Monfex Review: Warning – Scam Alert!

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Monfex - DO NOT TRADE WITH THIS PROVIDER

3.2/10

$100

Minimum Depositupdated 2020

Registered in St. Vincent and the Grenadines (SVG), Monfex is an offshore brokerage that provides web-based trading services and offers trading options for 12 different cryptocurrency tokens.

Traders have a leverage of 1:50, and the minimum deposit required is 0.01 BTC (Bitcoin), which amounts to about $130 at current BTC prices. The minimum deposit is actually quite favorable vis-à-vis the $250 industry average.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

- Website URL: https://www.monfex.com/

- Founded: 2018

- Regulations: No

- Languages: English, Portuguese, Spanish, German, Chinese, Polish

- Deposit Methods: Wire transfer, credit cards and cryptocurrencies

- Free Demo Account: Yes

- of Assets: 12 cryptocurrencies

- Types of Assets: CFDs in Cryptocurrencies

Overview

Registered in St. Vincent and the Grenadines (SVG), Monfex is an offshore brokerage that provides web-based trading services and offers trading options for 12 different cryptocurrency tokens.

Traders have a leverage of 1:50, and the minimum deposit required is 0.01 BTC (Bitcoin), which amounts to about $130 at current BTC prices. The minimum deposit is actually quite favorable vis-à-vis the $250 industry average.

Monfex: Advantages

Commissions

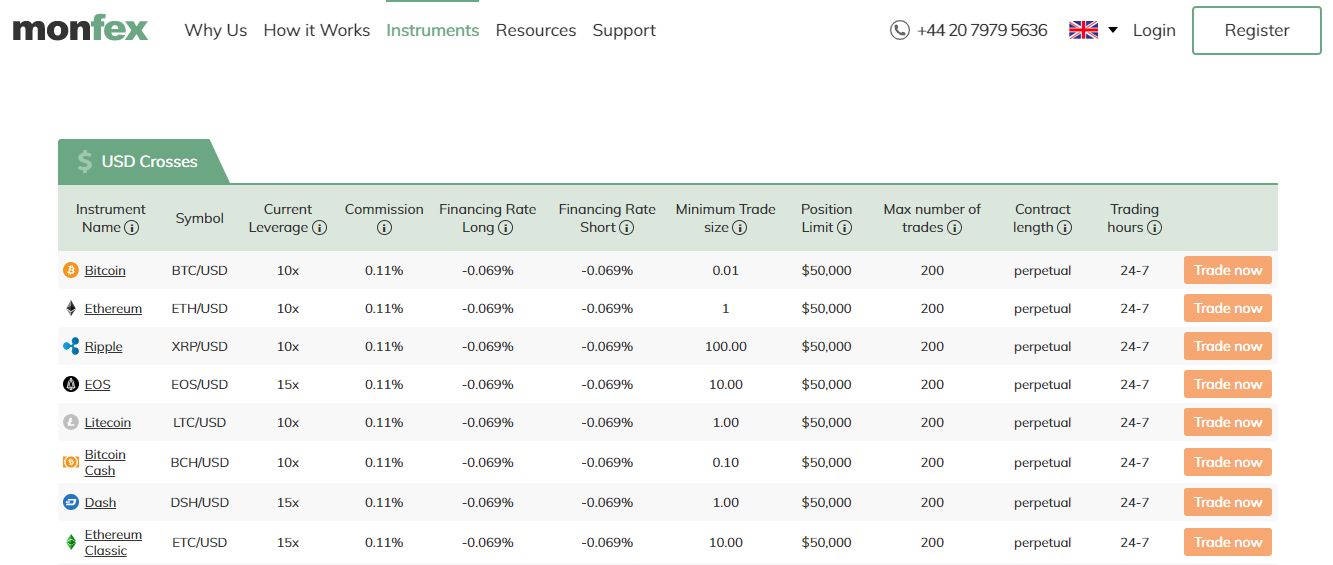

The trading fees are quite reasonable at 0.075%, and financing rates (SWAP) are at 0.069%, however, they may vary.

CFDs on Major Cryptocurrencies

The broker offers CFDs for a selection of the top cryptocurrency pairs – BTC/USD, EHT/USD, XRP/USD, BCH/USD, EOS/USD, LTC/USD, ETC/USD, DSH/USD, OMG/USD, ZEC/USD, XMR/USD and NEO/USD.

BTC/USD Spread

If you are to look at the live rates on the broker’s website, you can trade in Bitcoin with a spread of just 2.5 pips, which is quite advantageous for the trader. While it may not be as tight as some of the other brokerages.

Reasonable Leverage

A leverage of 1:50 in Bitcoin trading is also quite advantageous, since there are not many BTC margin brokers that offer that leverage. According to the latest ESMA (European Securities and Markets Authority) guidelines, the maximum leverage permitted with cryptocurrencies is only 1:2 (for Forex trading, the maximum leverage allowed is 1:30, and for other CFDs is 1:20).

Minimum Deposit Requirements Acceptable

The minimum deposit required to start trading on Monfex is 0.01 BTC. At current exchange rates, that comes to about $130, which is in line with the minimum deposit requirements that most other brokers offer.

Monfex: Disadvantages

Regulations and Licensing

Monfex is owned and operated by TENB Ltd., a company that is registered in SVG. The government of St. Vincent and the Grenadines has publicly stated that is does not supervise Forex trading. This means that the retail forex market (including cryptocurrencies) is not regulated here.

And considering that there is no information on the Monfex website with regard to licensing and regulation, it is safe to assume that the broker is unregulated and unlicensed.

This means that Monfex is not authorized to operate in regulated markets such as the EU, the US, Canada, Australia and Japan.

It is also to be noted that trading with a broker that is unregulated is extremely high-risk, since these firms cannot be held accountable for any losses you may suffer due to scams.

When a broker is regulated, it is subject to stringent laws that ensure that you as a trader are protected from scams and fraud. Added to that, many regulatory bodies also ensure that traders can get insurance against unforeseen losses (for example, losses caused by a brokerage going bankrupt).

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

Web-Based Trading Platform

Monfex offers its users a web-based trading platform, but not the MetaTrader trading platform, which is quite disappointing. A lack of the MetaTrader platform is considered a disadvantage since it is the preferred trading platform for more than 80% of traders the world over.

The MT platforms gives traders the benefit of advanced charting options, nearly 100 technical indicators, a range of EAs (Expert Advisors) as well as a user-friendly layout.

The website gives the impression that it is a cryptocurrency exchange – deposits are accepted in BTC, and the minimum deposit requirement is given in Bitcoins rather than USD. However, in reality, the brokerage actually only provides cryptocurrency trading via CFDs.

Rigged Demo Account

According to the home page of Monfex, you will receive 1BTC for trade on their demo accounts. However, when you start trading on the account, you will notice that your trades are successful 98% of the time, giving you some unrealistic profit margins. Even a novice with little or no trading knowledge will win while using Monfex’s demo account.

At this point, investors are then asked to deposit real funds to continue trading. However, once real money is being used, the success rates of trades drop dramatically, leading to traders losing their money.

A demo account is supposed to reflect real market conditions so that traders, especially novices, get to understand how trading will really work with that broker. By rigging the demo account, Monfex is setting unrealistically high expectations that are not met.

Funding Options

Unlike other brokers, Monfex’s funding options are rather limited. You have the choice of credit cards (Visa and MasterCard), wire transfer or cryptocurrencies (BTC, ETH and USDT) with which to deposit or withdraw money in and from your trading account.

Bonus Clause

According to the terms and conditions detailed on Monfex’s website, for you to become eligible to withdraw the bonus funds, you need to have traded in volumes of at least 100 BTC. That translates to over $1.29 million!

Such steep trading requirement conditions make it almost impossible for you to withdraw your bonus funds.

Offering bonuses to traders is an extremely controversial subject in the industry, as it is considered to be a tactic employed by unscrupulous brokers to relieve traders of their money.

Conclusion

Looks can be deceiving. This is an unregulated brokerage. It has some terms and conditions that are not advantageous to traders, a demo account that gives traders – especially new ones – unrealistic expectations of market performances and funding options are very limited.

At first glance, Monfex offers quite a few advantages for a cryptocurrency brokerage. It has a wide range of crypto-CFDs which traders can use to trade. The leverage is excellent for a crypto brokerage, as is the spread. The minimum deposit requirements are also in favor of traders, so overall, it looks to be an acceptable brokerage that you could trade from, so you need to be extra careful.

While it has not proved itself to be a scam, Monfex does raise enough red flags that it would be advisable for you to stay away from this broker and look for one where your investments would be safe.

Monfex

Pros

- High leverage

- Supports most altcoins

- You can trade anonymously

Cons

- Strange Withdrawal Conditions that are not fair to traders

- Not registered, licensed or regulated despite operating in the EU

- Limited time-limit for chargebacks

- Scammy bonus system that locks you in with no option to withdraw

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

1 comment

When I received 1 BTC in the demo account, I practised some trading. As soon as I started trading I was gaining good profits so I said why not move this to the real thing. When I started trading with real funds, the scenario seemed to be much different. The demo account was used to entice me to trade, and that was very suspicious.