Plus500 Review: read this before you start trading!

This is trusted and regulated multi-asset broker

Plus500 Review 2023

9.3/10

$100

Minimum DepositPlus500 is a publicly traded company on the London Stock Exchange, and it is a global multi-asset broker. Several years ago, the broker added cryptocurrencies to its list of tradable assets, enabling crypto-oriented investors to benefit from the price fluctuations Bitcoin and altcoins.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

| Plus500 Key Information | |

| Company Location: | Israel |

| Broker site: | www.plus500.com |

| Established Date: | 2008 |

| License: | CySEC, FCA, ASIC, FMA, FSCA, SG, SEY, EFSA and DFSA |

| Languages supported: | 32 languages: English, German, Spanish, Italian, Russian, French, Arabic, Chinese, Polish, Nigerian, Japanese, Korean, Mongolian, Magyar, etc. |

| Cryptocurrencies: | Cryptocurrencies BTC, ETH, XRP, LTC, BCH, XLM, ADA, XMR, TRX, NEO, and EOS |

| Payment methods: | Credit/Debit Card, Wire Transfer, PayPal and Skrill, Trustly, Apple Pay and Google Pay |

| Withdrawal Time: | Bitcoin, Ethereum, Bitcoin Cash, Ripple, EOS, and 170 +pairs |

Plus500 is a global multi-asset broker. Several years ago, the broker added cryptocurrencies to its list of tradable assets, enabling crypto-oriented investors to benefit from the price fluctuations Bitcoin and altcoins.

The company operates through several regulated subsidiaries, including in the UK, Cyprus, Singapore and Australia.

Plus500 has a premium listing on the Main Market of the London Stock Exchange since 2018 (symbol: PLUS) and is a constituent of the FTSE 250 index with a current market capitalization of £1.71 billion (Jan 2023)

The total market capitalization of Plus500 is just above $700 million, down from the one billion mark recorded in 2014. The decline is due to the increasing regulatory pressure on contracts for differences (CFDs) aimed at retail investors.

The trading platform is offered by Plus500CY Ltdauthorized & regulated by CySEC (#250/14).

Plus500’s subsidiaries are also regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Here is the broker’s main info:

Plus500 has one of the largest and most diversified lists of assets that we have seen with a CFD broker. The asset index can please any trader.

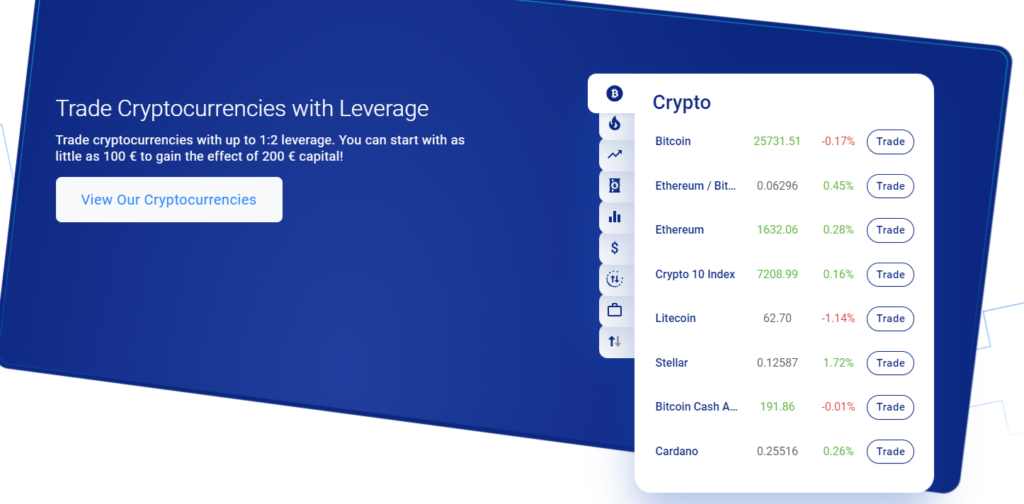

Cryptocurrency traders can choose from 13 tradable instruments that involve 11 coins, including Bitcoin, Ethereum, Ripple’s XRP, Litecoin, Bitcoin Cash (ABC), Stellar Lumens, Monero, Cardano, Tron, NEO, and EOS. All of the mentioned coins are traded against the US dollar, plus there is a BTC/ETH pair.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Apart from the crypto pairs, platform users can also trade the Crypto 10 Index, which tracks the performance of the ten largest coins weighted by market cap. The product enables Plus500 traders to benefit a diversified instrument that smoothes the wild volatility typical for most of the cryptocurrencies.

Note that trading Bitcoin and altcoins with Plus500 doesn’t involve the physical delivery of the coin, given that CFDs are derivative products. It means that you can’t own the coins you invest in but only speculate on the price movement.

Besides cryptocurrencies, Plus500 clients can trade the following instruments:

- More than 2,000 company shares, including stocks traded in the US, UK, Germany, Australia, Japan, Spain, Switzerland, Hong Kong, and many other countries.

- 22 commodities, including gold, silver, oil, copper, and agricultural commodities;

- 31 stock indexes;

- 71 foreign exchange pairs, including majors like EUR/USD, USD/GBP, and USD/JPY, among others;

- 86 exchange-traded funds (ETFs);

- Dozens of options, including on Facebook, Google, Apple, Tesla, DAX 30, CAC 40, and more;

- 2800+ CFDs (shares, ETFs, crypto, forex, options, indexes, commodities), 2700+ Shares, Futures

Plus500 Account Types

Plus500 offers a single live account, which requires a minimum deposit of 100 USD or GBP. The standard account offers leverage up to 30:1. There is also the demo option, which allows traders to train their skills with virtual money.

Free unlimited demo account

Plus500 users are now able to self-adjust their Demo account balance up to €40,000, or the equivalent in their trading account currency. This new feature allows users to personalize their trading experience while using the Plus500 demo and better reflect their target volume of investments.

They are also able to completely reset their demo account, including all history, so they can re-experience it over and over while executing different trading strategies

Besides the standard account, there is also a professional account, which is aimed at advanced traders. The trading activity can be with Plus500 or other trading platforms.

Plus500 Platform and Fees

Plus500 doesn’t provide its trading services through popular platforms like MT4 or cTrader. Instead, the broker offers its proprietary platform that is available in more versions as follows:

- Plus500 WebTrader (which can be accessed from the browser);

- Mobile version (which is available with Android, iOS, and Windows mobile devices).

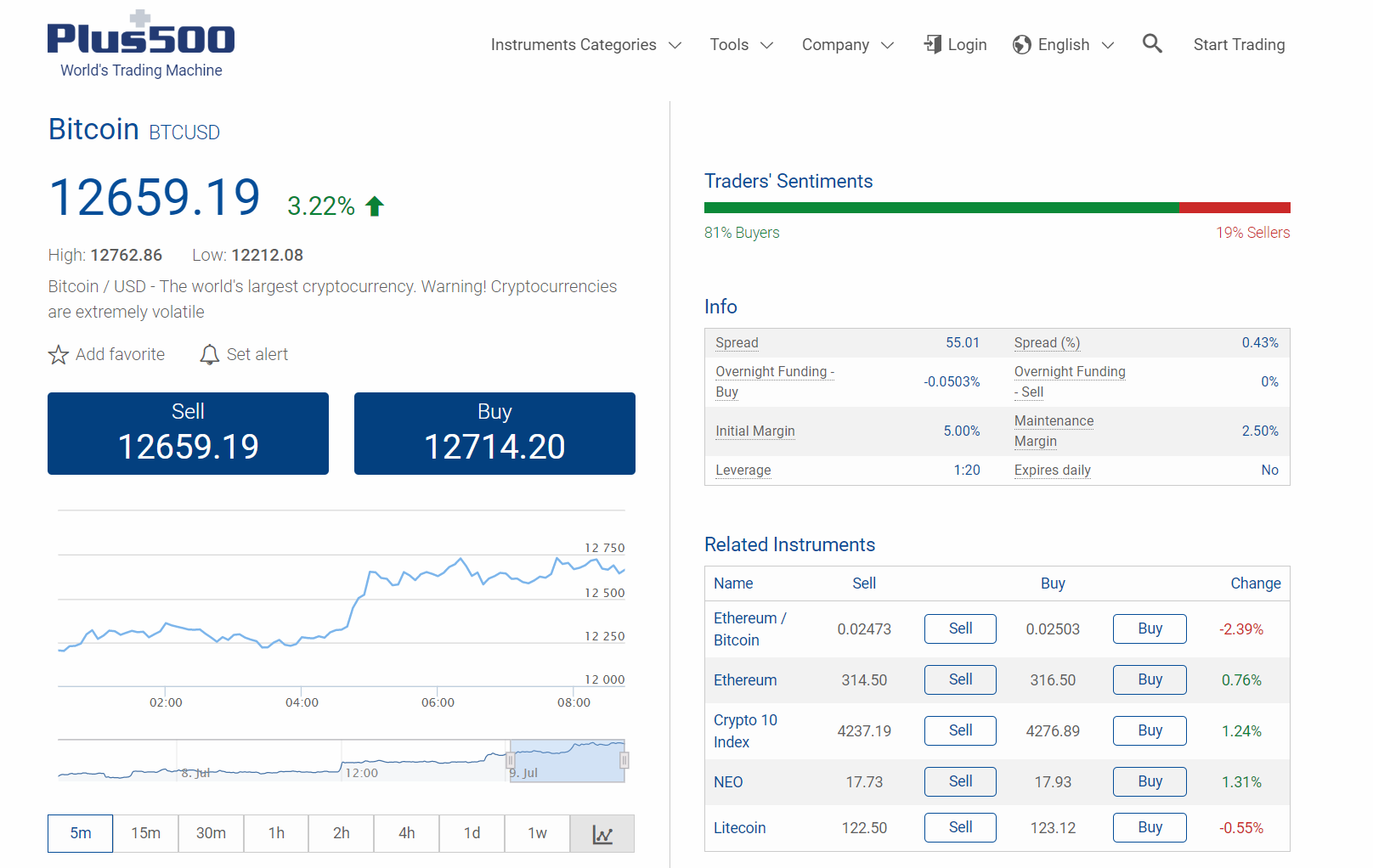

The platform is intuitive and allows traders to conduct advanced technical analysis. They can open multiple charts on the screen, trade manually, use stop and limit orders, and more. There are more than 13 chart types and more than 110 indicators to assist you during trading.

Illustrative prices

Plus500 offers some of the tightest spreads in the CFD industry and real-time forex quotes, opening or closing trades, rolling positions, and more.

Deposit/withdrawal with Plus500

Plus500 offers a decent range of deposit and withdrawal options. The good news is that there is no payment fee and no limit on withdrawals. You can pick one of the following payment methods:

- Credit card (VISA or MasterCard) – while there is no minimum withdrawal limit, clients who chose to cash out less than $100 will have to pay a $10 fee.

- Online payment systems – PayPal and Skrill; the minimum amount for free withdrawals is $50. Otherwise, a $10 fee is charged.

- Bank wire transfer – again, there is a $10 fee for withdrawals of less than $100.

- Trustly, Apple Pay and Google Pay

Customer Support

Plus500’s customer service is available in multiple languages, with the site itself being offered in 32 languages. While there is no phone channel to contact customer support assistants, traders can try the following communication methods:

- Live chat – it is available 24/7.

- Please note that all customer support channels are available 24/7.

Also, the website displays an extensive FAQ section that may be helpful in most of the situations.

Plus500 Pros and Conclusion

There are several things that we liked about this trading platform:

- A decent list of tradable cryptocurrencies and a huge list of company shares and other assets.

- An intuitive platform that can be accessed from all possible devices;

- The website is available in 32 languages;

- The company is regulated in several jurisdictions and is traded on the London Stock Exchange;

- Plus500UK Ltd authorized & regulated by the FCA (#509909).

- Plus500CY Ltd authorized & regulated by CySEC (#250/14).

- Plus500SG Pte Ltd, licensed by the MAS (#CMS100648-1) and IE Singapore (#PLUS/CBL/2018).

- Plus500AU Pty Ltd (ACN 153301681), licensed by: ASIC in Australia, AFSL #417727, FMA in New Zealand, FSP #486026; Authorised Financial Services Provider in South Africa, FSP #47546.

Plus500 is regarded as a conservative broker, which is actually good for retail traders who are often exposed to excessive risk. Our rating for Plus500 is 4.8 out of 5.00, given its reputation, user-friendly platform, and transparency.

Looking for somewhere else to trade?

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.