Tezos (XTZ) Review – True Decentralized Governance for Blockchain

| Name | Tezos |

| Ticker | XTZ |

| Total Supply | 763,306,930 |

| ICO Price | $0.47 |

| Category | Smart Contracts |

| Website URL | https://tezos.com/ |

| White Paper URL | https://tezos.com/static/papers/white_paper.pdf |

Thanks to a revolutionary model that allows for more decentralized and democratic governance, Tezos offers a system that facilitates verification and can simultaneously amend itself while operating. With more secure smart contracts alongside an emphasis on flexibility and scalability, Tezos could be a worthy rival to Ethereum.

The Idea Behind Tezos

Tezos is a distributed ledger built on blockchain that is designed to facilitate the building of smart contracts while allowing for the evolution of the platform in an organic manner. The Tezos blockchain is meant to be self-evolving and capable of amending functions based on the community’s determination thanks to the company’s on-chain governance process.

The goal is to build a platform that facilitates formal verification—a mathematical method to examine and confirm the code behind digital agreements—to create better and more secure smart contracts, as well as provide a truly decentralized model that avoids manipulation by centralized actors. On a more practical level, Tezos enables the construction of decentralized applications similarly to Ethereum, although with more robust underlying security. With an incentive system in place that rewards network members for suggesting upgrades and implementing approved improvements, the Tezos team hopes to build an ever-evolving and upgrading blockchain.

Tezos was conceived by Arthur and Kathleen Breitman, who also established the Tezos Foundation. After a highly publicized power struggle with a board member, the Breitmans retained control of the project through their company Dynamic Ledger Solutions and added Ryan Jespersen to the leadership group of the Tezos Foundation. The whole Tezos development and managerial team benefit from extensive experience working at some of the largest and most innovative tech firms in the world as well as the field of blockchain. The company also counts with high profile investors including both Tim Draper and Winklevoss Capital.

Tezos Partnerships

The Tezos Foundation has been actively forming partnerships that enhance its ecosystem, providing funding and support to several companies in both research and commercial fields.

In March 2018, the Tezos Foundation announced a partnership with Obsidian Systems to build security measures and tools for the Tezos platform.

A few months later, in May 2018, the foundation partnered with the IMDEA Software Institute, which will oversee the establishment of a research project to support Tezos development. Additionally, the company formally announced a partnership with OCaml Labs, with Tezos providing resources to OCaml to improve their existing programming language.

Shortly after that announcement, Tezos also revealed partnerships with two other companies: Inria—the French National Institute for Computer Science and Mathematics—and French development firm Tarides. The former will see Tezos supply resources and support for Inria’s research, while the latter will involve Tarides delivering additional development and support for the Tezos platform.

|

|

|

|

|

|

|

|

More recently, Tezos announced that PricewaterhouseCoopers (PwC) would be acting as the official external auditor for the company’s finances and operations. In early August, the foundation announced that it was issuing four separate grants to research groups across the world. These included Emin Gün Sirer of Cornell University, The University of Beira Interior in Portugal, Decentralized Et Consulting (Decet), and France-IOI.

XTZ Token Price History

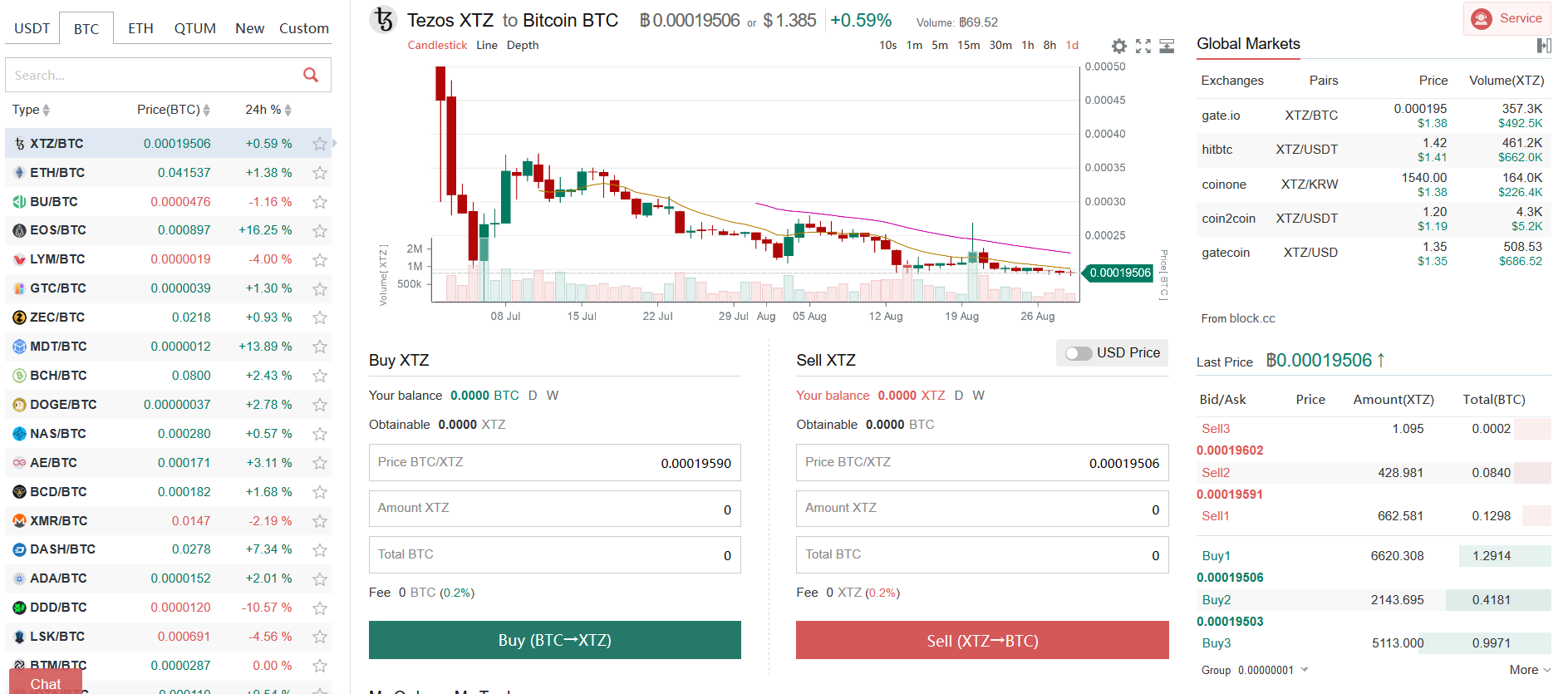

Tezos successfully completed an ICO between July 1st and July 17th, 2017, raising a then-record $232 million. The XTZ token was initially priced at $0.4700 and reached a peak of $11.2100 before settling lower in the $1.3000 to 1.3500 range. The high in prices coincided with news of turning public opinion against former Foundation head Johann Gevers and the spike in major coin prices including bitcoin’s historic climb. XTZ is currently slightly higher than $1.4100.

The Tezos Technology

Much like Ethereum, Tezos at its core serves as a platform for building and executing smart contracts. However, Tezos takes the concept further by adding a variety of built-in features that make the blockchain more secure, adaptable, and scalable. Developers can build applications directly on the Tezos chain, and the network has a direct way of voting on and implementing real-time changes to the blockchain.

Self-Amending Blockchain

One of the unique aspects of the Tezos blockchain is that it has a built-in system for governance that allows the community to make decisions about upgrades in real-time in a decentralized manner. Instead of the disruptive hard fork method chains like Ethereum and bitcoin employ, this self-amending blockchain is built to integrate changes seamlessly without requiring major events. To implement a change, a developer must submit a proposal for an upgrade to the Tezos protocol, which includes a request for compensation. Instead of requiring a core team to propose these changes, it decentralizes control and supports a more organic path towards continued evolution.

Formal Verification in Smart Contracts:

Another key aspect of Tezos’ vision is its integration of formal verification for smart contracts. The project uses Michelson, a domain-specific language built exclusively to write smart contracts on the platform. Michelson allows for developers to include code that can essentially verify the smart contract’s correctness. While this is not a 100% guarantee, it does significantly decrease the likelihood of a faulty contract, something vital for industries and sectors where the margin for error is much narrower.

Digital Commonwealth:

Tezos places a great emphasis on decentralization and allowing stakeholders to make real decisions. This creates a digital commonwealth that provides a more majoritarian approach to blockchain governance. New changes are voted on by stakeholders, removing the need for forks and other extreme measures. Instead, approved proposals are deployed on the testnet for trial, and if successful, they are voted on again and upgraded into the mainnet. The payment incentives for successful proposals also means that true change will be driven by the community and not a central core team.

Delegated Proof of Stake:

Tezos replaces the Proof of Work and Proof of Stake consensus models with its own version of delegated Proof of Stake (DPoS) which the project calls Liquid PoS. In this model, akin to traditional dPoS, Tezos allows users to “delegate” the staking process required to mine new coins to specific nodes, which the network calls “bakers”. Unlike traditional dPoS, however, these “bakers”—who are the ones staking, signing, and verifying new blocks—must commit their own funds “baked in” to a deposit.

Baking:

Bakers are an integral part of the Tezos consensus mechanism as they are the ones who sign and publish blocks to the chain. If they act in bad faith, the deposit they make is lost, and they are banned from participating in the network. There is a maximum number of bakers allowed, but they receive rewards for successfully verifying transactions, and the process is handled much like standard PoS.

Tezos Advantages vs. Ethereum

Tezos represents another major rival and threat for Ethereum, which was the first, but not necessarily best, smart contract platform. For one, although Ethereum is making a switch to PoS, their consensus is still expensive and has required several patches and upgrades. Additionally, the network is not capable of handling high numbers of transactions per second (15), while Tezos is capable of up to 40 TPS. More importantly, its self-amending nature makes it a more agile solution than Ethereum, as it allows for real-time changes that don’t fragment the community. The delegation process and the change proposals also provide strong incentives for positive and productive participation within the network.

How to Purchase XTZ

Currently, the most popular exchange by for trading XTZ is Gate.io. The token is also listed on CoinOne, Gatecoin, and HitBTC. XTZ can be traded for bitcoin, Tether, Ethereum, US Dollars, and Korean Won. The 24-hour volume of XTZ traded on Gate.io is $491,414.

XTZ is available on the following exchanges, among others:

- HitBTC (Trade XTZ for USDT on HitBTC)

- Gate.io (Trade XTZ for BTC on Gate.io)

- Gate.io (Trade XTZ for USDT on Gate.io)

- HitBTC (Trade XTZ for BTC on HitBTC)

- CoinOne (Trade XTZ for KRW on CoinOne)

How to Store XTZ

Currently, Tezos does not offer an official wallet to store XTZ, although the token can be stored in a variety of other hardware and software wallets. Even so, the community has produced two wallets specific to Tezos, including the Tezbox wallet and the Galleon Tezos Wallet (both of which are web wallets).

Tezos Class Action Suit

After its successful and record-breaking ICO in July 2017, Tezos was set to move forward with its development plans. However, an internal power struggle between the Breitmans and Gevers resulted in delays which fomented discontent among investors. Additionally, the company’s terms—which noted that funds received were considered non-refundable donations and not investments—rankled many participants. Even token delivery was delayed, with investors complaining about not receiving their allocations until October 2017.

As a result of the delays and perceived transparency problems, several groups filed class action lawsuits against Tezos and DLS. One of the more concerning proceedings is a suit that claimed the ICO was an unregulated securities sale. While the company has since launched its betanet and is already active, the lawsuits are still pending.

Road Map and Future Plans

Tezos launched its betanet after several delays and issues during the second quarter of 2018, and the project is finally operational. While the mainnet has not been launched, the company noted in April that they expected it to be fully ready in the third quarter of 2018. For now, the project is slowly onboarding more bakers and working to finalize many of the rules that will regulate the platform at least for the first few months.

The company’s legal problems will also likely continue for some time after a judge in the United States recently ruled that the lawsuit against the company can proceed.