CFreserve Review – Is it a SCAM?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

CFreserve - DO NOT TRADE WITH THIS PROVIDER

0.7/10

$100

Minimum DepositUpdated 2020

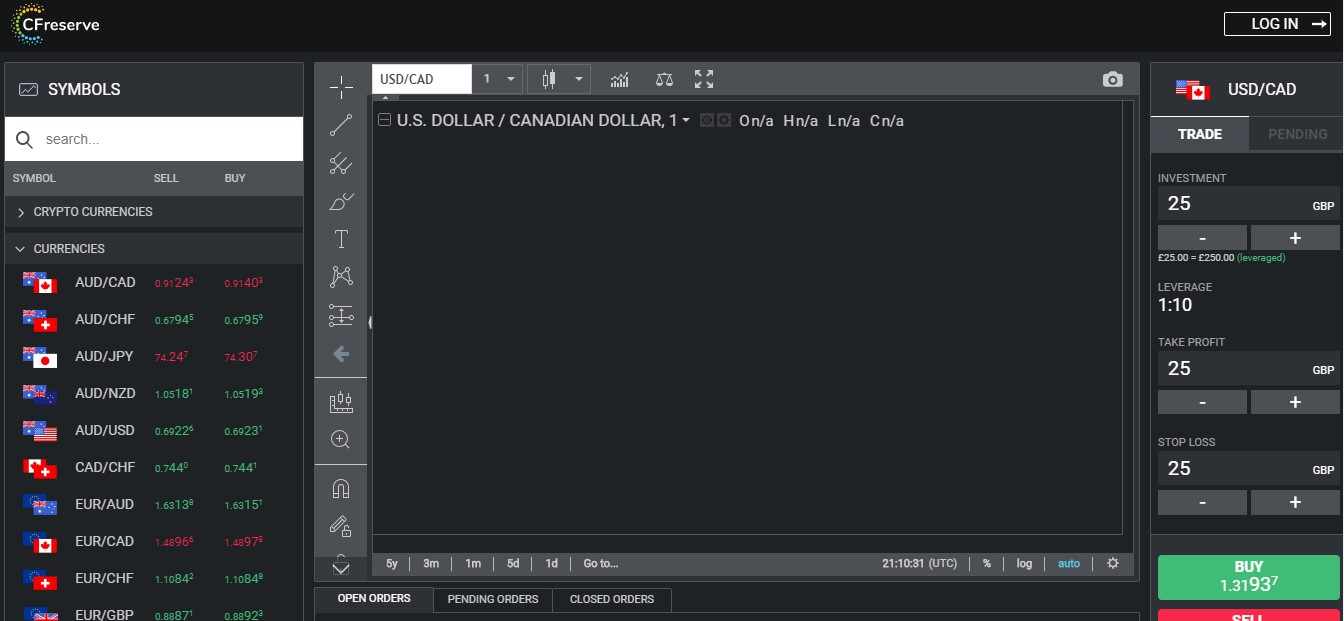

CFreserve is a web-based trading platform, mainly for CFDs, though it also offers trading in some commodities as well as Forex. The platform does not offer the hugely popular MetaTrader 4 (MT4) platform, but it does offer a very advantageous spread of 0.4 pips. Clients can get a leverage of up to 1:10, and the required minimum deposit to start trading on this platform is $250.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

CFreserve is a web-based trading platform, mainly for CFDs, though it also offers trading in some commodities as well as Forex. The platform does not offer the hugely popular MetaTrader 4 (MT4) platform, but it does offer a very advantageous spread of 0.4 pips. Clients can get a leverage of up to 1:10, and the required minimum deposit to start trading on this platform is $250.

CFreserve Trading Advantages

Here are the trading advantages if you plan to use the CFreserve platform:

Wide Range of Trading Instruments

The platform offers you a decent range of currency pairs, 35, to be exact, of which many are either exotic or minor currencies. You can also trade CFDs on 7 different indices and stocks. This is one of the platforms that also offers a great range of cryptocurrency trading options. You can trade in Bitcoin (BTC), Ether (ETH), Ripple (XRP), Bitcoin Cash (BCH), Litecoin (LTC), Ethereum Classic (ETC), Dash (DASH), OmiseGo (OMG), Monero (XMR), Lisk (LSK) and Zcash (ZEC).

This is what CFreserve’s trading platform looks like:

Good Spreads

The site offers a very advantageous spread of 0.4 pips to its traders. However, there is no demo account on which to practice, so it is not clear whether this platform has any trading commissions.

Minimum Deposit Requirements

CFreserve requires you to put in a minimum deposit of $250, which is the industry average.

Open Accounts in 4 Different Currencies

CFreserve offers its clients the option of opening their accounts in any one of 4 currencies – USD, GBP, AUD and EUR.

CFreserve Trading Disadvantages

Unfortunately, where there are some good things about this site, there are also some major disadvantages, because of which we would warn traders to be wary of this platform.

Unregulated Broker

CFreserve is owned and operated by Richfield Limited, which is based out of Dublin, Ireland. However, despite the fact that Ireland is a member of the European Union, and all Forex trading falls under the ESMA purview, this platform does not seem to be licensed or regulated in any way – either with local regulators or authorities in the EU.

This is a huge red flag against trading on this platform because this basically means that the platform’s operations in Irish or European Union territories are illegal.

With a legitimately regulated broker, you can rest assured that your money is safe because you can even get insurance cover for your trading account. What this means is that if the platform goes bankrupt, you will be compensated for your losses to some amount.

Strange Withdrawal Conditions

This site has some rather strange withdrawal conditions. For one, before you are allowed to withdraw your funds, you must qualify for the minimum trading amount and the minimum trading period. This is your money, and CFreserve should not place any conditions of when and how you can withdraw your earnings. This is not something that a legitimate brokerage will do. Another red flag here.

Another red flag is that the platform may offer you trading bonuses. This is a red flag because trading bonuses have been banned across Europe and many other regulated markets as they are considered to be unfair practices.

And because CFreserve offers a trading bonus, there are terms and conditions attached – the platform mandates that you have a turnover of at least 300 times for every bonus dollar you are given. This is a huge roadblock to you being able to withdraw your funds as getting that kind of a turnover is not an easy task.

No Support for MetaTrader 4

MetaTrader 4 (MT4) is one of the most popular trading platforms, with more than 80% of traders using it, especially for automated trading. CFreserve does not offer support for this platform. Rather, you get a basic web-based trading platform with none of the features that make MT4 so popular.

MT4 is extremely reliable and fast, and offers some excellent charting options, automated trading and tons of market technical indicators.

No Demo Account

Another strange thing about CFreserve is that its website does not seem to have any demo account. So, if you are a new trader, you have only one option – you need to open a live trading account immediately – you cannot assess the trading platform before you commit to it.

No Support for Skrill in Payment Options

CFreserve offers numerous payment options, but Skrill is not one of them. This is significant because Skrill recently adopted a strong anti-scam policy, in which one of the conditions is that their money transfer services can only be used by brokerages that are completely regulated. CFreserve is not regulated.

Very Low Leverage

The maximum leverage offered on CFreserve is 1:10, which is far lower that the regulated market average of 1:30 in the EU, or 1:50 in the US, or 1:75 in Canada.

Our Verdict on CFreserve

This is a site that you should be wary of. The biggest concern that we have with CFreserve is that it is not regulated. Added to that, it has some rather strange and trader-unfriendly conditions for withdrawing funds. There doesn’t seem to be any demo account that you can practice on, so you don’t really get to know how the platform performs until you buy into it.

CFreserve

Pros

- Wide Range of Trading Instruments

- Good spreads

- Minimum Deposit Requirements on Par with Industry Average

- Account can be opened in any one of 4 different currencies

Cons

- Not registered, licensed or regulated despite operating in the EU

- Strange Withdrawal Conditions that are not fair to traders

- No Demo Account

- No support for MT4

- Skrill not available as a payment option

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

1 comment

I opened account 4 July 2019

I deposited USD$251 on 4 July

I closed the account on 9 July

I received credit USD$243 on 24 July

I was charged again USD$251 on 13 December when I have no active account with them – they have illegally retained credit card information and billed me for a service i have not requested

No phone number on website. The “Financial Advisor” who I spoke with – his email bounces back.

I contact 18 December you and was told it resolved in 14 business days

I contacted on 14 January and told by Supp”ort Agent (web chat only – Name is Paul L) “have referred my query to management” and indicated no timeframe

Contacting them for a third time now 20 January.

No one has followed me up – I have been the only one chasing them up.