RoyalFXPRO – Is it a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Trade - DO NOT TRADE WITH THIS PROVIDER

3.6/10

$100

Minimum Depositupdated 2020

RoyalFXPRO claims that it has more than 20 years’ experience in financial markets across the globe, and offers CFDs (Contract for Difference) in cryptocurrencies, stocks, commodities, indices and currency pairs.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: www.royalfxpro.eu

Founded: N/A

Regulations: Unregulated

Languages: English

Deposit Methods: Bank Wire, Debit/Credit Cards, EcoPayz, Skrill, Neteller

Minimum Deposit: $250 for Basic Account

Free Demo Account: Yes

Number of Assets: 300+

Types of Assets: FOREX, stocks, indices, commodities, cryptocurrencies.

Trading Accounts and Conditions

RoyalFXPRO claims that it has more than 20 years’ experience in financial markets across the globe, and offers CFDs (Contract for Difference) in cryptocurrencies, stocks, commodities, indices and currency pairs.

You also get to choose from 6 different account types with this broker. They are:

- Basic Account – This account has a minimum deposit requirement of $250, a maximum leverage of 1:400 and a spread of 3.1 pips for the EURUSD currency pair.

- Bronze Account – With a minimum deposit requirement of $1000, this account also offers a leverage level of 1:400, but there is no information on the spread.

- Silver Account – A minimum deposit of $5000, and leverage of 1:400, but no information on the spread.

- Gold Account – Requires a minimum deposit of $10000. It has a maximum leverage of 1:400 and there is no information about the spread.

- Platinum Account – You need a minimum deposit of $50,000 to start an account of this type. The leverage remains at a maximum of 1:400 and there is no information about the spread.

- Black Account – To operate a Black Account you need to deposit a minimum of $100,000. You get a maximum leverage of 1:400 but there is no data on the spread.

RoyalFXPRO – Advantages

Here is a list of the pluses that we found at RoyalFXPRO:

-

Range of Assets

This broker offers a really wide range of trading instruments. There are 46 different currency pairs available for trade, including some exotic as well as minor pairs.

You also have CFDs on trading instruments such as oil and natural gas, precious metals, commodities, indices, stocks and cryptocurrencies such as Bitcoin, Ethereum, Ripple, Litecoin and Dash.

-

Account Types

The broker offers you a range of 6 different account types, starting with the basic trading account, and going up to the top-rung Black account. However, the problem is that there isn’t much information about each of the account types besides the minimum deposit requirement and the maximum leverage levels.

You don’t know the spread for each of the account types, which means that you won’t be able to calculate your returns until you actually start trading on RoyalFXPRO’s platform.

-

Minimum Deposit Requirements

The broker has kept an acceptable level of minimum deposit requirements which is line with the market average. This is unusual for an unregulated brokerage, since most of them have higher-than-average minimum deposit requirements.

-

Availability of a Demo Account

The only reason this is being mentioned as an advantage is because most unregulated brokers do not offer demo accounts. You can at least get to see the kind of trading that is taking place on RoyalFXPRO’s platform, and get an idea about the spread.

RoyalFXPRO – Disadvantages

Here is the long and serious list of disadvantages that RoyalFXPRO has:

-

Lack of Regulation

RoyalFXPRO is owned and operated by TomCom Limited, which is an offshore company that is located in St.Vincent and the Grenadines. The government of SVG has repeatedly and publicly stated that it does not regulate FOREX trading, which indicates that this brokerage is unregulated.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

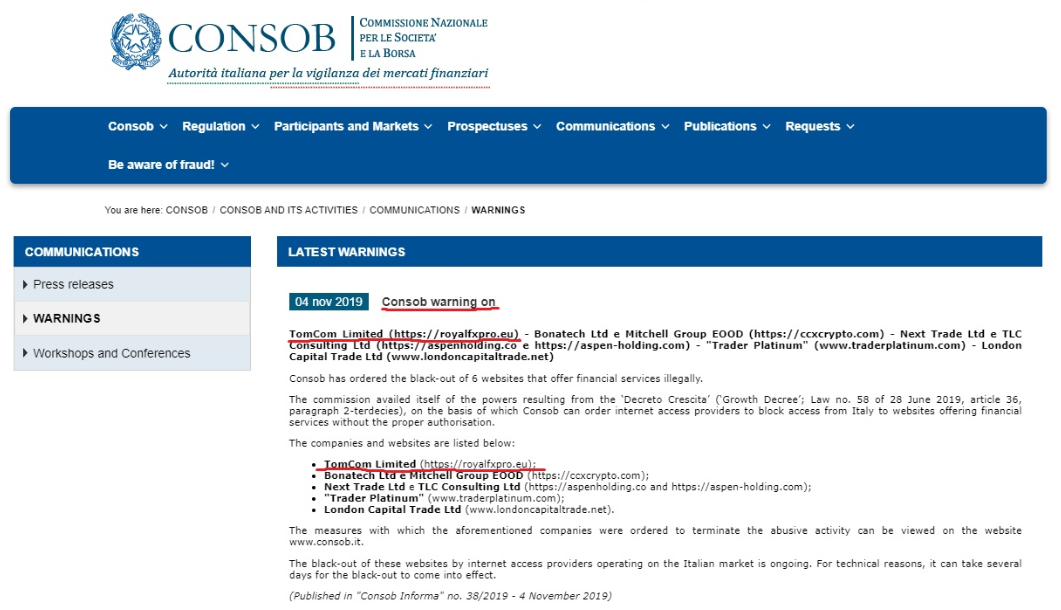

CONSOB Warning

CONSOB is the Italian financial regulator, and it has issued a public interest warning against this broker.

This warning alerts consumers to the fact that RoyalFXPRO and its parent company TomCom Limited have been targeting customers in Italy as well as other EU countries without authorization, and that this brokerage is in all probability a scam.

This kind of a warning is a strong red flag, so you should steer completely clear of this broker.

-

Trading Software and Spread

RoyalFXPRO does not have the MT4 trading platform.

Not having an MT4 trading platform is considered a disadvantage since it is the most popular trading platform that is used by most traders. It is easy to use, has more than 100 market indicators, as well as customizable automated trading bots.

What clients get instead on RoyalFXPRO is a web-based trading platform. It does not offer automated trading sessions, or even basic market indicators. Basically, traders do not get any analytics tools on this platform.

The platform also has a very high spread – an average of 3 pips (and 3.1 pips for EURUSD pair).

-

Trading Bonuses and Unusual Withdrawal Conditions

RoyalFXPRO offers trading bonuses which are forbidden in most regulated markets. This is because most of these offers come with very unreasonable terms that are designed to keep your money.

RoyalFXPRO states that if you have not met the required turnover target, then your request to withdraw your funds will automatically be cancelled.

This is a red flag because no legitimate broker will prevent you from withdrawing your own money.

There is also a $30 dormancy fee that the broker charges if you have been inactive for 12 months or more.

-

Skrill Payments Not Accepted

RoyalFXPRO does not accept payments from Skrill, which is an indicator that this site is not legitimate. One year ago, Skrill adopted a new policy with regard to scam sites. The payments company stated that it would only do business with brokers that are regulated.

To Sum Up Our Impression of RoyalFXPRO

Here is a quick summary of our investigation into RoyalFXPRO:

Conclusion

All the indications are that RoyalFXPRO is a scam. The broker is unregulated, are already on the scammer’s list of the Italian CONSOB, have very unfavorable terms and conditions for traders, and do not offer a user-friendly trading platform.

We would strongly advise you to stay far away from this brokerage.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.