Fiat Money Can Be a Pain – Here’s Why We Should Have Started With Crypto in the First Place

With a lot of talk around the recent cryptocurrency boom, everyone from enthusiasts, regulators, skeptics, and bystanders is wondering what the future holds for the new asset class. Yet, when discussing cryptocurrencies, we often overlook the fact that we’re comparing it not necessarily on its own merits, but based on how it stacks up to traditional fiat currency. At first, this seems fair. After all, fiat currency is what we’re all used to using in a our day to day lives, but far too often people overlook the shortcomings of fiat and emphasize the potential downsides of cryptocurrencies. To help put things into perspective, let’s look at why we we’d be better off with just cryptocurrency, rather than fiat, had we started with it in the first place.

Money Supply

First things first: supply. The entire purpose of using a currency over an old-school bartering system is as a means of representing and transferring value from one party to another. Rather than sit in a marketplace and haggle with a vendor about what constitutes a fair trade (this ____ for that ____), currencies were intended to make our lives easier by representing a standardized amount of value that’s universally accepted. That’s great.

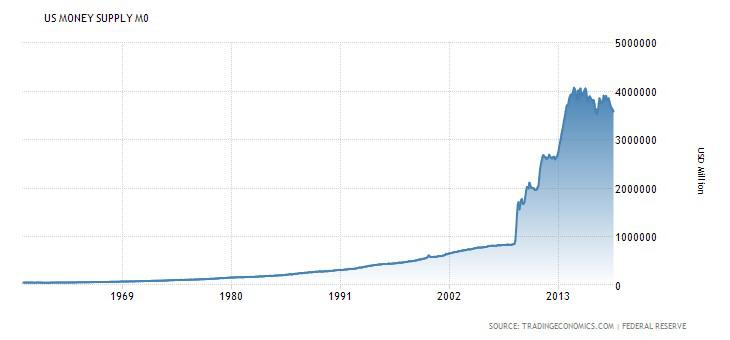

However, when currencies are able to be manipulated by one party, then we start running into issues. For example, there are not only a plethora of different currencies in the world (the United Nations currently recognizes 180 globally), but they’re all controlled by authorities that can manipulate the supply of them. In the United States for example, the Federal Reserve is in charge of controlling monetary policy and makes decisions about interests rates, reserve ratio requirements for banks, etc. effectively controlling the supply of money in the economy (though the actual printing and minting of US dollars and coins is done by the Treasury Department). Since World War II, the US dollar (USD) has consistently lost value, caused by inflation. That means that every year since, the USD has been depreciating in value as the supply continues to grow. While this isn’t a drastic 20% loss in value each year, inflation adds up over time, especially for those saving for extended periods of time. Take a look at the history of the US money supply since 1959 below.

United States Money Supply, 1959-2018, Trading Economics

Contrasting fiat currency, there is no third party making monetary policy decisions for the cryptocurrency markets. Instead, there is a predetermined amount of coins or tokens for each currency that will never be exceeded (think 21,000,000 bitcoin). With that, we have a more objective standard for how much value each coin ought to represent because we know that the supply will not be changing at all. Even with so-called responsible monetary policy, the US is still subject to inflation every year with some years significantly worse than others. With inflation, those holding fiat currency run the risk of their savings deteriorating in value over time.

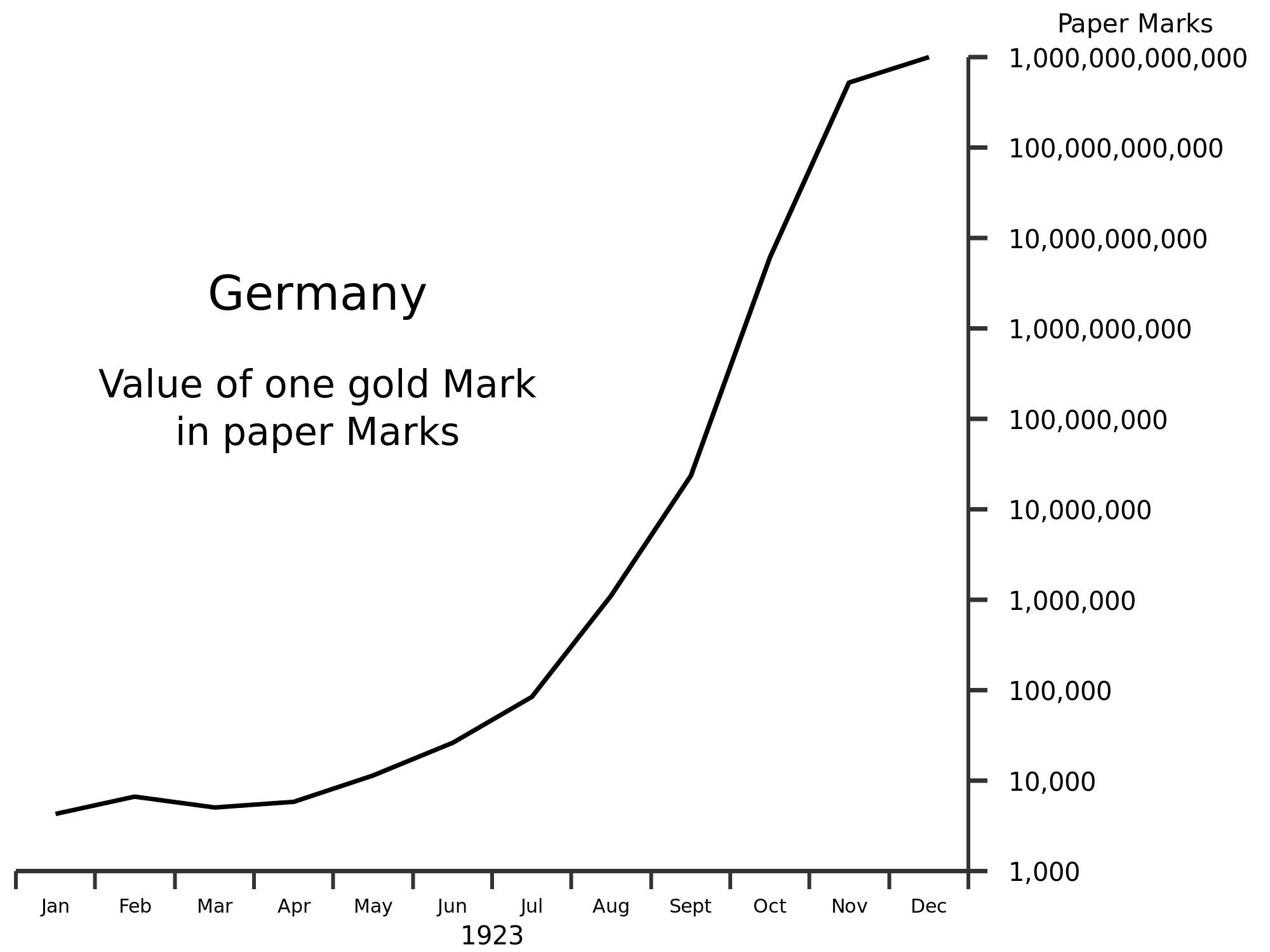

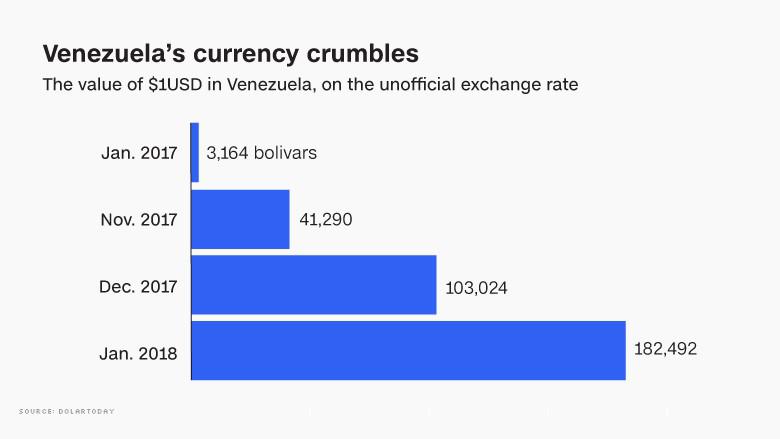

Typically, when we think about a depreciating asset, we don’t think of cash holdings. However, even with a relatively low inflation rate of 2.7% in the US, those holding their savings in a traditional savings account are actually losing value every year after inflation (the vast majority of APY for a savings account is a lot less than a measly 1%). Cryptocurrency doesn’t have that problem and can’t have that problem as there is a guaranteed limited supply. While crypto prices do fluctuate over time, that price movement is only based on the exchange rate between crypto and fiat. For example, even in 20 years, 1 BTC will still be worth 1 BTC, regardless of what the price is in USD. With fiat, on the other hand, you’d need $306 USD today to equal $100 USD in 1980. Should we have started with crypto in the first place, we’d never need to worry about the ever-increasing amount of money in circulation. To see an example of inflation totally out of control, take a look not at the US dollar, but at countries like post-war Germany in 1923 and Venezuela today. Unlike cryptocurrencies, the inflation of fiat currency can be absolutely devastating.

Value of One Gold Mark vs Paper Marks in the Weimar Republic Post WWI, Wikimedia Commons

“You Can’t Get $1 Out of the Bank in Venezuela. I Tried,” CNN

International Payments and Transfers

In addition to inflation and supply creating a lack of scarcity, fiat currencies cause even more pain points for international transfers and payments. Because the global community doesn’t operate off of one unified system, the process of sending money internationally can be both timely and expensive. If you’ve ever tried to send money abroad, then chances are you’ve personally dealt with this issue before.

In some situations, savvy consumers are able to find viable options that aren’t going to break the bank. For example, consumers who put in the work of finding ways to transfer money overseas can discover methods of doing so with no fees and in a timely manner. However, not everyone has the financial know-how or time to find services that benefit them. Instead, we end up with situations where those looking to send money to people in need end up having a substantial amount of their money lost to high bank fees. Sometimes those fees are deceptively high as well. It’s not uncommon for banks and service providers to advertise low fees, only to actually have hidden costs associated with them. As illustrated by TransferWise, the quoted costs from banks are not always what they seem to be.

Had we started with cryptocurrencies, transferring money across borders would never have been an issue in the first place. Cryptocurrencies allow users to send money with no consideration for the borders it crosses. Instead, users connect peer-to-peer, just like digitally handing cash to a friend (only, now you can prove that you in fact gave it to them!).

The Bottom Line

Besides the supply of money in the economy and transferring money across the globe, there are a whole host of other concerns that come with utilizing traditional fiat currency over cryptocurrency (record keeping, provability, immutability, etc.). At the end of the day though, two of the most glaring problems not only can be solved with cryptocurrency, but would never have existed in the first place had we started off with cryptocurrencies from the beginning. The concept of having a group of people control how much money there is in the economy would seem incredibly strange and the idea of paying high fees and waiting for extended periods of time to send money to someone in country ___ rather than country ___ would be absurd. Think of it this way: If we had been using cryptocurrencies from the beginning, what kind of response would you give to someone pitching the use of fiat currency? (You’d probably think they were crazy.)