Acquantum – Can You Trust Them?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Acquantum - DO NOT TRADE WITH THIS PROVIDER

2.4/10

$100

Minimum Depositupdated 2020

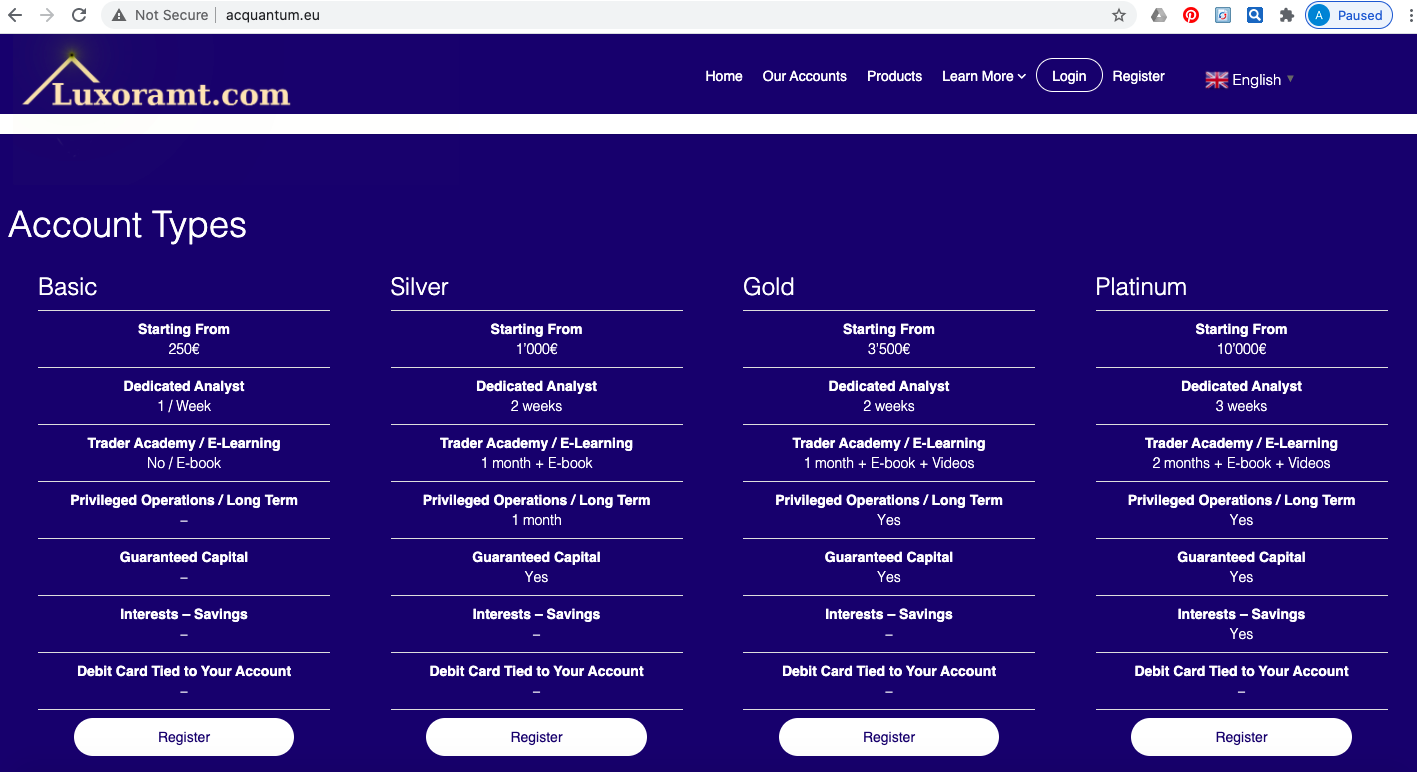

Acquantum seems to be a clear-cut scam. The company that owns and operates this brokerage also owns a twin brokerage by the name of Luxorampt.com. Both the websites look exactly the same, and the legal documents found on Acquantum’s site all bear the name of Luxorampt. In fact, if you enter www.acquantum.eu, you are sent to the Luxorampt site.

Thus, according to the information this broker has presented, the broker (it only mentions Luxorampt) is owned by a company which is based in Liechtenstein. The company’s name is Luxor Asset Management Trust, and it classifies itself as a financial services company.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: https://acquantum.eu

Founded: 2020

Regulations: Unregulated

Languages: English, Dutch, French, German, Italian, Spanish

Deposit Methods: Unknown

Minimum Deposit: €250

Free Demo Account: No

Number of Assets: N/A

Types of Assets: Foreign Exchange, Cryptocurrencies, Shares, Indices, Commodities

Trading Accounts and Conditions

Acquantum offers its clients 8 different trading accounts. Here are the details:

- Basic: The minimum deposit requirement for this type of account is €250.

- Silver: The minimum deposit requirement starts from €1,000.

- Gold: The minimum deposit starts from €3,500.

- Platinum: The minimum deposit starts from €10,000.

- Black: The minimum deposit is €25,000.

- Diamond: The minimum deposit is €50,000.

- Prestige: The minimum deposit is €50,000.

- Exclusive: The minimum deposit is €100,000.

This broker has given no information on its trading conditions offered by this broker. And since we failed to access Acquantum’s trading software, we could not verify this information for ourselves.

Acquantum – Advantages

There is not one single advantage that a trader will have by contracting with Acquantum. This is a broker you cannot trust.

Acquantum – Disadvantages

Here is the list of reason why you cannot trust Acquantum:

-

Unregulated, Scam Broker

Acquantum seems to be a clear-cut scam. The company that owns and operates this brokerage also owns a twin brokerage by the name of Luxorampt.com. Both the websites look exactly the same, and the legal documents found on Acquantum’s site all bear the name of Luxorampt. In fact, if you enter www.acquantum.eu, you are sent to the Luxorampt site.

Thus, according to the information this broker has presented, the broker (it only mentions Luxorampt) is owned by a company which is based in Liechtenstein. The company’s name is Luxor Asset Management Trust, and it classifies itself as a financial services company. The company states that it has been incorporate in and registered in Liechtenstein.

If a broker is based out of Liechtenstein, then it needs to be regulated by the country’s financial regulator, called the Financial Market Authority. However, despite checking for both Luxorampt and Acquantum, we could not find any listing of the brokers.

Neither of the two brokerages are listed on any other European or even UK regulator’s registers. This means that this broker (and its twin) are offering their services illegally in Europe.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Blacklisted by CONSOB

While checking for Acquantum’s regulation status, we also found out that the Italian financial watchdog, the Commissione Nazionale per la Societa e la Borsa (CONSOB) has blacklisted this brokerage. The warning was issued on September 07, 2020.

This is a clear indication that this broker is not to be trusted and that if you invest your funds with Acquantum, you are sure to lose your money.

-

Broken Link to Trading Software

Acquantum AG’s link to its trading software is broken, so there is no way to check what kind of platform the broker actually offers.

Most legitimate brokers offer their clients support for the MetaTrader 4 or MetaTrader 5 platforms, which are considered the best in the world. With these platforms, you get an amazing range of charting and market analysis tools, and even advanced algorithms that allow you to carry out automated trading. And the cherry on the cake is all of these tools can be customized if you are an advanced trader.

-

No Information on Payment Methods

The more we investigate this broker, the murkier things get. Acquantum has provided no details whatsoever of the payment methods it offers. We do not know how a trader can deposit money into their account or withdraw funds from their account.

The only hint we get is from the Terms and Conditions, which mentions in passing that clients can make deposits using Bitcoin and/or debit cards.

-

Strange Account Management Tool

On the broker’s homepage, there is a link to a heritage management tool.

On this page, there is no management tool. Rather, the broker promotes companies that produce marijuana. This is a trading product – not a management tool.

-

Lack of Terms and Conditions

When you visit the Terms and Conditions page, all you get to see is a very short list of provisos. Added to that, you will not see any condition that refers to Acquantum.

The Terms and Conditions are a critical document that every trader must read before they contract with a broker. This is a legal document that outlines clearly the terms of service that the broker offers. It also lets you know what your rights are. Therefore, the fact that Acquantum’s name is not even mentioned on this document indicates that you would not be contracting with this brokerage.

The contract that you make is with Luxoramt. Therefore, if anything were to go wrong with your funds, there is no way that you will be able to file a complaint, because you technically never had a contract with Acquantum!

-

Too Many Account Types

Acquantum offers its clients 8 different account types. But when you go through the offerings on these accounts, there is very little difference. The deposit amounts are only slightly different. And the Diamond and Prestige accounts have the same minimum deposit requirement. The main difference seems to be in the kinds of support offered to clients using these accounts.

We are unable to understand the need for so many different accounts when there is such a marginal difference between them.

Conclusion

Acqauntum is probably one of the worst brokerages that we have seen so far. There is not information on the broker’s website about this entity. In fact, you won’t even be dealing with this broker; you would be contracting with its twin – Luxoramt. This broker has also been blacklisted by the Italian regulator, which clearly indicates that you cannot trust it at all.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.