MyCapital – Is It Safe?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Mycapital - DO NOT TRADE WITH THIS PROVIDER

2.6/10

$100

Minimum Depositupdated 2020

MyCapital is an offshore Forex online broker that claims to be an industry leader. You have a selection of 4 different account types from which to choose:

- Cent: Which has a $250 minimum initial deposit and a spread of 2.4 pips.

- Mini: This has a requirement that you deposit a minimum of $1,000 to begin trading, and it offers a spread of 1.4 pips.

- Standard: This account requires you to make an initial deposit of $10,000 and is has a spread of 0.4 pips.

- VIP: With the VIP account, you need to deposit a minimum of $100,000 to begin trading, and you get a spread of 0.4 pips.

The leverage ratio is not mentioned on the website, so that remains a grey area. Overall, the trading conditions look attractive, and that may tempt you to trade with this broker. However, please read the rest of our review to get the bigger picture.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

Website URL: https://mycapital.io/index.html

Founded: N/A

Regulations: Not Regulated

Languages: English

Deposit Methods: Bank Wire, Visa, MasterCard

Minimum Deposit: $250

Free Demo Account: Yes

Number of Assets: N/A

Types of Assets: Forex, Metals, Cryptos, CFDs, Shares,

Trading Accounts and Conditions

MyCapital is an offshore Forex online broker that claims to be an industry leader. You have a selection of 4 different account types from which to choose:

- Cent: Which has a $250 minimum initial deposit and a spread of 2.4 pips.

- Mini: This has a requirement that you deposit a minimum of $1,000 to begin trading, and it offers a spread of 1.4 pips.

- Standard: This account requires you to make an initial deposit of $10,000 and is has a spread of 0.4 pips.

- VIP: With the VIP account, you need to deposit a minimum of $100,000 to begin trading, and you get a spread of 0.4 pips.

The leverage ratio is not mentioned on the website, so that remains a grey area. Overall, the trading conditions look attractive, and that may tempt you to trade with this broker. However, please read the rest of our review to get the bigger picture.

MyCapital – Advantages

Since we wish to be fair in our review, we try our best to highlight both the positives as well as the negatives. So, here are the positives that MyCapital has to offer:

-

Support for MetaTrader 4

The biggest plus that MyCapital has is that it offers its clients the MetaTrader 4 trading platform, which is the world’s leading trading interface today. The MT4 platform is easy to use, and has added features that make trading much easier.

Traders using the MT4 platform benefit from the almost 100 market indicators, numerous charting options and customizable bots for automated trading, to name a few.

Added to this, MyCapital also provides its customers with another platform, called the Status web trader.

MyCapital – Disadvantages

Unfortunately, with the exception of the MT4 platform offered by the broker, we could not find anything else that was positive about MyCapital. Here are the many disadvantages we found with this broker:

-

Lack of Corporate Information

There is very little information about this broker’s parent company. All we know is the name of the company that owns it – White Rock Partners Ltd. Instead of a proper physical address, there is only a P.O. Box address given, one that is located in St. Vincent and the Grenadines.

There is no contact number either. And there is no information about the company’s license or registration number.

One thing we wish to point out is that the supposed parent company of the broker – White Rock – has become quite well known in the Forex trading industry for launching multiple scamming websites in the last few years.

So, the fact that MyCapital is associated with White Rock leads us to believe that this is another scamming scheme set up by the company.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

-

Not Regulated

The fact that MyCapital’s parent company seems to be based out of St. Vincent and the Grenadines indicates that this is an unregulated broker. SVG’s financial authority has repeatedly stated that it does not regulate Forex brokers.

The lack of corporate information and not being regulated are serious issues that cannot be ignored. It means that your funds are not safe with this broker.

-

Asks You to Install TeamViewer and AnyDesk

MyCapital is asking its clients to install two applications called AnyDesk and TeamViewer. These are tools that allow you to access your desktop remotely. The thing is, when you download these tools from MyCapital’s website, they will be given access to your PC, which means that they will have access to all the information on your device, including your bank account and credit or debit card details, your passwords, your address and so on.

Considering the fact that this broker is untrustworthy, it would not be a good idea to trust your information with them.

-

High Spreads

MyCapital’s spreads are on the higher side. The higher the spread, the less lucrative it becomes for traders. On this broker’s website, the EURUSD pair has a spread of 2.4 pips, which is around two times the industry average for that set.

While the spread isn’t the most important part of a trade, it does make a difference in your returns. And when you’re dealing with a broker that seems suspicious, such as MyCapital, then every little bit adds up.

-

Issues with Withdrawal Policy

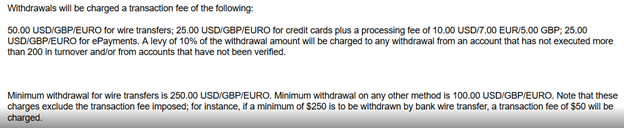

We have serious concerns about MyCapital’s withdrawal policy too. Withdrawal charges are quite high. You need to pay $50 if you’re withdrawing your funds via a bank wire. And if you want to use your credit card, you need to pay a withdrawal fee of $35. E-wallets will cost you another $25.

Furthermore, if you don’t manage to achieve at turnover of at least 200, then you will be charged a 10% turnover fee – a penalty, actually. This not a practice that is common among reputed Forex brokers.

In fact, it just highlights the unscrupulous nature of this broker.

-

Links to Shady Broker

When you read the withdrawal conditions carefully, it states that the fees charged may change depending on the bank of Dax100fx. This actually the name of another broker – one that is known for its shady dealings.

This makes us conclude that both MyCapital and Dax100fx are actually run by the same company, and that it is out to scam as many traders as possible.

Conclusion

We did a thorough investigation of MyCapital and unfortunately, what we discovered convinced us that this is a broker that is a scammer that is out to get unsuspecting traders’ money.

We would recommend that you not trade with this broker at all, or you stand to lose your investments.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

3 comments

How can I refund my money from Mycapital.io

SCAMMERS NEVER RETURNED ME MY MONEY. Andy Parker is a scammer.

NEVER DEPOSIT WITH THEM !!!!!

Bad hell animals, Bernard Jones and Andy Parker and others