Market Update 4.15.18 – Russia Blocking Telegram

Market News

Russia Blocking Telegram

The Roskomnadzor, the Russian Government’s media supervision agency, has finally banned the popular messaging application Telegram. In 2016, the Russian government passed anti-terror laws and as a part of that law, all messaging services were required to submit their encryption keys to Russia’s Federal Security Service.

Telegram declined to submit its encryption keys and announced that the new laws were in conflict with the company’s privacy policy. The reason the messaging service gave was that the encryption keys were not stored on a central server, but on individual users’ devices. This led to a long-drawn out battle between Telegram and the Roskomnadzor, wherein the government agency took the messaging company to court.

To read the full story, click here.

Nobel Prize Winner Shiller Says Bitcoin “Bubble” to Stay

According to the Nobel Prize winning economist, Robert Shiller, the Bitcoin “bubble” is going to stick around a little longer. According to him, while he still believes that Bitcoin is a bubble, it doesn’t mean that the bubble will burst and cryptocurrencies will disappear.

According to him, the Bitcoin is a “fad” that people are interested in and that there are also psychological and political reasons why Bitcoin will continue, rather than scientific ones. One main reason why the cryptocurrency will stay is because people who don’t trust their governments will want to invest in this market.

Read the full story here.

Bitcoin May Touch $250,000 by 2022

Earlier last week, investment tycoon Tim Draper made a sensational announcement that Bitcoin could touch $250,000 by 2022. Now, CNBC’s Brian Kelly is supporting that prediction.

Kelly, in an interview, stated that though it may sound crazy, when the numbers are analyzed, it is entirely possible. The cryptocurrency has already grown by 4000% in the last two years. So why would a 3000% jump in the next 4 years in Bitcoin’s price be a surprise?

Other data also points to more stratospheric growth for BTC. More and more institutional investments are being made in the cryptocurrency market. This includes heavyweights like Rockefeller’s Venture Capital division, an executive from Goldman Sachs and even Soros Fund Management.

Read the full story here.

Total Market Cap: Apr 15

Trading volume dipped a little this weekend to $15 billion and the cryptocurrency market’s value was at $333.84 billion.

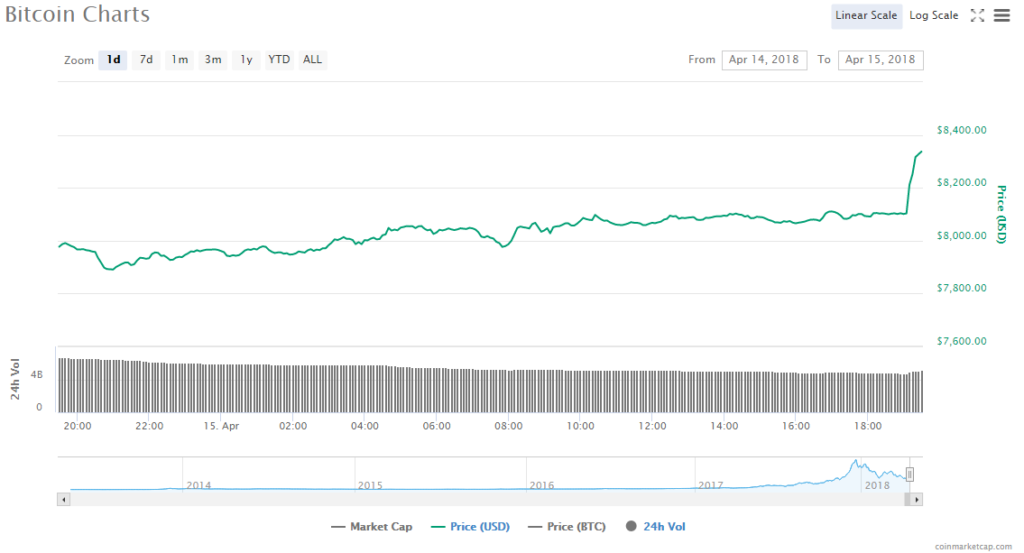

Bitcoin Price Analysis: Apr 15

Bitcoin’s price spiked higher by 3.83% to $8337.02. Trading volume fell in the last 24 hours $5.12 billion and the digital asset’s market value went up to $141.55 billion.

Ethereum Price Analysis: Apr 15

The world’s number two crypto went up 3.3% to $523.42 in the last 24 hours. Ethereum’s trading volume is $1.6 billion and its market value has increased to $51.73 billion.

State of the Top 10 Cryptocurrencies: Apr 15

In the last 24 hours, almost all of the top ten cryptocurrencies rose, with the exception of EOS, which fell for the second day by 4.71%. The star of the show, however, was IOTA, which rose by more than 20% in the last 24 hours.

- Bitcoin rose by 3.83% to $8337.02. BTC’s capitalization in the market has reached $141.55 billion.

- Ethereum rose by 3.3% to $523.42. ETH’s capitalization in the market has reached $51.73 billion.

- Ripple rose by 3.86% to $0.6749. XRP’s capitalization in the market has reached $26.4 billion.

- Bitcoin Cash rose by 3.45% to $777.26. BCH’s capitalization in the market has reached $13.27 billion.

- Litecoin rose by 3.44% to $131.83. LTC’s capitalization in the market has reached $7.39 billion.

- EOS fell 4.71% to $8.49. EOS’s capitalization in the market has reached $6.75 billion.

- Cardano rose by 4.54% to $0.21399. ADA’s capitalization in the market has reached $5.54 billion.

- Stellar rose by 9.53% to $0.278534. XLM’s capitalization in the market has reached $5.16 billion.

- IOTA rose by 20.58% to $1.64 and overtook NEO to take 9th MIOTA’s capitalization in the market has reached $4.54 billion.

- NEO fell 5.55% to $67.68. NEO’s capitalization in the market has reached $4.39 billion.