Coinyards – Can You Trust Them?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Coinyards - DO NOT TRADE WITH THIS PROVIDER

2/10

$100

Minimum Depositupdated 2020

Coinyards offers its clients the choice of the following types of trading accounts:

- Basic: You are required to make an initial deposit of 0.3 BTC (bitcoin) to be able to open a Basic account with this broker. You can make a weekly profit of as much as 9.5%.

- Classic: You need to make a first deposit of a minimum of 0.4 BTC to be able to use a Classic account. With this account, you can make as much as 10% in profits every week.

- Gold: To open a Gold account you first need to deposit at least 0.6 BTC. With this account, the maximum profit per week is 11.5%.

- Platinum: To open a Platinum account the minimum deposit requirement is 0.8 BTC. You can make as much as 17.5% in profits every week with this type of account.

All of the above account types carry a 2% withdrawal fee.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

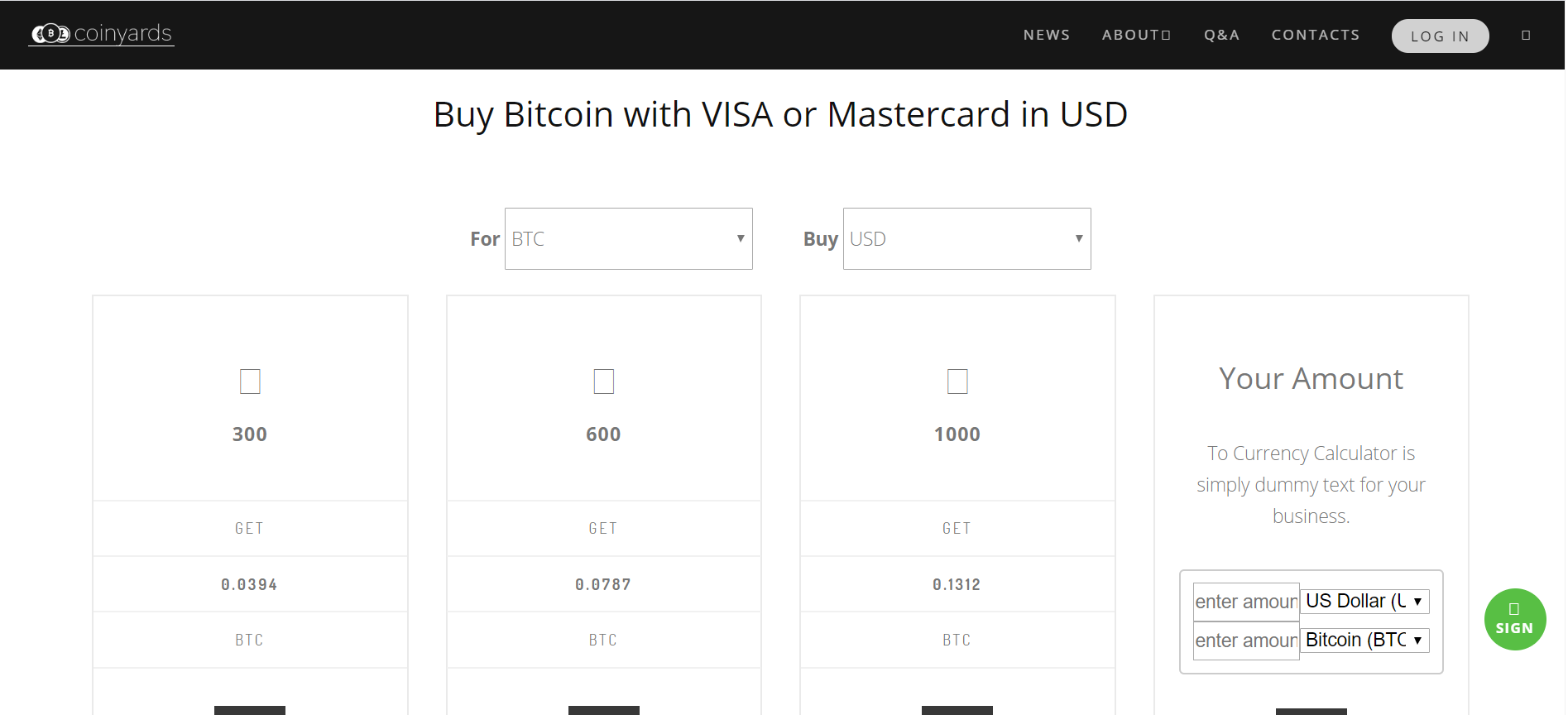

Website URL: http://coinyards.com/

Founded: 2019

Regulations: No Regulatory Oversight

Languages: English, Russian

Deposit Methods: Bitcoin, Ethereum

Minimum Deposit: 0.3 BTC

Free Demo Account: Available

Number of Assets: N/A

Types of Assets: Cryptocurrencies

Trading Accounts and Conditions

Coinyards offers its clients the choice of the following types of trading accounts:

- Basic: You are required to make an initial deposit of 0.3 BTC (bitcoin) to be able to open a Basic account with this broker. You can make a weekly profit of as much as 9.5%.

- Classic: You need to make a first deposit of a minimum of 0.4 BTC to be able to use a Classic account. With this account, you can make as much as 10% in profits every week.

- Gold: To open a Gold account you first need to deposit at least 0.6 BTC. With this account, the maximum profit per week is 11.5%.

- Platinum: To open a Platinum account the minimum deposit requirement is 0.8 BTC. You can make as much as 17.5% in profits every week with this type of account.

All of the above account types carry a 2% withdrawal fee.

Coinyards also offers its clients various investment plans, and uses automated crypto-trading bots, which the broker claims have been developed by them. The two bots are the Coinyards Arbitrage Bot and the Coinyards Scalp Bot.

Coinyards – Advantages

There is so much wrong with Coinyards that we cannot really say that there any advantages whatsoever of trading with this broker. Please read on to find out the serious issues we have with them.

Coinyards – Disadvantages

Here are the reasons why we feel that trading with Coinyards would be dangerous for all traders:

-

Anonymous Website

Coinyards claims to be owned by a company called PSP Joint System, which is supposedly based in Switzerland and registered in the UK. However, upon checking, we found out that there is no company by this name in existence. Added to that, this broker has also not provided any address.

Therefore, what we’re looking at in essence is an anonymous broker that is offering investment and financial services.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

No Regulatory Oversight

We checked both the UK’s FCA (Financial Conduct Authority) as well as the Swiss FINMA (Financial Market Supervisory Authority) to see if this broker was regulated by either.

However, upon checking both regulators’ online registries, we found that this broker (or its parent company) were not listed. This means that Coinyards is an unregulated broker, and so your investments are not safe with them.

-

Official Warning Against Coinyards by FINMA

As we were investigating Coinyards’ regulatory standing, we found some even more worrying information about this broker – they have been blacklisted by the FINMA.

The Swiss financial regulator has stated in its public warning that Coinyards is operating illegally in their jurisdiction, and have been targeting European traders.

Such a warning is only issued by a regulatory authority if there have been numerous complaints by customers. So, it is a clear indication that this broker is not one that you should do business with.

-

Lack of Clarity on Trading Conditions

Another signal that this broker is not trustworthy is the fact that there are no clear-cut trading conditions given. Besides the minimum initial investment requirement, we know nothing of the leverage levels or the spreads offered by Coinyards.

We also don’t know where these coins are being traded or even the type of trading algorithms used by the automated bots offered by this broker. We also don’t know how these bots perform.

Thus, traders who invest with Coinyards will just be shooting in the dark, with no idea about what is happening to their money.

-

Promises of Unrealistic Profits

Coinyards is promising returns of up to 17.5% per week. Such kinds of profits are unrealistic to say the least, but the danger is that novice investors are attracted by these false promises and that’s how they are trapped into getting scammed by such brokers.

One needs to remember that the general rule in trading is that the higher the investment, the higher the risk, and that most people lose more than their initial deposit. This is something that this broker fails to mention anywhere on its website.

- Lack of Legally Binding Documents

Coinyards’ website is missing all legally binding documents, what we call the Client Agreement, or the Terms and Conditions. Even after registering with this broker, we were not given access to any such documents that would clarify the relationship between us (traders) and the broker.

Without such a critical document, traders are left vulnerable to scammers.

-

High Withdrawal Fee

Coinyards states that it charges a 2% withdrawal fee, which is unreasonably high.

-

Negative Client Feedback

Before you invest with any broker, it is always wise to check other clients’ reviews on that financial service provider. We have found a lot of negative feedback about Coinyards online, especially on Russian website and trading forums.

-

Strange Web-Based Terminal That Serves as a Trading Platform

Besides the fact that there is no MT4 trading platform offered by Coinyards, another issue we have with this broker is that it offers its customers a strange web-based trading platform that doesn’t seem to have any trading conditions.

Conclusion

That is so much wrong with Coinyards and we can confidently say that this is not a trustworthy broker. If you do go ahead and invest with them, you are sure to lose your money.

We would recommend that if you are interested in trading in cryptocurrencies, then you should look for a broker that is regulated strongly and one that is completely transparent about its trading conditions and Client agreement.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.