Largus Brokers – Is It Safe or a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Largus Brokers - DO NOT TRADE WITH THIS PROVIDER

2.6/10

$100

Minimum Depositupdated 2020

Largus Brokers claims to be an international broker that offers trading in CFDs such as cryptos, indices and commodities, as well as Forex currencies pairs. The broker offers its customers 3 different account types with which to trade –

- Fixed: Which has a $100 minimum deposit, a leverage of 1:500, and a spread of 2 pips that is fixed.

- Classic: We don’t know the minimum deposit requirement for a Classic account, but its leverage is 1:200 and has a spread that starts from 0.1 pips and $9 per lot.

- Pro: This account also doesn’t have a leverage mentioned. But the leverage ratio is the same as the Classic at 1:200, and the spread is also the same.

While the details of leverage for the two higher-end accounts are not listed, we were able to find out that it extends as high as 1:500.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: https://largusbrokers.com/

Founded: 2019

Regulations: Unregulated

Languages: English, Italian, German, Portuguese, Spanish, Polish

Deposit Methods: MasterCard, Visa, Skrill, Bank Wire, Neteller, SEPA and Bitcoin

Minimum Deposit: $100

Free Demo Account: No

Number of Assets: Unknown

Types of Assets: Currency Pairs, CFDs – Cryptocurrencies, Indices, Commodities

Trading Accounts and Conditions

Largus Brokers claims to be an international broker that offers trading in CFDs such as cryptos, indices and commodities, as well as Forex currencies pairs. The broker offers its customers 3 different account types with which to trade –

- Fixed: Which has a $100 minimum deposit, a leverage of 1:500, and a spread of 2 pips that is fixed.

- Classic: We don’t know the minimum deposit requirement for a Classic account, but its leverage is 1:200 and has a spread that starts from 0.1 pips and $9 per lot.

- Pro: This account also doesn’t have a leverage mentioned. But the leverage ratio is the same as the Classic at 1:200, and the spread is also the same.

While the details of leverage for the two higher-end accounts are not listed, we were able to find out that it extends as high as 1:500.

Largus Brokers – Advantages

Largus Brokers has a few good points, which have listed out for you:

-

MT4 Trading Platform

Largus Brokers offers its clients support to trade on the MT4 (MetaTrader 4) trading platform. This is one of the best trading platforms in the world, with more than 100 market indicators, customizable and automated trading bots, and other features that make trading so much easier.

-

Generous Leverage

Besides the trading platform, another plus we found with this broker is the fact that it offers very generous leverage ratios. The maximum leverage you can get from Largus Brokers is 1:500, something that will make even the most demanding of traders.

-

Decent Spreads

The basic account on Largus Brokers offers a spread of 2 pips, fixed. This is a solid spread to offer since it benefits the trader.

-

Attractive Minimum Deposit Requirement

You can actually open an account and start trading on Largus Brokers’ platform for just a $100 initial deposit. This is actually better than the market average, since most Forex broker require you to make a minimum initial deposit of $250.

Largus Brokers – Disadvantages

The advantages mentioned above seem to indicate that this broker is a good one to do business with. However, upon closer inspection, there are some serious red flags which actually point to the fact that if you trade with Largus Brokers, you stand a very good chance of losing all the money you have invested. Here’s why:

-

Offshore Broker

Largus Brokers is owned and operated by a company called Largus Brokers Ltd. This company is registered in St. Vincent and the Grenadines (SVG). The problem we have with brokers that are registered offshore is that they are not properly regulated.

These jurisdictions have lax regulations that don’t really protect traders from unscrupulous brokers and scammers. For example, in SVG, all you need to do to open a brokerage is to follow a very simple registration process and you’re done.

Furthermore, SVG’s financial regulator the Financial Services Authority has clearly stated that it does not have regulatory oversight for providers of financial services (read: Forex brokers, among others).

So, the fact that Largus Brokers’ parent company is registered in SVG is a cause for concern.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Illegally Targeting European Investors

There are many brokers that are registered offshore, but also ensure that they have the required authorization to offer financial services in the countries they are targeting.

Largus Brokers offers financial services to customers in the European Union however, it is doing so illegally. This is because this broker does not have the required licenses to operate in these markets. In fact, Largus Brokers does not have the authorization to offer services in any heavily regulated market, be it the EU, the US, Canada, Australia, Japan, etc.

-

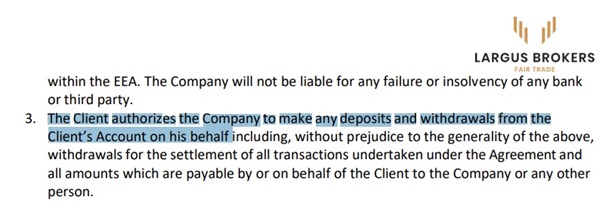

Unfair Provisions

When we went through Largus Brokers’ legal page, there were provisions there that caused concern. The major cause for concern was the broker’s condition for being able to open an account with them: customers have to give the broker the authority to make deposits as well as withdrawals on your behalf into your account.

What this basically means is that you need to give this broker the freedom to do whatever they want with your trading account.

And considering the fact that this broker is neither regulated not legally operating, it would be a dangerous step to give them such authorization.

-

No Clear Terms and Conditions on Withdrawals and Other Transactions

Largus Brokers also doesn’t give any clear information about its terms for withdrawal, deposits or other transactions. Because of this we don’t really know whether you will be charged unexpected fees for transactions you carry out on this brokers platform.

-

No Actual Demo Account

Another red mark against Largus Brokers is the fact that it doesn’t offer a free demo account to its customers.

A demo account is critical to traders, since it allows them to validate the trading conditions offered by a broker as well as to test the trading platform. Most shady brokers avoid offering a demo account, since it would mean revealing to prospective victims the trading conditions – which are usually extremely unfavorable to traders.

So, the fact that this broker does not offer a demo account immediately raises out suspicions about its trustworthiness.

Conclusion

Largus Brokers is not a financial services provider that you can trust with your money. There are too many indications that this broker is out to scam you. Our recommendation would be to avoid this broker completely.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.