GlobalCapitalOptions – Is It a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

GlobalCapitalOptions - DO NOT TRADE WITH THIS PROVIDER

2.7/10

$100

Minimum Depositupdated 2020

GlobalCapitalOptions claims to be an industry leader in online trading, and it offers its customers trading instruments such as CFDs on stocks, commodities, indices as well as forex pairs. The broker offers you 5 account types through which you can trade:

- Standard Account: This account requires a minimum deposit of $350 if you wish to use it for trading, and has a spread of 4 pips.

- Silver Account: You need to deposit a minimum of $2,000 to use this account to execute trades, with a spread of 4 pips.

-

-

-

-

-

-

-

-

-

-

-

-

- Gold Account: A minimum initial deposit of $5,000 is required for you to use this account, and it offers a spread of 3 pips.

-

-

-

-

-

-

-

-

-

-

-

-

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

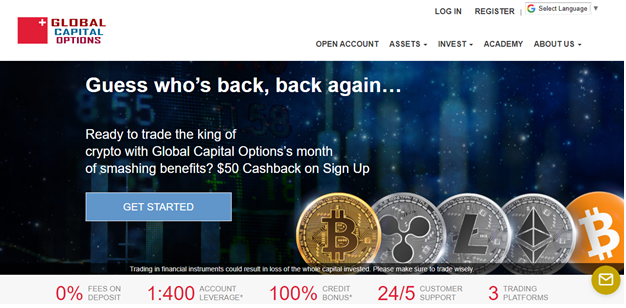

Website URL: https://globalcapitaloptions.com/

Founded: N/A

Regulations: Yes

Languages: English, 110+ Languages

Deposit Methods: Unknown

Minimum Deposit: $350

Free Demo Account: No

Number of Assets: N/A

Types of Assets: Currencies, Stocks, Commodities (Oil, Metals, Corn, Coffee), Indices

Trading Accounts and Conditions

GlobalCapitalOptions claims to be an industry leader in online trading, and it offers its customers trading instruments such as CFDs on stocks, commodities, indices as well as forex pairs. The broker offers you 5 account types through which you can trade:

- Standard Account: This account requires a minimum deposit of $350 if you wish to use it for trading, and has a spread of 4 pips.

- Silver Account: You need to deposit a minimum of $2,000 to use this account to execute trades, with a spread of 4 pips.

- Gold Account: A minimum initial deposit of $5,000 is required for you to use this account, and it offers a spread of 3 pips.

- Platinum Account: To use this account you need to make an initial deposit of $10,000, and you get a spread of 2 pips with which to trade.

- VIP Club Account: You need to make a first deposit of $20,000 to use this account, and you get a spread of 1 pip for your trades.

The leverage ratio offered on all account types is 1:400, which is very generous. However, the spreads, especially for the first 3 account types are too high, making them more favorable for brokers than for traders.

GlobalCapitalOptions – Advantages

Here are the few advantages we could find for GlobalCapitalOptions:

-

Range of Trading Instruments

GlobalCapitalOptions offers a wide range of trading instruments, from currency pairs, to commodities, stocks and indices. You can find the complete list of assets for trade on their website.

-

Generous Leverage

This broker offers its clients a leverage ratio of 1:400, which is a very generous amount. This kind of leverage allows for even the most risk-friendly traders to trade on the GlobalCapitalOptions platform.

GlobalCapitalOptions – Disadvantages

Two advantages are not enough to offset the long list of very serious issues this broker has. After going through GlobalCapitalOptions’ website, here are the major disadvantages we discovered:

-

Weak Regulation

GlobalCapitalOptions seems to be owned by two different companies – U-NEX LTD and Algobit Ltd. There is not information about where U-NEX LTD is based, but Algobit Ltd. is based out of the Seychelles.

Algobit is licensed to operate by the Financial Services Authority of Seychelles.

The problem is while the Seychelles does offer regulatory oversight, it is not known for its stringent regulations. It does not participate in a financial mechanism allows traders to be compensated if a broker is found guilty of fraud or goes bankrupt.

The FSA of Seychelles also does it ensure that there is a segregation between a broker’s account and the traders’ accounts. A stringent regulator ensures that clients’ funds are protected from losses by insisting that brokers and clients’ funds are separated.

And finally, this regulator only requires a broker to have a starting capital of $50,000, which means that if there are losses incurred, there is no way the broker will be able to compensate traders.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Blacklisted by the US CFTC

GlobalCapitalOptions’ name appears in the US CFTC’s recent list of blacklisted brokers. The warning reads that this broker is suspected of being a part of scamming operations.

-

Link to Old Scammer

Our investigations into GlobalCapitalOptions’ regulatory status also revealed that this broker was a part of an older scam that was linked to another broker called zurichprime.com.

This broker had been blacklisted by multiple regulators including the Financial Conduct Authority of the UK as well as the Financial Services Regulatory Authority of Ontario, Canada.

How we know that GlobalCapitalOptions is connected to zurichprime.com is because of the fact that the broker did not bother to edit its compliance section correctly.

Zurichprime was owned and operated U-NEX Solutions SRL, which was based out of Romania.

-

No Terms and Conditions

One of the most critical legal documents on a broker’s website is the Terms and Conditions. This is what establishes the terms of the relationship between the broker and the trader. We looked on GlobalCapitalOptions’ website, but the page itself was missing.

What this means is that if you register to trade with this broker, you will be agreeing to terms you have no idea about. This gives the broker carte blanche to impose whatever transaction fees it wants and also keep your money.

-

Offering Trading Bonuses

Trading bonuses have been banned in most strongly regulated jurisdictions because they are so controversial. Traders are lured into signing up for trading bonuses, and then they cannot withdraw their funds until they meet the ridiculously high trading volume conditions set by the broker.

This is a tactic used by most brokers that are out to scam unsuspecting traders. So, GlobalCapitalOptions having trading bonuses is a big red flag for us.

-

Minimum Deposit Requirement High

You are required to deposit a minimum of $350 before you are allowed to trade on this broker’s platform. This is much higher than the industry average, which ranges between $100 and $250.

-

MetaTrader 4 Not Supported

GlobalCapitalOptions offers its clients the Sirix trading platform, which has been developed by Leverate. However, we don’t really know for sure whether it works or not since we were unable to download the platform.

While the Sirix platform, if were actually working, is a good platform to have, it is not as good as the MT4 trading platform, the premier platform for traders across the world.\

Conclusion

After investigating GlobalCapitalOptions, we would strongly advise you stay away from this broker, since it has all the signs of being a scammer that is out to get your money.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.