Bancor (BNT) Review – Liquidity for All Tokens

| Name | Bancor |

| Ticker | BNT |

| Total Supply | 77,626,942 |

| Initial Price | $3.92 |

| Category | Liquidity |

| Website URL | https://about.bancor.network/ |

| White Paper URL | https://storage.googleapis.com/website-bancor/2018/04/01ba8253-bancor_protocol_whitepaper_en.pdf |

Bancor is a blockchain protocol that helps traders swap their cryptocurrency coins and tokens for others, but without the need for an exchange. This means no matching with a counter party, no spread, no deposits or withdrawals, and no registration involved. Instead, Bancor’s network helps users convert their tokens via smart contract, and a new variety of cryptocurrencies called Smart Tokens. This means faster and less expensive conversion from coin to coin, but also better liquidity and interoperability for ERC20 coins that connect to the Bancor network.

The Idea Behind Bancor

Liquidity is a serious problem for many new cryptocurrencies, as there is a drought of active traders that makes it hard to buy or sell at any given time. The most unfortunate tokens are deprived of significant value due to these circumstances, and Bancor helps inject liquidity into those that join its network. The root of Bancor is its Smart Tokens, which are essentially cryptocurrencies that themselves holdautomatically balancedd reserves of all other coins connected to the Bancor network.

Someone who wants to trade their BAT for ENJ, for instance, can forget about registering for an exchange, navigating the blockchain wallet system, and paying the spread. Instead, they can convert instantly via Bancor’s protocol, which maintains a vast network of Smart Tokens, with their internal token reserves algorithmically balanced to account for fluctuating demand. Blockchain startups with their own tokens can also integrate them with the Bancor network, as long as they’re built on ERC20. This liquidity network enables any connected coin to fast forward past its growing pains and start off on the right foot.

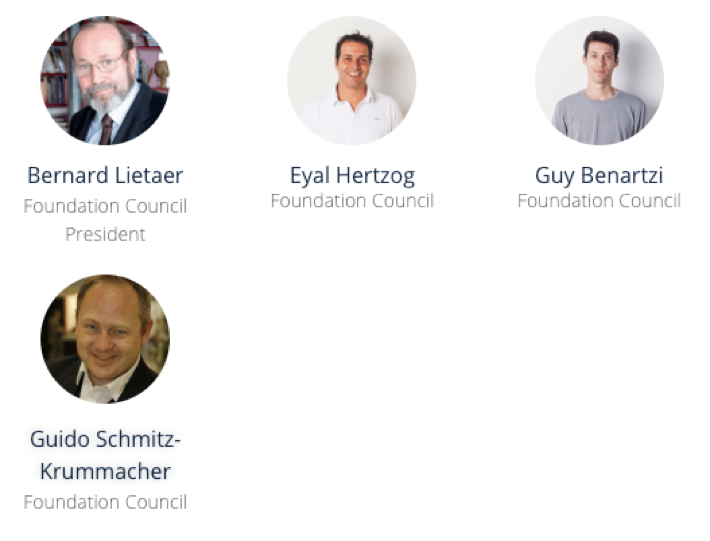

Bancor has an official entity dedicated to incorporating the world of cryptocurrencies into its network. It’s called the Bprotocol Foundation and it’s headed by Bernard Lietaer—a world renowned expert on currency systems and sustainable economics. Bancor itself is headed by CEO Guy Benartzi, a veteran in both the blockchain space but also a serial entrepreneur, with former successes Particle Code and Mytopia both acquired in the last decade. Co-founder Galia Benartzi is Bancor’s other leader, and she has an equally impressive pedigree of technology entrepreneurship and innovation.

Bancor Partnerships

As a network and protocol that benefits the tokens and projects integrated with it, and one that increases in efficacy with more participants, Bancor has signed a long list of esteemed partners. One of the most recent is Game Protocol—a blockchain that seeks to integrate cryptocurrency payments into videogames and create tokenized in-game item marketplaces.

The list is enormous, with some of the most prominent Bancor partners including EOS, COTI (Currency of the Internet), BlitzPredict, Sirin Labs, Trade.io, Decentraland, NAGA, Goldmint, Gnosis, and countless others. Bancor is also backed by Tim Draper, one of the most successful venture capital investors in the world, which is a positive signal.

BNT Price History

Despite the relatively high price of one BNT during the Bancor ICO, on June 12, 2017 at $3.92, the offering is still considered one of the most successful ever, even more than a year later. Whether it was because Bancor rode the first wave of ICO popularity in mid-2017, its astoundingly useful protocol, or some other factor, the company is still one of the few to meet their ICO funding goal in less than a day. This is doubly impressive when one considers that Bancor raised $153 million during the ICO alone, and in just a few hours.

Since the ICO, the price of BNT (Bancor Network Token) has largely fluctuated with the market, though it does gain value as partner coins become Smart Token compatible. The few months post-ICO were rough for BNT, and it declined to an average price of around $2.00 until November, when the market began to rise. In late December 2017 and early January of 2018 BNT reached its all-time high of $10.08. It’s currently trading at $1.38 per BNT.

Bancor’s Technology

The array of technology that Bancor employs is both sophisticated and unique to the space. Bancor’s ingenious method for providing automatic liquidity essentially makes it a decentralized, algorithmically-driven bank teller. The tools it uses to achieve its purpose are both common to other blockchain platforms and proprietary.

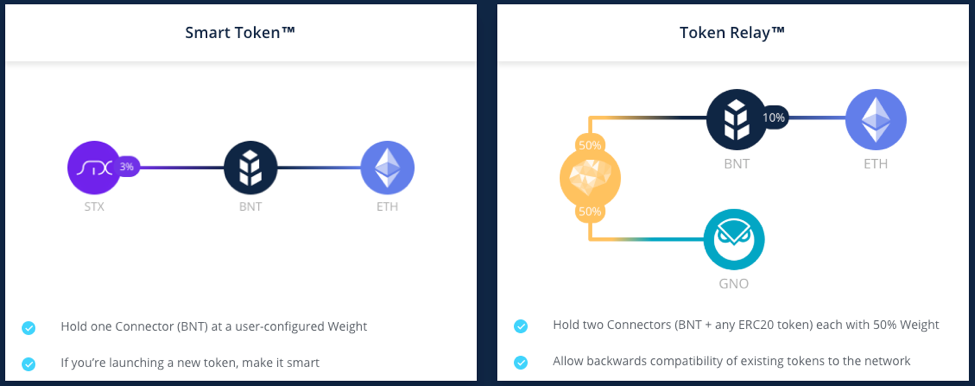

Smart Tokens

Bancor’s Smart Tokens are cryptocurrencies that are primarily employed as the counter-party for anyone who wants to convert one type of ERC20 coin to another. They each have reserves of other ERC20 tokens within their individual smart contract, and there is a global network connecting these Smart Tokens to ensure deep liquidity. The primary goal is for no one Smart Token to run out of any single coin. An algorithm maintains all network Smart Tokens at a Constant Reserve Ratio (CRR), based on network usage and demand for certain coins relative to others.

BNT

BNT is the Bancor Network Token. New projects that partner with Bancor and turn their coins into Smart Tokens will hold BNT in their reserves, which allow their own Smart Token to connect to the Bancor network and provide better liquidity. Smart Tokens use BNT to convert back and forth across the network between these reserves, based on user requests.

Smart Contracts

Though the idea of a smart contract is anything but special, Bancor ties a smart contract into each of its Smart Tokens (hence the name), which is how the tokens can act as a “counter party” with which anyone can swap their coins. Trading your ERC for AGI through Bancor looks like this: You first navigate to the Bancor website and connect your wallet. Then, you can simply select the two coins and click “Convert”. Before anything else, your ERC are converted into a Smart Token with the same amount of ERC held in reserves, which are then liquidated for another Smart Token with the same amount of AGI in its reserves, which then deposits it into your wallet.

How to Buy BNT

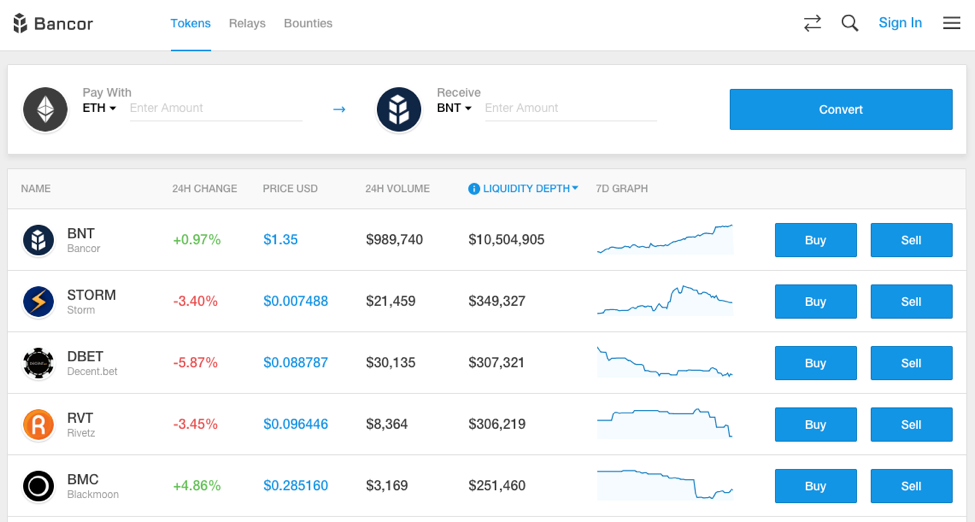

Buying Bancor Network Tokens is relatively straightforward. It’s best accomplished through the Bancor network itself, by buying virtually any ERC20 coin elsewhere and then converting it to BNT via a Smart Token at https://www.bancor.network. Once you’ve acquired some other cryptocurrency, connect your wallet to Bancor and then use the easy swap tool at the top of the home page for an instant conversion to BNT.

Other exchanges also list BNT, but the highest volume is found on Bancor with ETH as the counter-currency, at a 24h volume of $1,104,699 and 21.14% of the market’s volume. Surprisingly, the second-highest source of BNT volume comes from security token exchange LATOKEN, with 15.05% against Ethereum. It’s also found on HitBTC, Binance, OKEx, Upbit, and others.

Bancor tokens can be traded on Binance with BTC and ETH.

- Bancor (Trade BNT with ETH at Bancor)

- LATOKEN (Trade BNT with ETH at LATOKEN)

- BitForex (Trade BNT with USDT at BitForex)

- Bancor (Trade BNT with DAI at Bancor)

- HitBTC (Trade BTN with USDT at HitBTC)

How to Store BNT

As an ERC20-based coin, BNT can be stored on a wide range of wallets. Investors report that their Ledger Nano S and Trezor cold-storage devices support BNT, which undoubtedly represents the safest way to hold your investment. BNT can also be stored on MyEtherWallet, which is a very popular web wallet that lets you control your own private key and keep your BNT closer to online markets. However, any wallet that is compatible with ERC20 will work, just ensure you do your due diligence.

Road Map and Future Plans

As of the second quarter in 2018, Bancor listed over 42 tokens on their network, but this number has since grown to over 50 in recent months as Bancor achieves partnership after partnership with big names in the space. Listing new tokens is only a small fraction of Bancor’s great ambition, however, which is to be the baseline liquidity provider connecting all companies that offer tokens via blockchain. In terms of measurable milestones, Bancor’s next goal is to launch self-service Smart Token activation for new projects during the third quarter of 2018, which will let its network scale organically without increasing inputs. They also plan on launching a developer API and upgrading technical tools on the web application to better serve traders.

The major goal for 2019 is to incorporate cross-blockchain support for Bancor, so that it can expand beyond its ERC20 roots and begin to offer greater liquidity for tokens based on any blockchain. This will be a crucial step in cementing Bancor as a crucial part of the token economy, especially when considering the idea of “blockchain” is no longer unilateral. With a mountain of capital at its disposal and a healthily growing network, Bancor is setting a fast pace to success that will carry it into the next phases of the young blockchain industry.