Market Update 10.25.18 – Japan Mulls On Crypto Margin Trading

Market News

Japan Mulls On Crypto Margin Trading

Japan’s Financial Services Agency or FSA is reportedly weighing a plan that would soon put a cap on the leverage in cryptocurrency margin trading. It is meant as a move to curb speculation and market risks. According to official reports, the financial market regulator is considering limiting crypto margin traders’ borrowing power to two to four times of their deposits.

Currently, there is no regulation specifically governing the cryptocurrency margin trading space in Japan, with exchanges offering as much as 25 times of borrowing power. That means users can trade digital assets worth up to 25 times of their deposits with the exchange but a four percent drop in the purchased crypto assets will wipe out the original deposits. It is even said that seven of the 16 licensed exchanges by the FSA now offer marge trading services.

Read the full report here.

Binance’s First Crypto-Fiat Exchange Uganda Launched

There is no doubt about Binance being the world’s largest crypto exchange. Its title has only been further cemented with its launching of its fiat-to-crypto exchange in Uganda. Binance Uganda, the exchange’s first fiat-to-crypto exchange in the country, has officially launched live trading, enabling users to buy two major cryptocurrencies — Bitcoin (BTC) and Ethereum (ETH) — with local fiat currency Ugandan shillings (UGX).

The exchange had announced last week that Binance Uganda would open this week. Today’s statement reads that Binance Uganda is also a “first step” to the expansion of crypto exchange markets for a “more inclusive ecosystem that will involve fiat currencies.” According to previous announcements, Binance Uganda clients are set to be provided with zero-fee trading until November 24. After that, it will start charging users with 0.1 percent trading fee. Following the announcement, Binance has also announced a recent donation of $500,000 for Uganda through its charity wing called Blockchain Charity Foundation (BCF).

Read the full report here.

Lawsuit Against Coinbase Enabling Insider Trading Dismissed

A federal judge has dismissed a lawsuit against Coinbase, which basically alleges the exchange hurt investors when it listed Bitcoin Cash by allowing insider trading. U.S. District Judge Vince Chhabria, who is from the Northern District of California, dismissed a lawsuit filed by Arizona resident Jeffrey Berk against Coinbase, who claimed that the exchange allowed insiders to trade the said cryptocurrency prior to its listing on the exchange. This, in turn, harmed investors.

In the original complaint that was filed in March, Berk claimed that “unsurprisingly, those who had been tipped off [about bitcoin cash’s listing], immediately swamped Coinbase and the GDAX [sic] with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices. The market effect was to unfairly drive up the price of BCH for non-insider traders once BCH came on line at the Coinbase exchange.”

Read the full report here.

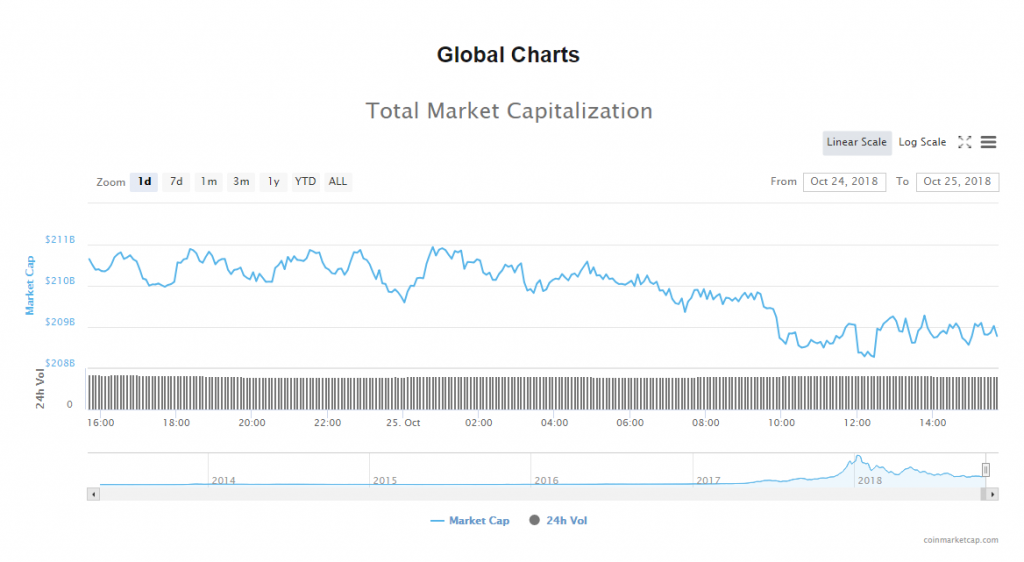

Total Market Cap: October 25

The volume of trade in the crypto market sat at $9.8 billion. The market’s capitalization, on the other hand, reached $209.12 billion.

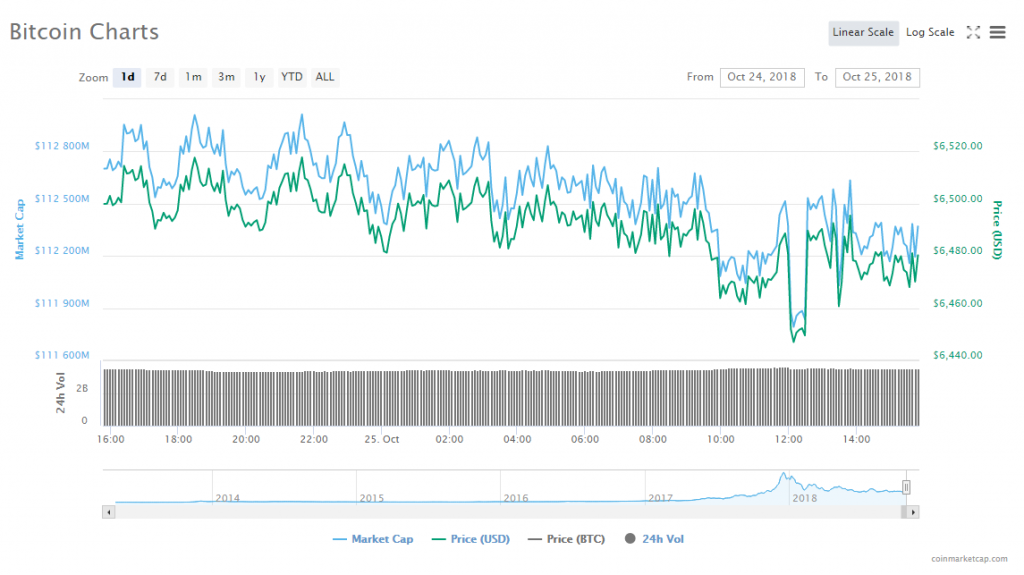

Bitcoin Price Analysis: October 25

In the past 24 hours, Bitcoin fell 0.40% to trade at $6,482.64. The leading cryptocurrency’s trade volume trickled to $3.53 billion, while its market slid to $112.41 billion.

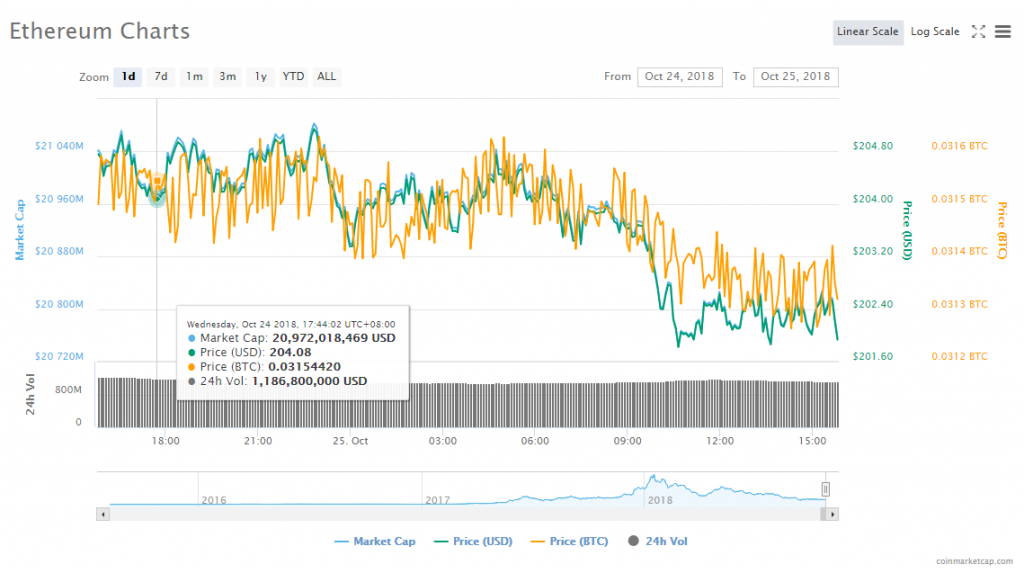

Ethereum Price Analysis: October 25

Ethereum’s price fell 1.21% to trade at $202.30. As for the altcoin’s trading volume, it reached $1.12 billion; whereas its market capitalization hit $20.79 billion.

State of the Top 10 Cryptocurrencies: October 25

In the past 24 hours, all prices were down except for Tether’s. Meanwhile, Monero continues to dethrone TRON at the 10th spot.

- Bitcoin’s market price fell 0.40% to $6,482.64, and its value in the market is $112.41 billion.

- Ethereum’s market price fell 1.21% to $202.30, and its value in the market is $20.79 billion.

- XRP’s market price jumped 1.24% to $0.456884, and its value in the market is $18.27 billion.

- Bitcoin Cash’s market price fell 0.83% to $441.92, and its value in the market is $7.70 billion.

- EOS’ market price fell 0.56% to $5.38, and its value in the market is $4.87 billion.

- Stellar’s market price fell 2.90% to $0.236347 and its value in the market is $4.47 billion.

- Litecoin’s market price fell 0.37% to $52.27, and its value in the market is $3.08 billion.

- Tether market price jumped 0.22% to $0.988048, and its value in the market is $2.00 billion.

- Cardano market price fell 1.96% to $0.073621, and its value in the market is $1.91 billion.

- Monero dethroned TRON at the 10th spot, but its market price fell 2.10% to $106.16, and its value in the market is $1.75 billion.