VirtualStocks – Is It Safe or a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

VirtualStocks - DO NOT TRADE WITH THIS PROVIDER

2.6/10

$100

Minimum Depositupdated 2020

VirtualStocks claims to be an award-winning online trading global leader that offers more than 200 different trading instruments in currencies, futures, spot metals and indices, shares and commodities.

The broker offers its clients 6 different types of accounts with which to execute trades:

- Micro Account: This account requires you to make a deposit of $250 to start trading on it, and you get a maximum leverage of 1:100, and a spread of 3 pips.

- Standard Account: You can trade on this account after making an initial deposit of $5,000, for which you get a leverage of 1:200.

- Platinum Account: A Platinum Account requires you to make a deposit of $25,000 before you can start trading on it, and it gives you a leverage of 1:350.

- Premium Account: With this account, you need to make a deposit of $50,000 to start trading. You get a leverage ratio of 1:500.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: https://www.virtualstocks.co/

Founded: N/A

Regulations: Unregulated

Languages: English, Italian, Spanish, German

Deposit Methods: Bank Wire, MasterCard, Visa

Minimum Deposit: $250

Free Demo Account: No

Number of Assets: 200+

Types of Assets: Currencies, World Shares, Commodities, Indices

Trading Accounts and Conditions

VirtualStocks claims to be an award-winning online trading global leader that offers more than 200 different trading instruments in currencies, futures, spot metals and indices, shares and commodities.

The broker offers its clients 6 different types of accounts with which to execute trades:

- Micro Account: This account requires you to make a deposit of $250 to start trading on it, and you get a maximum leverage of 1:100, and a spread of 3 pips.

- Standard Account: You can trade on this account after making an initial deposit of $5,000, for which you get a leverage of 1:200.

- Platinum Account: A Platinum Account requires you to make a deposit of $25,000 before you can start trading on it, and it gives you a leverage of 1:350.

- Premium Account: With this account, you need to make a deposit of $50,000 to start trading. You get a leverage ratio of 1:500.

- VIP Account: With the VIP Account, you get a leverage of 1:750 once you make an initial deposit of $250,000.

- Business Account: In this account, you need to make a deposit of $500,000. You are given a massive leverage of 1:1000 when you trade on this account.

The number of account types and leverage amounts make this broker look very attractive, however, before you start investing with them, we suggest you read the rest of our review about VirtualStocks.

VirtualStocks – Advantages

Here are some of the advantages we found in our research into VirtualStocks:

-

MetaTrader 4 Platform Offered

VirtualStocks offers its clients use of the MetaTrader 4 platform. This is one of the world’s best trading interfaces, with nearly a hundred market indicators, customizable and automated trading bots, various charting options and other features that help traders make more accurate investments.

However, what causes us concern is that this platform is offered by a third party called Muller Enterprises Ltd.

-

Minimum Deposit Requirement

The minimum deposit requirement is on par with the industry standards. VirtualStocks requires a trader to make an initial deposit of $250, and the industry range is from $100 to $250. So, this is another plus for the broker.

-

Range of Trading Accounts

VirtualStocks offers you 6 different trading accounts, which is higher than the norm, so we will mark this as a plus.

-

Range of Assets for Trading

This broker claims to offer more than 200 trading instruments to its customers. Which means that traders have a range of assets to choose from and to trade with, which is always a plus.

VirtualStocks – Disadvantages

Sadly, the seriousness of the disadvantages outweighs the advantages that VirtualStocks has, because of which we would flag it off as an untrustworthy broker. Here is what we have found out about this broker:

-

Anonymous

There is no company name, address, or even a contact telephone number given in VirtualStocks’ website. The one bit of information we have is that the website is branded with the logo of a company called Muller Enterprise Ltd., however, we don’t know if this is the company that owns and operates the brokerage, or if is just the third-party company that provides the MT4 platform.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

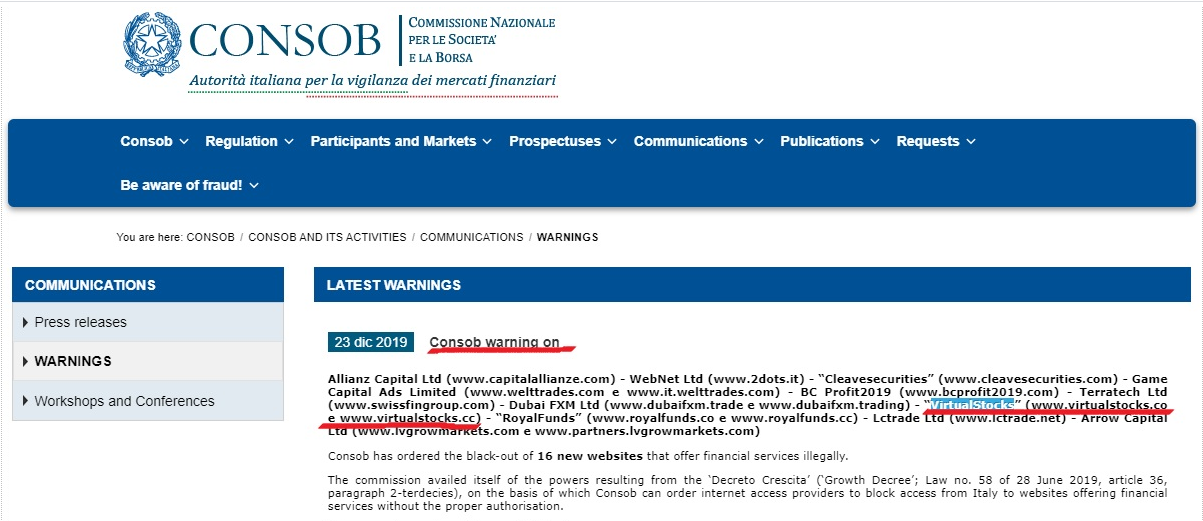

Lack of Regulation – Blacklisted by CONSOB

Because of the anonymous nature of the website, we also do not have any information about its regulation status. Based on the fact that this broker offers trading services in major European languages (English, Spanish, Italian and German), we checked with the financial regulators in each of these countries to see if there was a broker by the name of VirtualStocks that had been given a license to offer financial services to traders in those countries.

We found no such evidence. However, we did unearth some even more troubling information.

This broker has been blacklisted by the Italian watchdog, the CONSOB. The regulator issued a warning against VirtualStocks for offering trading services illegally in Italy and has stated that it will be blocking this broker’s services in their country.

-

No Terms and Conditions Given

When you register with a broker, there is usually a box you need to check, agreeing to their terms and conditions. There is a link that is provided where you can go through the terms and conditions before you accept them.

What surprised us was that there was no such link to VirtualStocks’ terms and conditions. You have to go through the entire website to be able to find the broker’s terms and conditions.

-

Connection to Scammer Broker

Another thing that sticks out in the terms and conditions is the mention of Gett Options in conjunction with VirtualStocks. Gett Options is another Forex broker that was proved to be a scammer.

From the look of things, these terms and conditions have been copied and pasted from Gett Options’ page, which means that there is a link between the two brokers. Are they being run by the same scammers?

-

High Spreads

The basic account spread is given at 3 pips for the EURUSD currency pair. This is a rather high spread that is favorable to brokers, but not to traders. So, a high spread is something that we would consider another negative.

-

Trading Bonuses

This broker also offers its client trading bonuses. Trading bonuses have been banned by most regulated jurisdictions because the enforce ridiculous high trading volume targets as a condition for withdrawal of funds.

The fact that VirtualStocks offers trading bonuses shows that it is not a trustworthy broker.

Conclusion

After going through all the details of VirtualStocks’ website, we would strong recommend that all traders avoid this broker since it has all the hallmarks of a scammer.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.