Market Update 8.12.18 – David Marcus Quits Facebook’s Coinbase

Market News

David Marcus Quits Facebook’s Coinbase

David Marcus is no longer Facebook’s blockchain head after he announced his decision to quit the position. The announcement was made during the board of U.S. cryptocurrency exchange Coinbase. It is worth noting that he joined the said board in December of last year. From there, he took on a blockchain research group at the company in May. Unfortunately, he believes that now is the “appropriate” time to leave.

Marcus, in an official statement, said: “Because of the new group I’m setting up at Facebook around Blockchain, I’ve decided it was appropriate for me to resign from the Coinbase board.” The decision arrives as rumors continue to fly regarding a potential acquisition of Coinbase by the social media giant. Last month, Facebook managed to give the exchange the capability to advertise its services. This ultimately reversed a ban which became a reality in January.

Read the full report here.

FinCEN Reveals Receiving Over 1K Crypto Complaints A Month

FinCEN or also known as The Financial Crimes Enforcement Network reportedly receives about 1,500 reports on a monthly basis. These reports came from financial institutions about cryptocurrencies. Speaking at the Chicago-Kent Block (Legal) Tech Conference, FinCEN director Kenneth Blanco talked about the role the agency takes in regulating digital currencies. According to him, while cryptocurrencies are capable of proving beneficial for certain use cases, they can also create opportunities for bad actors. This could be anything from financial criminals to terrorists to rogue states, among many others.

Blanco discussed the importance of SAR or Suspicious Activity Report (SAR) filings. The latter is basically a type of document that financial institutions, in one way or another must file after the occurrence of a suspected incident involving either fraud or money laundering. Apparently, the agency receives more than 1,500 SARs every month, all of which refer to suspicious activities involving digital asset transactions.

Read the entire report here.

Public Firm First In Launching a Singapore-Based ICO

An e-commerce platform has made history after launching token sale, which is meant to raise $50 million. This automatically became Singapore’s first public firm to hold an ICO. It is none other than the Y Ventures Group, a firm which went public on the Stock Exchange of the country last year.

The firm announced a plan discussing its process of creating a blockchain-based e-commerce system in July. At the same time, it sent the sale of its AORA token which went live at the end of the same month. It also revealed that the tokens, in one way or another do not necessarily represent ownership of equity in the firm; hence, they must not be regarded as securities. Reports suggest that this was a move probably aimed to sidestep concerns straight from market regulators.

Read the full report here.

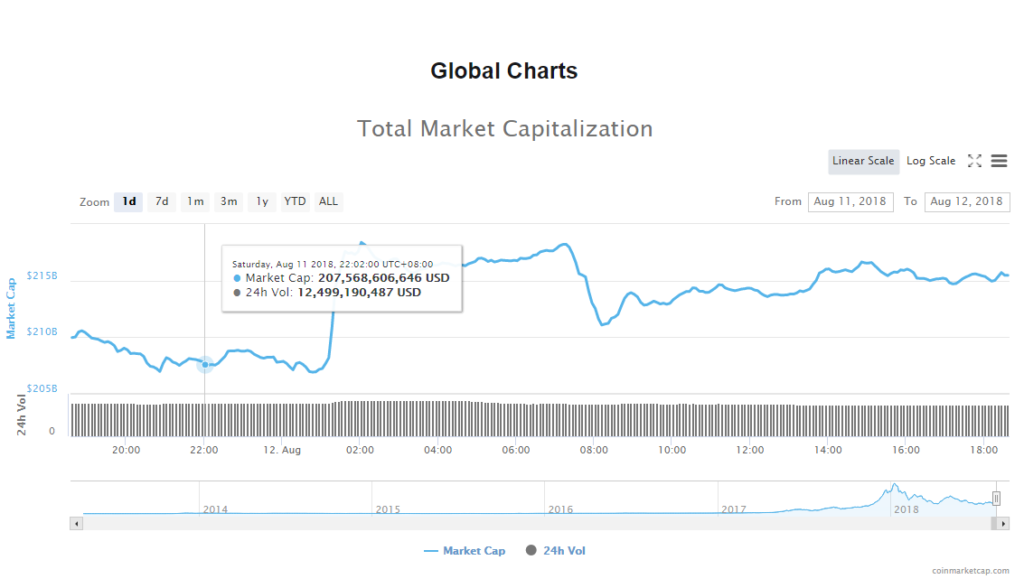

Total Market Cap: Aug 12

The volume of trade in the crypto market sat at $11.82 billion. The market’s capitalization, on the other hand, reached $215.25 billion.

Bitcoin Price Analysis: Aug 12

In the past 24 hours, Bitcoin jumped 3.55% to trade at $6,370.82. The leading cryptocurrency’s trade volume trickled to $3.91 billion, while its market slid to $109.611 billion.

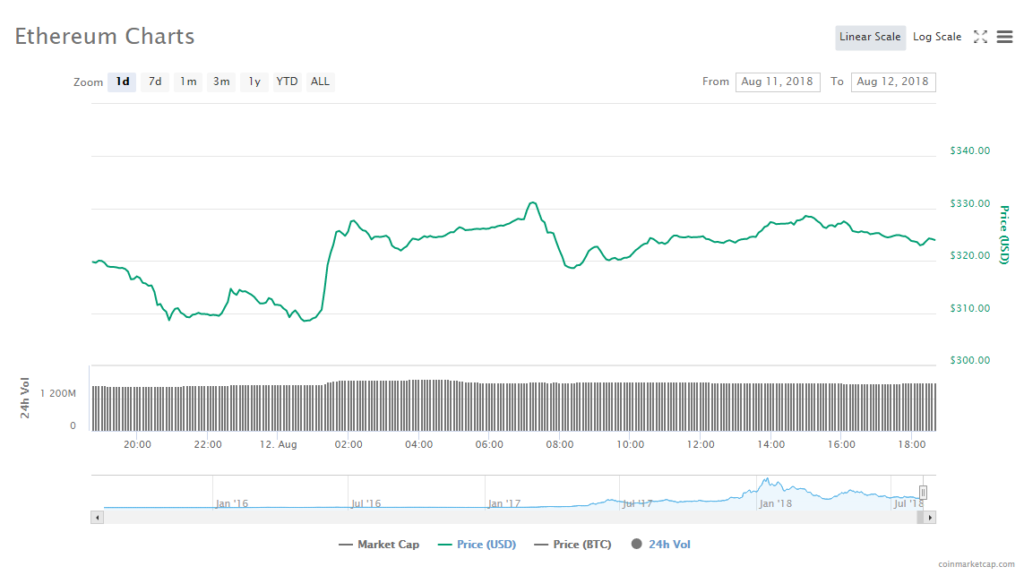

Ethereum Price Analysis: Aug 12

Ethereum’s price jumped 1.68% to trade at $323.95. As for the altcoin’s trading volume, it reached $1.77 billion; whereas its market capitalization hit $32.8 billion.

State of the Top 10 Cryptocurrencies: Aug 12

In the past 24 hours, all prices were up except for Tether. Meanwhile, Monero dethroned TRON at the 10th spot.

- Bitcoin’s market price jumped 3.49% to $6.366.9, and its value in the market is $109.54 billion.

- Ethereum’s market price jumped 1.69%% to $323.96, and its value in the market is $32.81 billion.

- XRP’s market price jumped 2.53% to $0.306682, and its value in the market is $12.05 billion.

- Bitcoin Cash’s market price jumped 4.09% to $576.04, and its value in the market is $9.96 billion.

- EOS’ market price jumped 1.33% to $5.15, and its value in the market is $4.67 billion.

- Stellar’s market price jumped 5.68% to $0.225744, and its value in the market is $4.24 billion.

- Litecoin’s market price jumped 6.66% to $60.33, and its value in the market is $4.49 billion.

- Cardano’s market price jumped 1.30% to $0.113886, and its value in the market is $2.95 billion.

- Tether market price fell 0.61% to $1.00, and its value in the market is $2.41 billion.

- Monero dethrones TRON at the 10th spot, with its market price jumping 4.76% to $95.27, and its value in the market is $1.55 billion.