Minting in Crypto Explained: What Does It Entail And The Market Opportunities

Image Source: Pixabay

The minting process in the crypto ecosystem involves the validation of transactions to be added as new blocks on a blockchain network. At the core, blockchain networks are designed to operate as distributed ledgers, which means that users can leverage these ecosystems to record on-chain transactions and validate their authenticity. Minting supports validating transactions in Proof-of-Stake (PoS) blockchain networks, while the Proof-of-Work (PoW) consensus is supported by mining.

The concept of minting dates back to the medieval age, with the first mint being introduced in the 7th century B.C. This was an industrial facility for coin manufacturing that coined precious metals such as silver, gold, and electrum, which would later be used as currency. Since then, minting has been a core part of monetary economics and can be seen in modern-day societies where central authorities such as the federal reserve or central banks mint (print) fiat money.

In the emerging crypto world, minting is closely related to staking as they both play a fundamental role in PoS blockchain environments. While the two concepts play hand-in-hand to support blockchain networks, the fundamentals of each are different. Staking involves the process of buying crypto-assets and locking them in a wallet for a specific period to enhance the network’s security. On the other hand, minting is the process of recording on-chain data, generating new blocks and validating transactions.

Staking & Minting in PoS Blockchains

The past year has been a game-change for crypto following the debut of Decentralized Finance (DeFi) projects, most of which are built on the Ethereum blockchain. DeFi projects introduced decentralized protocols and opportunities to stake or mint new tokens depending on the underlying smart contract code.

As mentioned earlier, staking and minting are closely related. However, it is noteworthy that each concept operates differently in terms of incentives and required resources. Staking is easier than minting as users only need to allocate a significant amount of tokens to their staking wallets. Meanwhile, minting requires one to have already staked a particular amount in the blockchain network.

For incentives, minting is more lucrative than staking; the former rewards validators with both staking rewards and incentives for transaction validation while staking only rewards users with the staking rewards. That said, the emergence of flexible DeFi environments is now creating an opportunity for users to mint advanced tokens, including crypto assets that replicate complex traditional financial instruments like derivatives.

The Opportunities to Mint New Coins in Crypto

The DeFi ecosystem features several protocols where users can mint new tokens ranging from stablecoins, NFTs and derivative-focused tokens. Some prominent examples include the famous MakerDAO protocol and Premia, a decentralized financial instrument protocol that allows users to create customizable call/put options for various supported assets.

-

MakerDAO

The MakerDAO protocol is one of the leading DeFi platforms, with its total locked value (TVL) currently at $6.38 billion. This DeFi protocol allows crypto users to mint DAI stablecoins whose value is equivalent to 1 USD. Essentially, MakerDAO’s smart contracts are coded to act as a mint, requiring users to deposit ETH as collateral to mint new DAI stablecoins.

The DAI stablecoin value is designed to remain at an equivalent of 1 USD through automatic pricing mechanisms featured within the smart contracts. In the event of a fluctuation in ETH prices, DAI owners who had placed their ETH as collateral must review their Collateralized Debt Position (CDP) to avoid liquidation if the collateral’s value has been reduced.

-

Premia Finance

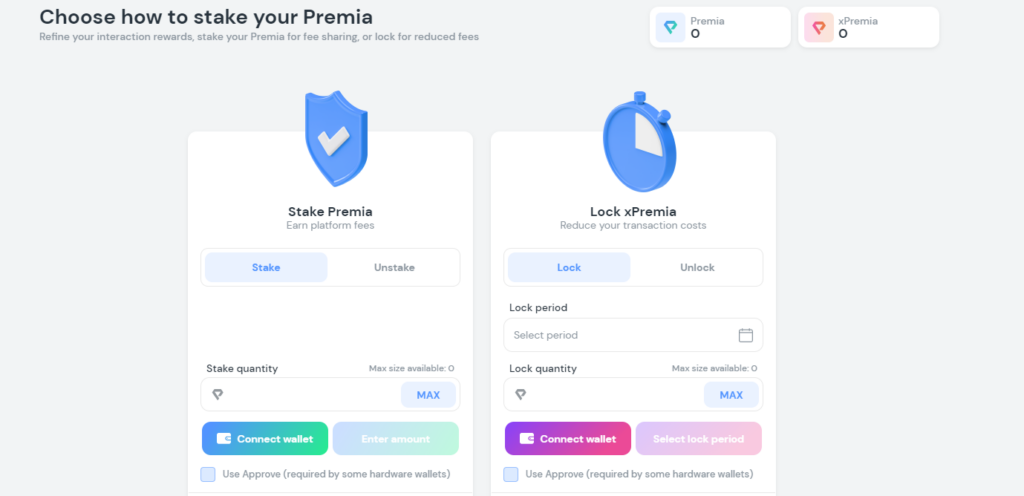

Premia Finance is another DeFi protocol that allows users to mint crypto tokens. The approach taken by this decentralized financial instrument protocol revolves around minting new tokens that can be customized to hedge risk. With Premia Finance, DeFi users can create customizable call/put options by minting them for storage in their wallets or sale in the open market.

The minteable derivative tokens on Premia Finance also allow users to customize particulars such as quantity, strike price, and expiration date. In addition to minting new tokens, Premia users can leverage the platform’s staking initiative by staking Premia tokens in return for a share of the network’s fees.

Benefits of Minting New Coins

Just like the process of minting in traditional finance, introducing new tokens into the crypto ecosystem has some benefits. Some of these include introducing sophisticated instruments that can be used for risk-hedging and the upcoming NFT niche where creators can mint their work for on-chain storage.

Furthermore, minting creates an additional source of revenue for crypto users as they can participate in the validation of transactions. In doing so, the validators earn network rewards in the form of native tokens or other incentives whose value can go up significantly, depending on the fundamental value proposition of a specific DeFi project.

While minting has some benefits, the variation in tokenomic models differentiates how networks approach this process. Some crypto projects have adopted an inflationary model, while others feature a deflationary model or a combination of both.

Conclusion

The evolution of money has been going on for civilizations, with the earliest form being barter trade. We are now seeing a paradigm shift from fiat and plastic money to digital money such as cryptocurrencies. This being the case, it is inevitable for modern-day innovations such as crypto to borrow traditional finance market concepts to advance the use of money. Minting proposes a significant value in the growth of cryptocurrencies as a form of money. It might as well define the next era of monetary ecosystems, which will probably be decentralized.