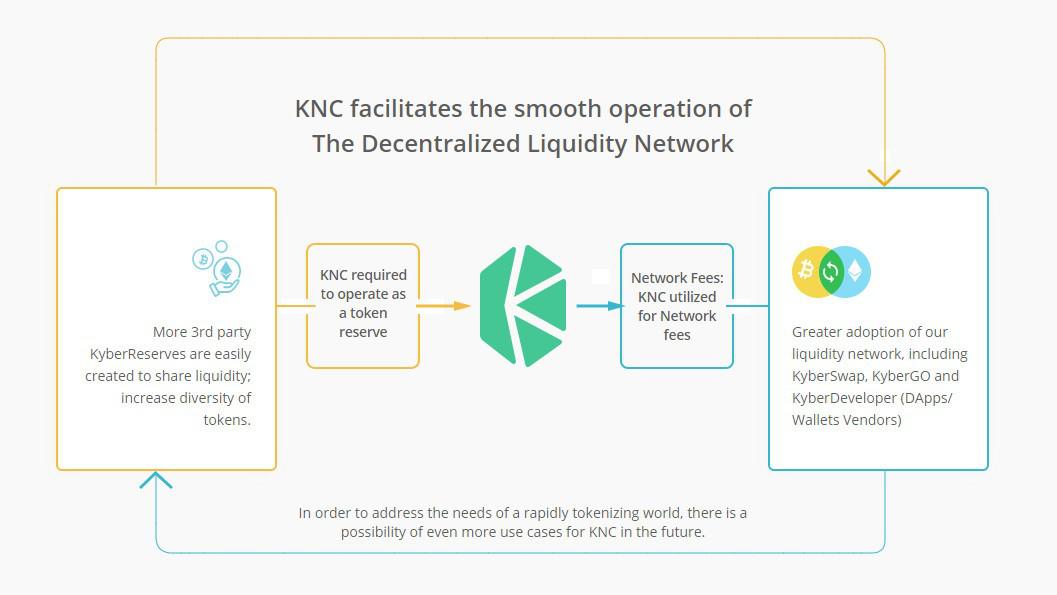

KNC powers the Kyber Network by allowing for third-party token reserve to purchase KNC in order to operate. This process is incentivized as reserves receive a spread from every transaction that involves their liquidity pool.

More KNC will be needed as more reserves are created and there are more users in the Kyber Swap, Kyber Go and Kyber Developer interfaces. In addition, DApps earn a portion of the profit of any transaction for referrals to the Kyber Network. A percentage of the fees on the Kyber Network paid in KNC are destroyed and burned, keeping the token stable and protecting it against inflation.

How to Purchase KNC

The main exchange for purchasing KNC is on OKEx, which currently has the largest volume of the currency at over $1.3 million. KNC can be traded on OKEx for USDT, BTC and ETH.

KNC is also available on the following exchanges:

- Bithumb (Trade KNC with KRW on Bithumb)

- CPDAX (Trade KNC with BTC on CPDAX)

- ABCC (Trade KNC with BTC on ABCC)

- Binance (Trade KNC with BTC on OKEx)

- Liqui (Trade KNC with BTC on Liqui)

How to Store KNC

KNC can be stored in any wallet that supports ERC-20 tokens such as Coinomi, MetaMask and Myetherwallet.

For maximum security, however, you should store your KNC on hardware wallets such as Ledger Nano S and Trezor.

Roadmap and Future Plans

There are several different phases to Kyber Network’s roadmap.

The basic mainnet was deployed at Q1 of 2018, supporting tokens with high demand and high trading volumes in the marketplace. The company increased its partnerships during this time period as well.

In Q2 of 2018, the company worked towards supporting the arbitrary pairing of tokens as more tokens accumulate in their reserves. Kyber Network worked with strategic partners to build APIs that integrate into new platforms that allow users to trade tokens.

By the end of Q4 2018, the company will support the trading of advanced financial instruments, such as decentralized hedge fund platforms. APIs will be built to enable further collaboration between platforms.

In 2019 the company aims to allow users to trade between Ether/tokens and Bitcoin, ZCash, ETC, etc. They will do this through chain relays and interchain communication protocols.