Duxa Capital – Is it Safe to Put Your Money Here?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Duxa Capital - DO NOT TRADE WITH THIS PROVIDER

3.5/10

$100

Minimum Depositupdated 2020

Duxa Capital is a Forex and CFD broker that offers its clients a range of 6 different account types from which to choose. These are the Basic Account (minimum deposit of $500), Silver (minimum deposit of $10,000), Gold (minimum deposit of $100,000), Platinum (minimum deposit of $250,000), Diamond (minimum deposit of $500,000) and Millionaire (minimum deposit of $1,000,000).

The problem is that while these account types have been mentioned with the minimum required deposit, we can’t get any information about the leverage levels or spreads. We also can’t get specific details about the terms and conditions of service since they are very generic.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: https://www.duxacapital.com/

Founded: 2019

Regulations: Unregulated

Languages: English

Deposit Methods: Visa, MasterCard, S€PA

Minimum Deposit: $500

Free Demo Account: Not Accessible

Number of Assets: N/A

Types of Assets: Currency Pairs, CFDs on precious metals, bonds, stocks, indices, commodities, ETFs and cryptocurrencies.

Trading Accounts and Conditions

Duxa Capital is a Forex and CFD broker that offers its clients a range of 6 different account types from which to choose. These are the Basic Account (minimum deposit of $500), Silver (minimum deposit of $10,000), Gold (minimum deposit of $100,000), Platinum (minimum deposit of $250,000), Diamond (minimum deposit of $500,000) and Millionaire (minimum deposit of $1,000,000).

The problem is that while these account types have been mentioned with the minimum required deposit, we can’t get any information about the leverage levels or spreads. We also can’t get specific details about the terms and conditions of service since they are very generic.

Duxa Capital – Advantages

While Duxa Capital shows all the signs of being a scam, here is its one good point:

-

Wide Range of Tradeable Assets

Duxa Capital offers its clients a comprehensive selection of assets with which to trade. It has a large number of Forex currency pairs, and CFDs on ETFs, stocks, indices, bonds, commodities, precious metals, and the top cryptocurrencies.

Duxa Capital – Disadvantages

There are just too many discrepancies in Duxa Capital and what it has to offer as a broker. Here is a list:

-

Lack of Corporate Identity

On Duxa Capital’s home page, there is simply one UK-based telephone number and an e-mail ID. As you go through the website, you will find another contact number which seems to be Switzerland-based. But that’s all the information we have about the broker and its company.

There is absolutely no information about the company that owns and operates this brand, or even where it is located. This means that this broker has kept itself essentially anonymous, which is a danger sign to all investors.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Not Regulated

Since we have absolutely no information about which company operates and owns Duxa Capital, we can only assume that it is not regulated. When we tried to contact the company via the numbers listed on the broker’s website, we found out that they were not operational.

All in all, the opacity of information and the fake telephone numbers are serious causes for concern and we can conclude that this is site that is out to scam investors.

-

Lack of Clarity on Trading Conditions

There is no clarity about what the spreads on Duxa Capital’s trading platform are, or what the leverage levels are, or even what fees are applicable for deposits, withdrawals and other transactions.

This lack of information about the key aspects of a brokerage is alarming and once again points to a scammer at work.

-

No Demo Account

Duxa Capital also has no demo account, so the only way we can find out about trading details and other transactions is by creating a live account. This lack of transparency is just another indicator that this is one broker you need to stay away from.

-

No MetaTrader 4 Available

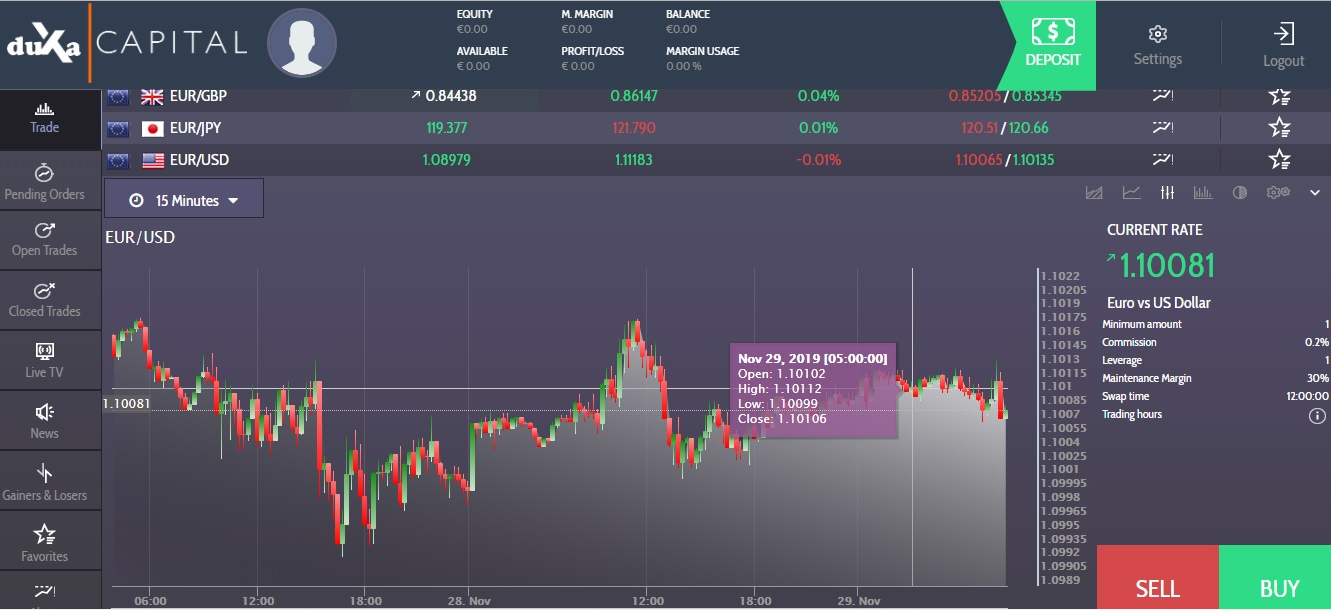

Since there was no demo account available, the only way to get more details about the trading platform supported by Duxa Capital was to create a live account – which we did.

When we accessed the trading platform, we found out that it was just a simple web-based trading interface. There were no extra functionalities to the platform like you would have with a reliable and proven platform such as MT4.

Added to that, despite it being a live account, we still couldn’t get any information on the spreads or leverage levels for trading. In fact, it looked more like a fake trading platform than anything else.

-

Very High Initial Deposit

The basic account requires you to deposit a minimum amount of $500 to begin trading. That amount is above the industry average of between $100 and $250. However, it isn’t unreasonably high.

But, the next 5 account types have obscenely high initial deposit requirements, conditions that the majority of traders will never be able to meet. A Silver account requires you to deposit a minimum of $10,000! That is a premium account for most other brokers. And the Millionaire Account requires you to deposit $1 million!

Considering the fact that we don’t know who will be handling your money (remember the lack of corporate information?), these deposits are ridiculously high. So, we would say that the wisest thing you can do is not invest on this broker’s platform.

-

No Information on Withdrawal Fees

All we know is that you can withdraw your funds using bank wire transfers or debit or credit cards. Beyond that, there is no information about how much would a withdrawal cost, or whether there are any trading commissions, or even deposit fees.

This means that you don’t know what you will be charged for any kind of a transaction you carry out on this broker’s platform. That is a sure sign that this is a scam.

Conclusion

After having gone through the Duxa Capital website with a fine-toothed comb we can say with complete certainty that this site is a scam and that you would be well-advised to not put your money here.

There is no information with regard to which company runs this brokerage, or whether it is regulated, or even what the terms and conditions are. Added to that, the trading platform looks to be fake, and the initial deposits for each of the account types are ridiculously high.

This is a scam site and you should avoid it at all costs if you wish to keep your money.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3 comments

Keep away from this brokerage company. Right for the start I had my reservations

with the staff not providing any legitimate trades to back up there trading success.

Their brokers use false names that do not exist anywhere and Linked IN etc… and can not be traced.

I was dealing with a broker called Jeff Sims. He had a heavy Balkan accent…. he sounded more like a Dalebor or a Vladimir.

They pressured me to increase funds into my account promising 80 -90 percent returns! What a load of baloney.

I recently tried to log into my account and now its blocked.

KEEP AWAY from these scammers!

Dorian, did you ever resolve this? What happened? I think I have been scammed

Just loose 500€ with these scammers.. DO NOT DEPOSIT a $. You will lose everything with this wankers.