GinebraBank – A Legit or Scam Broker?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

GinebraBank - DO NOT TRADE WITH THIS PROVIDER

2.6/10

$100

Minimum Depositupdated 2021

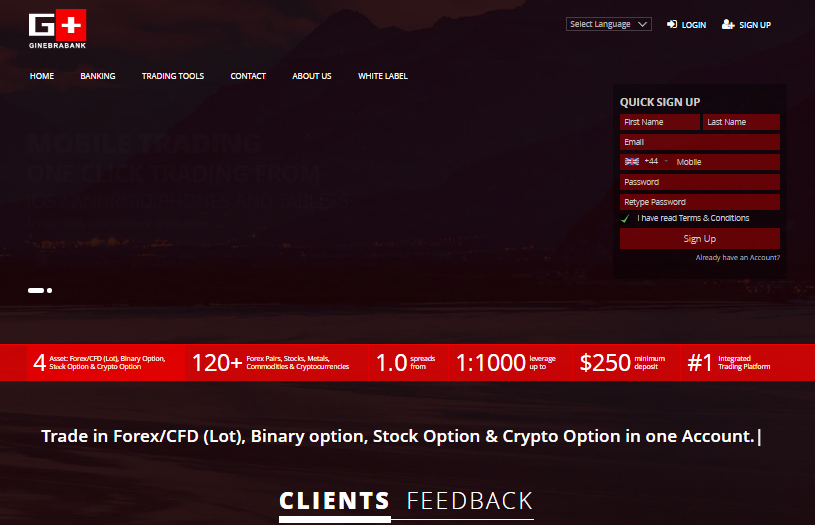

The details for opening trading accounts are not indicated on the broker’s website. In order to register with this broker, you only need to go to their sign-up page where you’ll be asked to enter your name, email address, phone number, and password. You’ll also be asked to accept their Terms and Conditions and confirm that you’re over 18 years of age. After this, the trading platform will be made available for you and you can start trading using their demo account.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: http://ginebrabank.com/

Founded: 2020

Regulations: Unregulated

Languages: Available in 20 languages but uses Google Translation

Deposit Methods:Bitcoin, Credit and Debit cards, Payeer, and Neteller

Minimum Deposit: $50

Free Demo Account: None

Number of Assets: N/A

Types of Assets: Binary options, Cryptocurrencies, Commodities, Forex pairs, Indices, Precious Metals, and Stocks

Trading Accounts and Conditions

If you want to venture with GinebraBank, you can choose from six types of trading accounts. The leverage they’re offering goes as high as 1:1000. No other information can be found on their home page except for a registration form that contains all kinds of salesy details.

GinebraBank – Advantages

After carefully considering all the necessary information, we can confidently say that you won’t get any advantage or benefit when investing with this broker.

GinebraBank – Disadvantages

After digging in the necessary information we need, we found several red flags that imply GinebraBank being a scammer. Here’s why we think they’re a big scam.

-

Anonymous and Unregulated Broker

GinebraBank claims to be regulated by MiFID. However, this entity is just a piece of the European legislation but is not in any way a regulatory institution. This means that they have lied about their licensure. Another thing, we weren’t able to find any contact information on their website. Hence, tracing their origin is almost impossible. Withholding such vital information to investors is a big red flag which is a clear indicator of them being a scammer.

Regulation is the most important thing when considering a broker to venture with. Regulatory authorities are like watchdogs that remove the rotten from the good ones. Today, some of the most respected regulators in the forex scene are the FCA in the UK, and CySEC in Cyprus. Other regulators such as the ASIC in Australia are also reputable. If you want to protect your capital, only trade with brokers that are licensed by the said authorities.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Limited functionality of trading platform

GinebraBank’s trading section shows a web-based trading platform which is very poorly designed, both visually and technically. It’s only real function is to allow traders to process buy and sell deals. Other than this, the software is totally useless.

Today, there are several trading platforms with sophisticated functionalities such as the MetaTrader 4 and MetaTrader 5. Both platforms are favored by 80% of traders around the world because of their powerful tools and features such as built in indicators, commerce integration, and more. For a better trading environment in the future, only choose either of these two trading platforms.

-

Risky Deposit and Withdrawal Methods

The website states that this broker supports the following payment and withdrawal methods: Bitcoin, Credit and Debit cards, Payeer, and Neteller. You can deposit a minimum of $50, but the minimum withdrawal amount isn’t stipulated. Moreover, the processing time of all withdrawal requests takes 10 days.

Aside from the fact that the information being shared on their website is very limited, GinebraBank being an unlicensed and anonymous broker only gives empty promises to investors. Most scammers won’t allow their customers to withdraw. They do this by implementing a minimum requirement for trade volume. Unless you meet their criteria, you won’t be able to get any of your capital.

Another tricky part is that scammers can change their policies anytime to their advantage and without issuing a notice. What’s worse, if they decide to shut their website down, you won’t be able to retrieve even your capital investment.

-

Offers illegal trading options

Binary options have been banned by the European Securities and Markets Authority or ESMA last 2018 due to the heavy losses that retail traders suffered from betting.

This type of trading works by placing a bet on any market or instrument. The trader needs to predict whether that asset’s value goes up or down. If the trader guesses the outcome correctly, he will get a fixed amount, and if he’s wrong, he gets nothing.

The nature of this trading option is like gambling. Hence, this is banned in Europe. Having offered such an illegal option to investors is another clear indication that GinebraBank is a scammer.

Conclusion

So, is GinebraBank a legit or scam broker? They are undoubtedly a SCAM broker. They don’t have any license and with an anonymous origin. They are withholding too much vital information from investors, a clear indication that they don’t want to be exposed from their fraudulent operations. Furthermore, they are offering illegal financial services such as trading with binary options which have been banned in the EU for the past 3 years. Having said, we suggest you stay out of scam brokers like GinebraBank or you’ll lose all of your investments.

As we mentioned above, if you want to protect your capital investments, you should only deal with brokers that are regulated by reputable authorities such as the FCA, CySEC, and even ASIC. These regulatory authorities conform to a set of rules in coordination with the local governments. Brokers that need to get licenses have to adhere to the strict rules imposed by these regulators. As a matter of fact, the minimum capital required to start a brokerage company in the EU amounts to 730,000 EUR. No scammer would go through such lengths just to set up a fraudulent company.

Moreover, those brokers who have been regulated by the said authorities are also required to set up a fund safety program for their investors. This would ensure that investors will get financial compensation regardless of what happens to the broker. For EU brokers, investors can get up to 20,000 EUR per client.

Trading with regulated brokers offers a lot of advantages and protection to investors. Not only that you’ll be insured to receive something in case of bankruptcy or other related incident, you’ll also be trading in the safest trading environments increasing your chances of gaining profits in every trade.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.