Market Update – 5.05.19 – Fidelity Hires Former Barclay’s Executive

Market News

Fidelity Hires Former Barclay’s Executive

Fidelity Investments, which is a financial services giant, has decided to hire a former executive of Barclays. It is none other than Chris Tyrer, the former head of digital assets at the investment bank. The new hire is expected to join the company at the end of the month. However, there are no further details suggesting what his exact role will be, except for the fact that his LinkedIn profile says “Digital Assets.”

Tyrer worked at Barclays for around eight months. During his tenure, he was the company’s head and managing director of digital assets project. Apparently, he decided to leave the investment bank sometime in August last year. Prior to his exodus, though, he became the head of commodity trading at the company, something he did from 2015 to 2017.

Read the full report here.

US Drug Companies Join Blockchain Project

Pfizer Inc. is being joined by other leading U.S.-based pharmaceutical companies in an attempt to develop a project designed for the creation of a blockchain network. The latter, in particular, is meant solely for the health and pharmaceutical industry. The companies in question are AmerisourceBergen Corporation, McKesson Corporation, Pfizer Inc., and Premier Inc.

These four pharmaceutical companies are joining the MediLedger Project Contracting and Chargebacks working group. MediLedger is basically an initiative of Chronicled Inc., a blockchain tech firm based in San Francisco. By essence, it is designed for significantly reducing costs and allowing processes to become more efficient in data sharing. This goal is being achieved by simply building a common network. Interestingly, this attempt will make all processes involving contract reconciliation and chargebacks to be automated.

Read the full report here.

Experts Discuss State Vs. Federal Crypto Regulations

There are at least three crypto experts who have expressed diverging perspectives towards U.S. digital currency regulation. This narrative took place during a panel at the Massachusetts Institute of Technology’s (MIT) Business of Blockchain event.

According to Caitlin Long, the president of Wyoming Blockchain Coalition, digital assets are to be considered property; hence, there is a need to regulate them at a state level. She even praised her company’s diligence when it comes to legally clarifying these terms as applied to digital currencies.

Read the full report here.

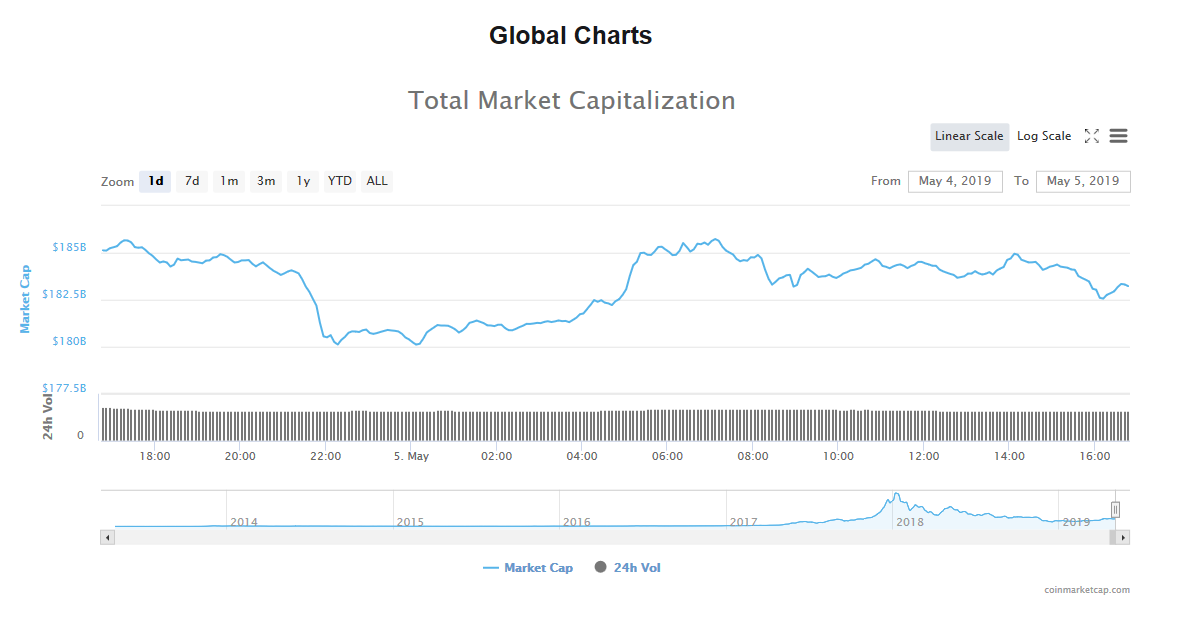

Total Market Cap: May 5

The trade volume reached $51.48 billion in the past 24 hours. As for the market capitalization, it reached $183.41 billion.

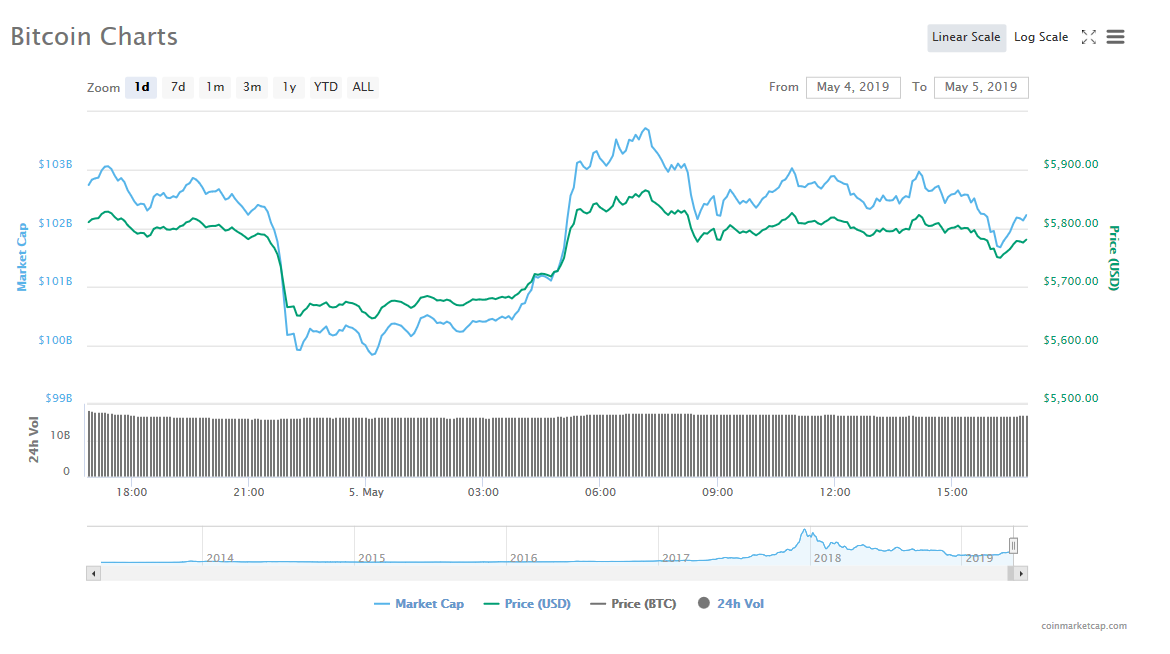

Bitcoin Price Analysis: May 5

The world’s leading crypto, Bitcoin, remains to be a leader. However, it fell 0.60% and reached a trade price of $5,780.86. The digital currency’s trade volume and market capitalization had reached $16.87 billion and $102.23 billion, respectively.

Ethereum Price Analysis: May 5

Ethereum also Bitcoin’s plummet at 1.67%, result to a trade price of $163.26. When talking about ETH’s trade volume, it went to $6.54 billion, while its market cap reached $17.30 billion.

State of the Top 10 Cryptocurrencies: May 5

Bitcoin Cash is the only crypto in the rankings that did not falter. Meanwhile, TRON was once again removed from the 10th spot by Cardano.

- Bitcoin’s price in the market declined 0.60% to $5,780.86, with a market value of $23 billion.

- Ethereum’s market price fell 1.67% to $163.26, and the market value is $17.30 billion.

- XRP’s market price fell 1.24% to $303282. The crypto’s market value is set at $12.76 billion.

- Bitcoin Cash jumped in terms of market price at 0.89% to $292.80 in price, and as far as its market value is concerned, it is $5.20 billion.

- Litecoin’s market price fell 1.83% to $76.86, and market value topped $4.74 billion.

- EOS’s market price fell at 1.22% to $4.90, and the confirmed value in the market is $4.63 billion.

- Binance Coin’s price in the market fell 1.34% to $22.91, and its value in the market is $3.24 billion.

- Tether fell 0.24% to $1.00 in terms of market price, and market value is said to at $2.78 billion.

- Stellar’s market price fell 2.41% to $099008, and its value in the market is $1.89 billion.

- Cardano removed TRON from the 10th spot even after failing 3.46%, resulting to a trade price of $0.067171 and a market value of $1.74 billion.