Trendex – Is it a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Trendex - DO NOT TRADE WITH THIS PROVIDER

3.3/10

$100

Minimum Depositupdated 2020

Trendex is a Forex and CFD broker that is based out of Hong Kong. The broker offers its clients a choice of 4 different account types:

- Bronze: With a minimum deposit of €500, a leverage of 1:200 and a spread of 1.8 pips

- Silver: With a minimum deposit of €5,000, a leverage of 1:300 and a spread of 1.5 pips

- Gold: With a minimum deposit of €25,000, a leverage of 1:400 and a spread of 1 pip

- Black: The minimum deposit is not specified, but the account has a leverage of 1:500 and a spread of 0.5 pips.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: http://trendex.co/

Founded: 2019

Regulations: Unregulated

Languages: English, Spanish, Russian

Deposit Methods: Visa, MasterCard, Bank Wire

Minimum Deposit: €500

Free Demo Account: No

Number of Assets: N/A

Types of Assets: Forex, CFDs

Trading Accounts and Conditions

Trendex is a Forex and CFD broker that is based out of Hong Kong. The broker offers its clients a choice of 4 different account types:

- Bronze: With a minimum deposit of €500, a leverage of 1:200 and a spread of 1.8 pips

- Silver: With a minimum deposit of €5,000, a leverage of 1:300 and a spread of 1.5 pips

- Gold: With a minimum deposit of €25,000, a leverage of 1:400 and a spread of 1 pip

- Black: The minimum deposit is not specified, but the account has a leverage of 1:500 and a spread of 0.5 pips.

Trendex – Advantages

Here is a list of the advantages we have seen with Trendex:

-

Activ8 Trading Platform Offered

Activ8 is a popular trading platform that is solid and reliable. It was developed by Leverate, the creator of the Sirix trading platform.

Even though it is a web-based trading platform, Active8 is user-friendly, has good charting options and comes loaded with analytics tools. The platform also has a Strategies segment, where traders can choose from a range of trading bots, and also incorporate external market analyses.

-

Generous Leverage Levels

Another plus is the levels of leverage offered by the broker in each account type. The Black account offers clients a maximum leverage of 1:500, which is quite favorable and appealing to all types of investors.

However, we also need to point out that high leverages come with correspondingly high risk.

Trendex – Disadvantages

Here are the disadvantages we have seen with Trendex:

-

Not Regulated

Trendex claims to be owned and operated by a company called TRND HLDS Limited. This is a company that is registered in Hong Kong, however, on the broker’s website, there is no information given about its registration or license.

When we checked the online registry of the Hong Kong Securities and Futures Commission (SFC), the financial regulator of the territory, we did not find TRND HLDS Limited listed anywhere.

Based on this investigation, we can safely say that Trendex is an unregulated broker. And this means that it would be best if you did not trade with it.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

No Demo Account

Another negative we found with Trendex is that it has no demo account. This means that a trader cannot check the trading conditions or experience the trading platform until he or she actually opens a live account and starts trading with real money.

Not having a demo account is typical of iffy brokers, so it’s another warning to stay away.

-

Problems Registering Account

Since the broker has no demo account, we tried opening a live account with Trendex. However, when we signed up, we were unable to access the trading platform or even view a client dashboard.

This is yet another red flag since if you cannot access the trading platform, there is no way to confirm that the Trendex actually offers the Activ8 platform. We also cannot confirm that the spread and leverages promised on the broker’s website actually exist.

-

Not-so-Great Spreads

The basic (Bronze) account offered by Trendex has a spread of 1.8 pips on the benchmark EURUSD currency pair, which is on the higher side by industry standards. It is also not favorable for traders.

-

AnyDesk Installation

The website also asks its clients to install as well as use the AnyDesk app. This software is a remote desktop tool that gives remote access to your personal computer.

So, if an unregulated broker asks you to install this app, it is a dangerous sign – all your personal information such as credit card details, bank account details and so on could be theirs for the taking.

-

High Minimum Deposit Requirement

The minimum deposit requirement demanded by Trendex is quite high at €500. Reputed and regulated brokers usually require you to put in about $250 as an initial deposit so that you can start trading.

-

No Support for Skrill

Skrill is one of the most popular online payments providers today, and the fact that Trendex does not have support for this payment method is a red flag.

The company recently instituted a new policy targeting scammers, and it will not partner with brokers that are unregulated, so that should give you a warning sign that Trendex is not to be trusted.

-

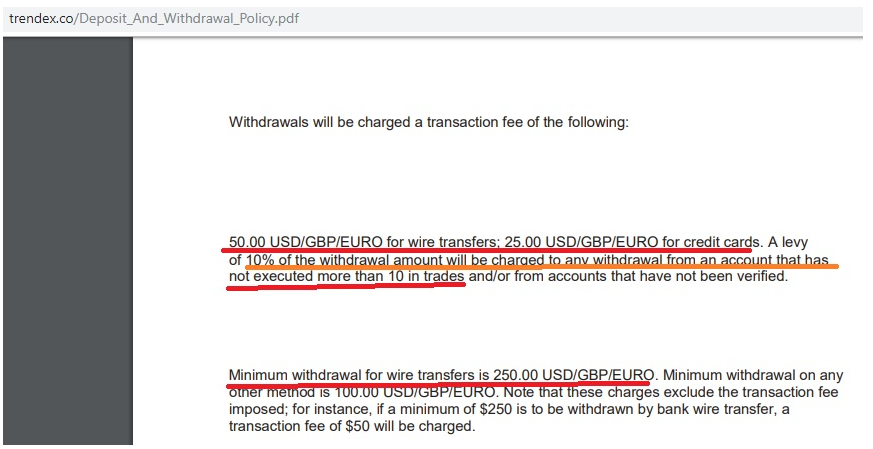

Unfriendly Withdrawal Conditions

If you wish to withdraw your funds from Trendex, you are in for a shock. The broker will not allow you to withdraw less than $100 at a time if you are withdrawing to your debit or credit card. And if you are withdrawing to your bank account, then you cannot withdraw less than $250.

Added to that, if you haven’t executed at least 10 trades on the Trendex platform, then you will be charged extra withdrawal fees.

This is not a friendly not a common practice and it sends out another warning signal that this broker is not to be trusted.

Conclusion

After having gone through the Trendex website and having tried to create a trading account, we have come to the conclusion that this is a broker that cannot be trusted. There are too many anomalies that lead us to believe that this broker is a potential scammer.

Trendex is not regulated – even by the Hong Kong SFC, has no demo account, offers poor spreads, has a high minimum deposit requirement, has unfriendly terms and conditions, and is asking you to install and use the AnyDesk software.

These points all clearly show that you stand a very strong chance of losing your money if you invest with Trendex.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.