Veritaseum (VERI) Review – A Global P2P Economy Fueled by Smart Contracts

| Name | Veritaseum |

| Ticker | VERI |

| Token Type | ERC-20 |

| Total Supply | 100,000,000 |

| Website URL | https://veritas.veritaseum.com/ |

Veritaseum envisions a P2P capital markets platform that allows transactions of value without the need for a third-party (such as brokers, financial advisors, and banks). It provides this through the use of a smart contract suite of distributed software applications (VeApps) on the blockchain.

The Idea and the Team Behind Veritaseum

Currently major banks such as JP Morgan, Goldman Sachs, Citibank, and regional banks are gatekeepers between you and your money. Every time you make a transaction, one of these gatekeepers takes a bit of your money.

Veritaseum is seeking to change the status quo and decentralize this central authority by developing a smart-contract driven, peer-to-peer (P2P) capital market. It is comparable to the BitTorrent protocol which allows P2P file-sharing.

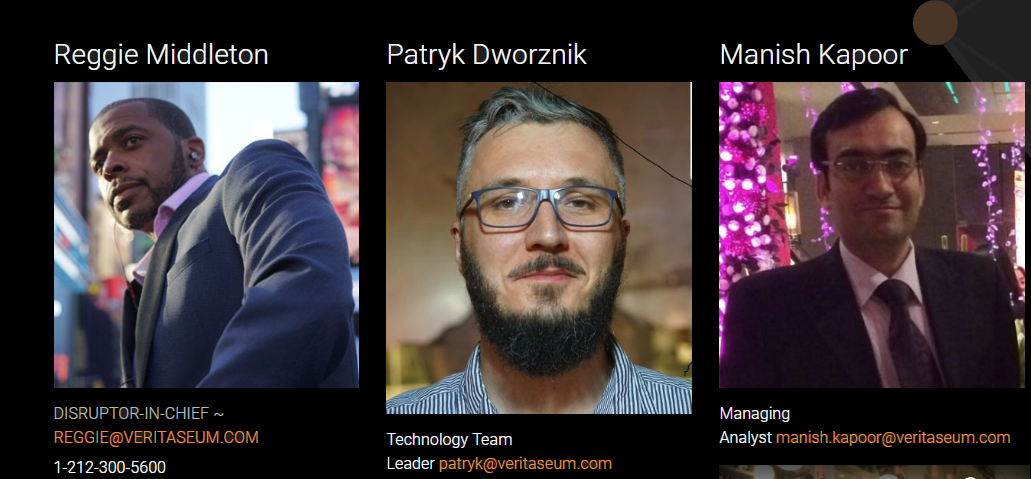

The Veritaseum team is headed by Reggie Middleton, an entrepreneurial investor with an outstanding track record which includes (but is not limited to) the rise of Apple, Google and Samsung and the collapse of Bear Stearns in January 2008.

Patryk Dworznik is the team’s senior software engineer. A full-stack developer and engineer, he has deep knowledge of Bitcoin blockchain development, bitcoin script, Java, Resct, Javascript, C++, GO and Solidity.

Manish Kapoor is the team’s certified public accountant. He has been working with Reggie for the last 15 years and has held management positions at Deloitte and Price Waterhouse Coopers. He has deep expertise in forensic accounting, valuation, due diligence, investment, M&A advisor7y, and business restructuring.

Veritaseum Partnerships

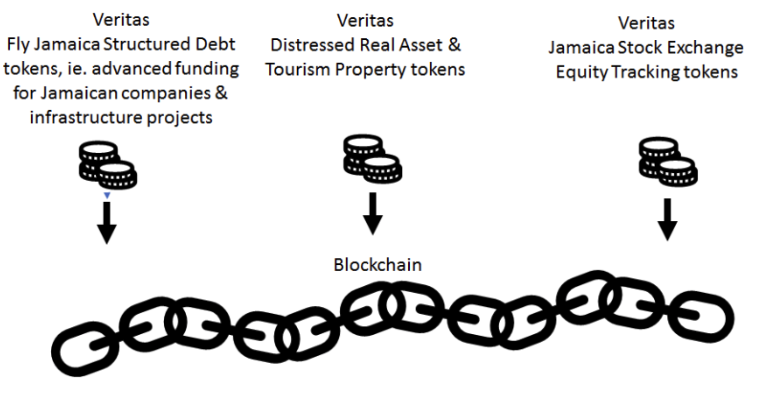

Veritaseum has entered into a joint venture with the Jamaican Stock Exchange (JSE). Currently, JSE is a small stock exchange that was incorporated in 1969. It is a small exchange even in comparison with other exchanges in the Caribbean region, with only 63 companies listed on it and a daily volume of $1.7 million.

Veritaseum’s goal is to increase revenue opportunities for JSE and allow them higher trading volume, easier investment, and better access to global capital. This in turn will lead to higher growth of the local economy.

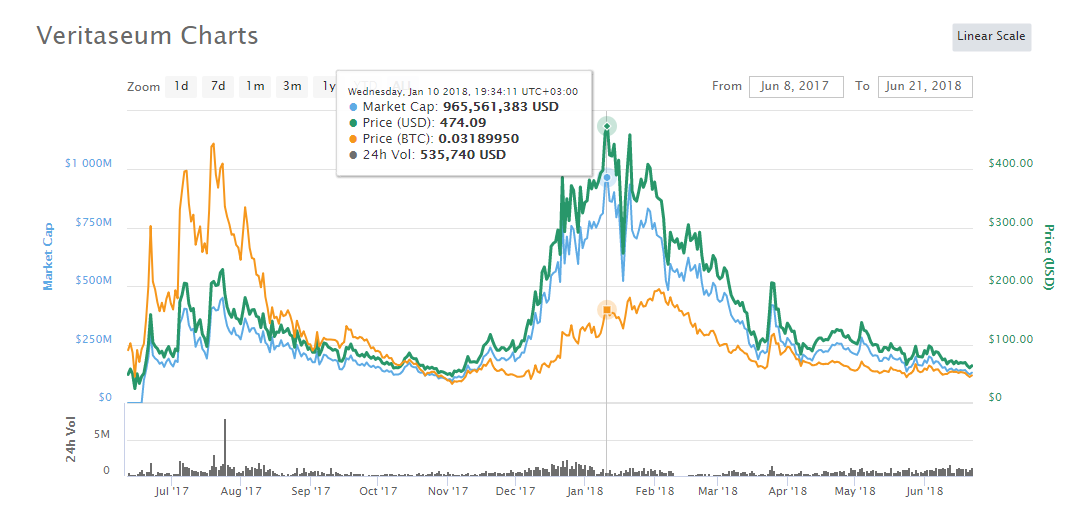

Veritaseum Price History

Veritaseum’s ICO took plan in April of 2017 and ended a month later.

The token rose to $474.72 in early January and then again to $78.37 by January.

The Veritaseum Technology

Veritaseum has a number of offerings, both centralized and distributed.

- The centralized solution is available for traditional institutions that are not yet able to integrate with distributed capital markets system. This solution will run on servers under the control of the client.

- Distributed solutions are both research and analysis-based, and a number of steps are involved in developing each one:

- The client states the goals of the project

- Veritaseum financial analysts, macro-strategists, and financial engineers develop a framework for the project according to the client’s goals

- A software token and smart contract is created to support the business process and logic involved through financial analysis

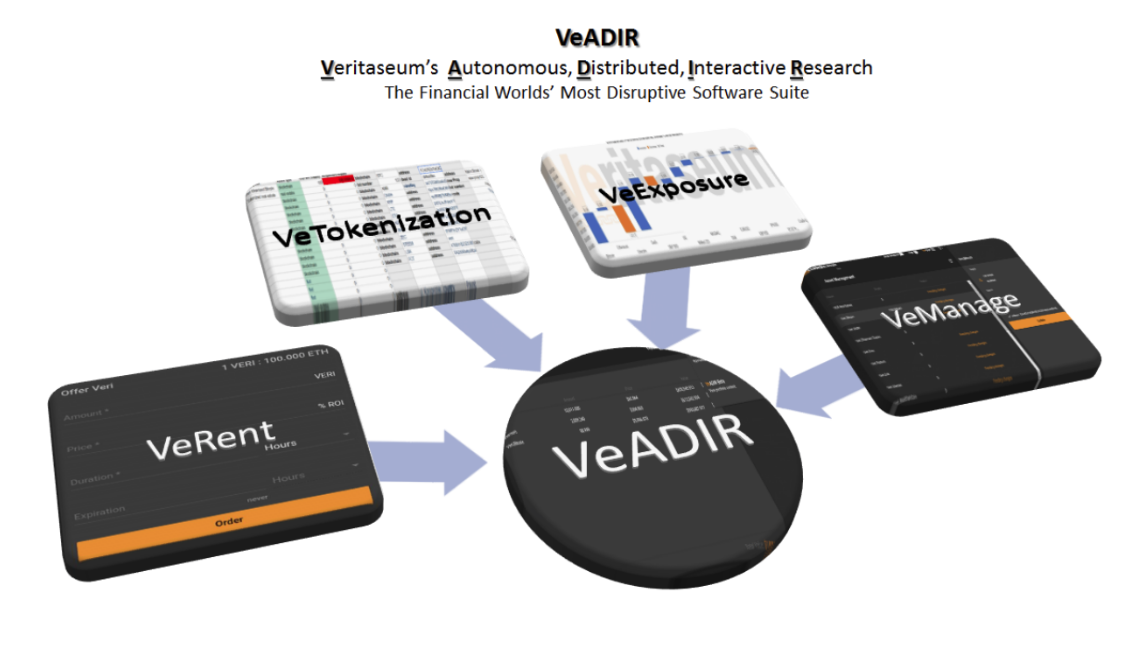

- The software token is issued to the client for P2P, OTC transfer or to hold. This is all done through the appropriate financial machine, the VeADIR (Veritaseum’s Autonomous Distributed Interactive Research).

The VeADIR is a group of smart contracts that enables software applications to be distributed and run on the public blockchain. The VeADIR is also a financial machine that gains exposure to assets and opportunities in order to expand its assets through positive risk-adjusted returns. It does this by running analysis and then creating a “model portfolio” based on its findings. Platform users can purchase these portfolios with the VERI tokens.

The VeADIR has five major components:

- VeRent – This is an interface that enables interested parities to acquire or rent Veritas tokens. Veritas are needed to access the VeADIR software suite.

- VeResearch – The Veritaseum analytics team builds an investment model for the crypto asset the platform needs to analyze. It is the human compartment to VeADIR, the research end of the platform driven by human analysis.

- VeTokenization – This is an automated facility that develops a custom Veritas sub-token to match an asset, opportunity or exposure by the VeADIR.

- VeExposure – A facility granting those with access to the VeADIR to gain access to exposures.

- VeManagement – An interactive that manage exposures as the VeADIR develops into a fully autonomous entity. It enables users to view the model portfolios produced by VeResearch and make adjustments if necessary.

The VERI Tokens

Veritaseum has a platform utility token, VERI, that users can purchase to gain rights to the smart contracts that manage the platform’s services. VERI holders can research different portfolio models and trade between and amongst themselves as well as different VeADIR constructs.

In addition, it has sub-tokens which serve a two-fold purpose.

‘Veritas tokens are redeemable assets but are also used to fund the development of the Veritaseum platform. Veritaseum analysts research opportunities and enable the financial investment by “veritizing” the deals that are most worthwhile. Clients invest in the deal by putting them on the blockchain as Veritas sub-tokens. Anyone with internet access has the opportunity to purchase veritized assets as Veritas sub-tokens, without need for a 3rd party. After purchasing Veritas sub-tokens, they are entered into Veritaseum’s financial machines, of which VeADIR is the first. The token is then issued to the Veritaseum client for P2P or OTC transfer or to hold.

‘Veritas tokens are redeemable assets but are also used to fund the development of the Veritaseum platform. Veritaseum analysts research opportunities and enable the financial investment by “veritizing” the deals that are most worthwhile. Clients invest in the deal by putting them on the blockchain as Veritas sub-tokens. Anyone with internet access has the opportunity to purchase veritized assets as Veritas sub-tokens, without need for a 3rd party. After purchasing Veritas sub-tokens, they are entered into Veritaseum’s financial machines, of which VeADIR is the first. The token is then issued to the Veritaseum client for P2P or OTC transfer or to hold.

How to Purchase VERI

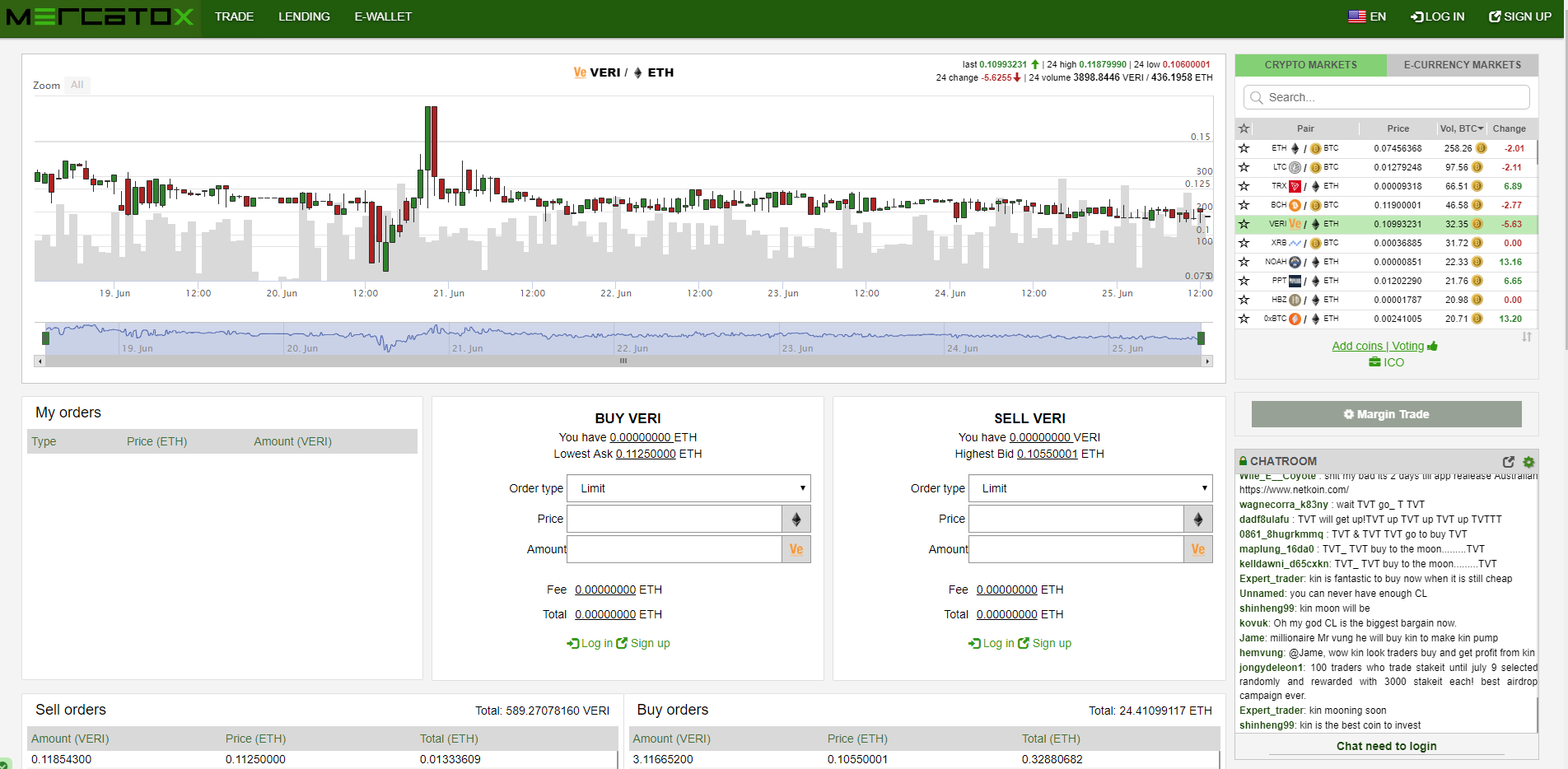

Mercatox is currently one of the main options for purchasing VERI, along with LATOKEN. Both are available for purchasing with ETH.

VERI is also available on the following exchanges:

- HitBTC (Trade VERI with BTC on HitBTC)

- Mercatox (Trade VERI with BTC on Mercatox)

- HitBTC (Trade VERI with ETH on HitBTC)

- ForkDelta (Trade VERI with ETH on ForkDelta)

How to Store VERI

Veritaseum offers a Windows, Mac and Linux desktop wallet on their site that is currently in development.

VERI can be stored in any wallet that supports ERC-20 tokens such as Coinomi, MetaMask and MyEtherWallet.

For maximum security, however, you should store your VERI on hardware wallets such as Ledger Nano S and Trezor.

Roadmap and Future Updates

Veritaseum’s P2P over-the=counter contracts have been operational on the Bitcoin public blockchain since 2013. It is now available in beta. The team is currently focusing on staffing and business development as well as operational management and marketing. Veritaseum expects a beta relaunch of the P2P platform this year, with additional services to be released throughout 2019.

The company has no official roadmap, but you can follow developments on the Veritaseum blog.

One of Verisateum’s long-term goals is to unite the pan-African continent through the Veritaseum platform.