Market Update 4.28.19 – Samsung Eyes Bespoke Crypto

Market News

Samsung Eyes Bespoke Crypto

There is no doubt that Samsung is another big-name company across the world. Interestingly, it is strongly considering the idea of issuing its own crypto. This is not something new in the crypto space, as similar stories have emerged from the likes of JPMorgan Chase and Facebook.

Although nothing has been set in stone yet, a so-called “Samsung Coin” might just find a use as a a payment means on the tech giant’s app store. Even more so, it can be traded on all digital currency exchanges. It is worth noting that the company has unveiled its flagship Galaxy S10 smartphone, which will reportedly arrive with a built-in cryptocurrency wallet.

It seems a good number of mega-corporations are starting to delve into the blockchain scene. As such, it is interesting to see just how their respective crypto implementation can compare with each other, not to mention the already existing ones in the entire crypto ecosystem.

Read the full report here.

Consumer-Targeted Cryptojacking ‘Extinct’

Cryptojacking, or better known as illicit crypto mining, against consumers is already deemed “essentially extinct.” This is basically based on a report courtesy of MalwareBytes, a cybersecurity company. According to the firm, after in-browser miningservice called CoinHive decided to close its doors in early March this year, this practice targeted at consumers has significantly declined.

In addition, the number of reported attacks designed for businesses has increased as far as the last quarter is concerned. Add to this the fact that MalwareBytes suggests that all holders of Bitcoin, the world’s leading crypto, who are fond of using Electrum wallets on a Mac have experience a loss of more than $2.3 million in stolen coins. This happened due to an infamous Trojanized version of the wallet in the first quarter of 2019.

Read the full report here.

Austria Wants Fintech Regulatory Sandbox

Austria’s very own Ministry of Finance is believed to be interested in establishing a regulatory sandbox specifically designed for fintech industry. According to the government department’s Finance Minister named Hartwig Loeger, the FinTech Advisory Council will be responsible in developing relevant rules designed to steer the “young financial market,” which is circling around digitized financial services.

This council, in particular, was reportedly formed by the aforementioned department last year. The move is said to include initial coin offerings (ICOs), as well as digital currencies in an attempt to facilitate their growth.

Read the full report here.

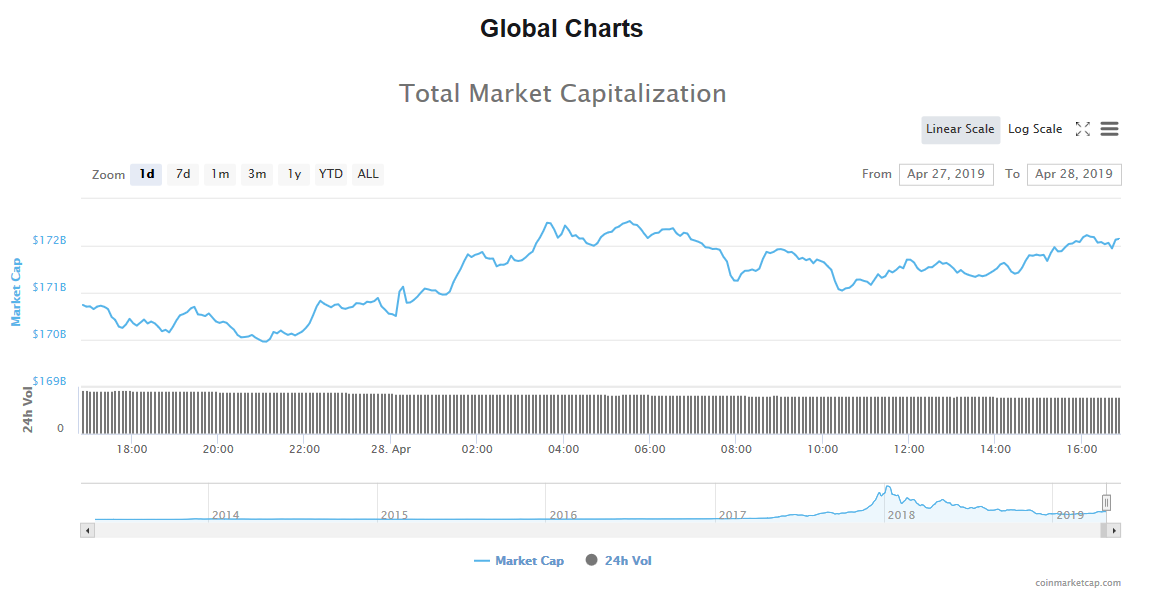

Total Market Cap: April 28

The trade volume had reached $37.73 billion in the past 24 hours. The market capitalization, on the other hand, was $172.14 billion.

Bitcoin Price Analysis: April 28

The world’s leading cryptocurrency, Bitcoin, has once again shown its dominance, as it jumped 0.58% and got a price $5,249.05. BTC registered a trade volume of $12.55 billion and a market capitalization of $93.54 billion.

Ethereum Price Analysis: April 28

Ethereum is still a leading crypto, managing to be second in the rank with its trade jump of 1.49% and price of $158.92. The digital currency’s trade volume and market cap reportedly reached $5.47 billion and $16.82 billion, respectively.

State of the Top 10 Cryptocurrencies: April 28

Litecoin proved to be the only crypto to have not experienced a jump in the past 24 hours. As for Cardano, it finally took the 10th place from TRON.

- Bitcoin’s market price jumped 0.58% to $5,294.05, with a market value of $54 billion.

- Ethereum’s market price jumped 1.49% to $158.92, and the market value is $16.82 billion.

- XRP’s market price jumped 0.37% to $298539. The crypto’s market value is set at $12.54 billion.

- Bitcoin Cash jumped in terms of market price at 0.91% to $265.76 in price, and as far as its market value is concerned, it is $4.72 billion.

- EOS’s market price jumped at 0.43% to $4.75, and the confirmed value in the market is $4.48 billion.

- Litecoin’s market price fell 0.90% to $71.98, and market value topped $4.43 billion.

- Binance Coin’s price in the market jumped 2.65% to $23.04, and its value in the market is $3.25 billion.

- Tether jumped 0.20% to $0.994917 in terms of market price, and market value is said to at $2.83 billion.

- Stellar’s market price jumped 0.96% to $100079, and its value in the market is $1.91 billion.

- Cardano obtained the 10th spot and removed TRON after jumping 1.15%. This resulted to a trade price of $0.070086 and a market value of $1.82 billion.