Solo Capitals Review: Scam Alert!

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Solo Capitals - DO NOT TRADE WITH THIS PROVIDER

1.6/10

$100

Minimum Depositupdated 2020

Solo Capitals is registered in Estonia and has been in operation since 1994. All trading is offered with a leverage of up to 1:100, however, the spreads are rather high, being fixed at 3 pips, which is much higher than the industry standard. Added to that, Solo Capitals offers a web-based trading platform that offers its users a wide range of trading account types from which to choose.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

- Website URL: https://www.solocapitals.net/#/

- Founded: 1994

- Regulations: No

- Languages: English

- Deposit Methods: Visa, MasterCard, American Express, PayPal

- Free Demo Account: N/A

- of Assets: N/A

- Types of Assets: Forex, CFDs on precious metals, oil, natural gas and commodities, indices, cryptocurrencies

Overview

Solo Capitals is registered in Estonia and has been in operation since 1994. All trading is offered with a leverage of up to 1:100, however, the spreads are rather high, being fixed at 3 pips, which is much higher than the industry standard. Added to that, Solo Capitals offers a web-based trading platform that offers its users a wide range of trading account types from which to choose.

Solo Capitals: Advantages

Tradeable Assets and Cryptocurrencies

The one advantage that Solo Capitals has is that is offers a wide range of tradeable assets and a large number of cryptocurrency tokens on which to trade. The broker offers more than 50 Forex pairs, including a number of exotic as well as minor currencies such as USD/SGD, USD/RUB, USD/ZAR, USD/INR etc. It also offers CFDs on precious metals like silver, gold, palladium and platinum, as well other commodities such as oil, natural gas, sugar, copper, wheat, and so on.

The company also offers trading in 23 indices as well as cryptocurrencies, such as Bitcoin, Ether, Litecoin, Ripple, Dash, Bitcoin Cash, Ethereum Classic, Verge, Monero, Bitcoin Gold, Siacoin, Stellar, Qtum, NEM and Lisk.

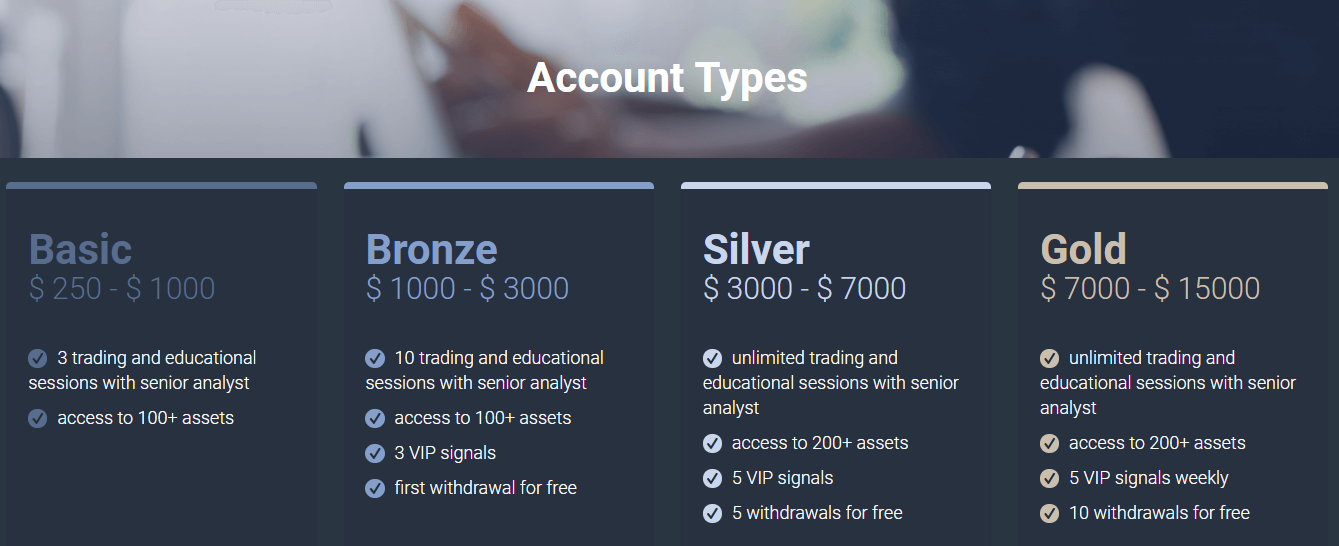

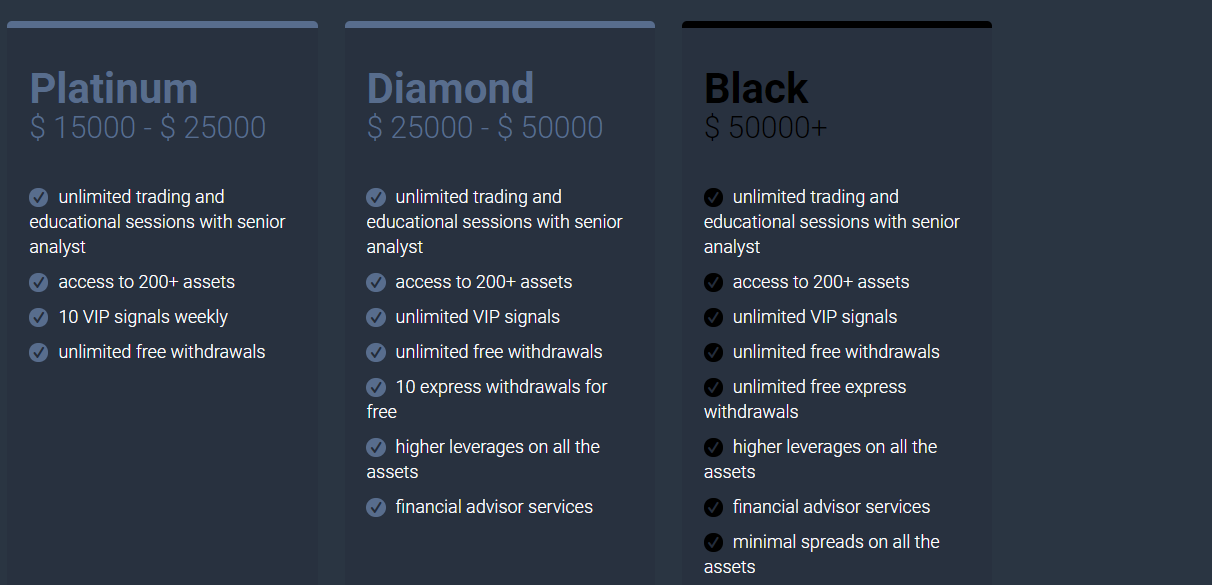

Account Types

Solo Capitals offers its users a large range of account types to choose from, besides professional recovery services as well as savings accounts. Here is the list of accounts the brokerage offers:

Solo Capitals: Disadvantages

Regulatory Issues

Solo Capitals is a broker that is owned and operated by TB Corp OU, an Estonian company.

However, the first thing that you need to be aware of about Solo Capitals is that the UK’s FCA (Financial Conduct Authority) has issued a warning against the brokerage because it has been particularly targeting traders in the country. The FCA recently warned the public that the broker is not authorized to operate in the UK and has been therefore blacklisted as a possible scammer.

Regulators put strict rules in place so that traders are protected against unscrupulous brokers who are out to defraud them.

Despite being based in Estonia, Solo Capitals has no legitimate license to operate by local government regulators. In fact, the company is not licensed to conduct any Forex transactions whatsoever.

It would be best to stay away from this broker, because if you have any legitimate grievances, you would not have any government authority to turn to. Your investments would not be safe with Solo Capitals.

Terms and Conditions

Besides the huge red flag of this company having been blacklisted by the FCA, there are also some worrying issues about the terms and conditions listed.

One condition is that if you sign up with Solo Capitals, you give the broker the right to make deposits and withdrawals on your behalf – from your bank account. This is not the norm. Brokers should not have access to your funds.

Another condition states that Solo Capitals has the right to charge fees on their sole discretion. This includes a fixed commission of a fixed amount of $30 for every request for withdrawal that is made.

Added to that, the company states that it reserves the right to cancel withdrawal requests, especially if you have not met the minimum trade volume requirement, which is linked to the welcome bonus you are awarded when you sign up with them.

The biggest red flag is the bonus itself. No reputed broker will offer bonuses as it is a highly controversial trading practice. This is a tactic that is usually used by scammers to take your money.

Solo Capitals gives you a $200 bonus, but demands in return that you need to trade for at least $1,000,000 before you can submit a withdrawal request. This is such a huge sum, that most traders cannot meet that requirement, which means that you will lose your money.

No Support for MetaTrader and Very High Spreads

Solo Capitals offers its users a basic web-based interface for trading, such as those provided by other suspicious CFD providers. A reputable brokerage will offer its customers the MetaTrader 4 (MT 4) or MetaTrader 5 (MT 5) platform, the industry’s leading trading interfaces. In fact, more than 80% of all traders use the MetaTrader platforms to carry out their transactions.

For example, the MT 4 platform offers traders great functionality as it is fast, light, reliable and very easy to use. It also offers excellent charting options, and is known to give superb support from Expert Advisors (automated trading robots).

Not only does Solo Capitals not offer any such support in its trading platform, but its pricing is also significantly higher than the industry standard. If, for example, you see the most-liquid Forex pair, the EUR/USD, has a fixed spread of 3 pips.

The industry average for spreads is 1.0 to 1.5 pips for the EUR/USD pair. So, at 3 pips, Solo Capitals’ spread is detrimental for the trader.

Conclusion

Solo Capitals is a brokerage that is best avoided.

The website is attractive, the range of products on offer are varied and you get to choose for a large number of account types, each of which seem to give you some really good deals.

However, these are the only advantages that the broker offers. The massive red flag of it being blacklisted by the FCA should be enough to keep you away from Solo Capitals. And if that is not enough, remember, the company’s terms and conditions are designed to benefit it, and not you. The entire operation seems to be one huge scam that is designed to take your money.

So, it would be best to stay away from Solo Capitals and choose a brokerage that is licensed and regulated so that your interests are protected at all times.

Solo Capitals

Pros

- Wide Range of Trading Instruments

- Supports MT5

- Minimum Deposit Requirements on Par with Industry Average

- Account can be opened in any one of 4 different currencies

Cons

- Not registered, licensed or regulated despite operating in the EU

- Strange Withdrawal Conditions that are not fair to traders

- No Demo Account

- Skrill not available as a payment option

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.