XPTrade – Is it a Safe Broker or a Scam?

Stop! It’s a Scam! Your money is not safe if you are trading with this unregulated, off-shore broker.

Trade - DO NOT TRADE WITH THIS PROVIDER

2.3/10

$100

Minimum Depositupdated 2020

XPTrade is an offshore broker that is based out of the islands of St. Vincent and the Grenadines (SVG). This broker offers its users 4 different types of accounts with which to trade:

- Starter Services: The minimum deposit to begin trading on this account is $500.

- Basic Services: You need to deposit $10,000 before you can begin trading on this account.

- Advanced Services: This account can only be started once you make a minimum deposit of $25,000.

- Premier Services: To open a Premier Services account, you need to first make a minimum deposit of $100,000

The layout of how the account types are presented on XPTrades’ website is very attractive, but it has absolutely no information about the broker’s trading conditions. We don’t know what the leverage ratios are or even what the spreads look like.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

Website URL: https://www.xp-trade.com/

Founded: 2019

Regulations: Unregulated

Languages: English

Deposit Methods: Bank Wire, MasterCard, Visa

Minimum Deposit: $500

Free Demo Account: No

Number of Assets: 1000+

Types of Assets: Forex, Cryptocurrencies, CFDs

Trading Accounts and Conditions

XPTrade is an offshore broker that is based out of the islands of St. Vincent and the Grenadines (SVG). This broker offers its users 4 different types of accounts with which to trade:

- Starter Services: The minimum deposit to begin trading on this account is $500.

- Basic Services: You need to deposit $10,000 before you can begin trading on this account.

- Advanced Services: This account can only be started once you make a minimum deposit of $25,000.

- Premier Services: To open a Premier Services account, you need to first make a minimum deposit of $100,000.

The layout of how the account types are presented on XPTrades’ website is very attractive, but it has absolutely no information about the broker’s trading conditions. We don’t know what the leverage ratios are or even what the spreads look like.

Having said that, when we accessed the broker’s trading platform, we found that the benchmark currency pair, the EURUSD, has a spread of 0.6 pips, which is quite favorable to the trader.

XPTrade – Advantages

Since we believe in being fair about all the brokers we review, we try our best to present both the pros as well as the cons about each one. Here are the advantages we were able to find about XPTrade:

-

Favorable Spread

Despite the fact that there is no information about the broker’s spreads on its website, when we logged into a live account that we opened with XPTrade, we found that the spread for the EURUSD Forex pair was at 0.6 pips.

Such a low spread is favorable for the trader as it indicates low volatility and therefore low risk for traders.

-

Number of Trading Instruments

XPTrades claims to offer its users over 1000 trading instruments on its trading platform. We found this information on the broker’s account types description on its website.

However, there was no way to verify whether this claim was true or not.

XPTrade – Disadvantages

XPTrades has a long list of disadvantages, most of which point to that fact that this broker is not to be trusted with any trader’s money. Here’s why:

-

Corporate Anonymity

Despite searching through XPTrade’s website, we were unable to find any information about the company that operates the broker. There is no company name given or even a contact address. There is a phone number given, which simply points to Europe, and the code seems to indicate that the number is from the Czech Republic.

The terms and conditions give conflicting information, stating that the unknown company is registered in St. Vincent and the Grenadines. When a broker is offering financial services anonymously, it’s a clear sign that it is not trustworthy and that you should avoid trading with it.

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

-

Not Regulated

The only clue we have to go by that XPTrade is not a regulated broker is the fact that it is supposedly registered in SVG.

The government of SVG has clearly stated that it does not regulate Forex trading, so if this company/broker is registered there, then we know that it not regulated.

-

Fake Reviews

XPTrade has been found to be posting fake reviews about its services on various websites. These reviews proved to be fake when it was discovered that the reviews were posted from the same IP address that had been used by a XPTrade representative when registering on various forums.

Added to that, it was found that the reviews stated that the customers had been trading on XPTrades’ platform for more than a year. However, according to the broker’s website, it was only launched in early 2019, making it impossible for any trader to have traded on its platform for more than a year.

-

Trading Platform

Another negative about XPTrade is its trading platform. It is a simplistic, web-based interface, with few charting options and little security. We were able to access the platform without having to register on the broker’s site.

A reputed trader offers its clients a reliable platform that offers added features to make trading easier. The most popular trading platform today is the MT4, which no just offers more than 100 market indicators, but also automated trading bots, charting options, options to customize, etc.

-

No Demo Account

XPTrade does not have a demo account to offer its clients, which means that they have no choice but to open a live account to figure out the trading conditions.

This is a tactic that is commonly employed by scam brokers who are out to get unsuspecting traders’ money.

-

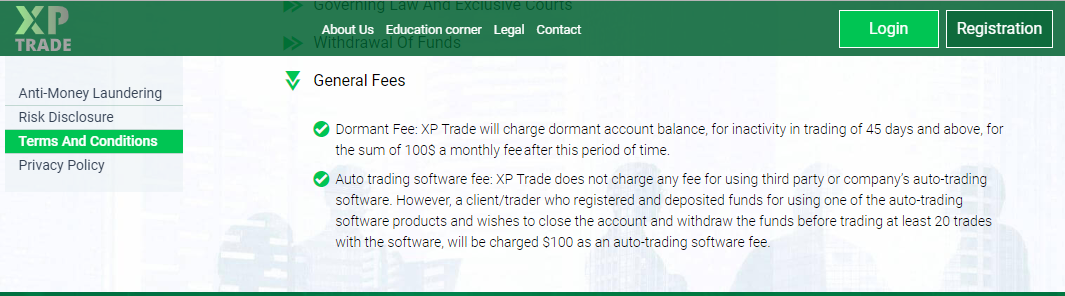

Dormancy Fees

While most of the terms were run-of-the-mill, there was one proviso that caused us concern. XPTrades charges a massive $100 per month in case a trader’s account goes dormant for more than one and a half months.

This condition is outrageous as even the most stringent of brokers in the regulated market give a time limit of 1 year before charging any dormancy fees, which is nominal.

-

Founding Date Fake

In its About Us page, the broker has stated that it has been in operation since 2012. However, when you checked the registration date of its website, it showed 2019.

Conclusion

There are just too many red flags that indicate that this broker is a scammer. XPTrades has no information about its company, its trading conditions, and it has lied about its founding date. Added to that, the broker has tried to post fake reviews to promote itself.

These are actions that are clear warnings to all traders to stay away from this broker.

Do not trade with unregulated brokers that will steal your funds - try these regulated brokers:

82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Plus500 is a FTSE 250 listed brokerage providing online trading services in CFDs, across 2,000+ securities and multiple asset classes.

The company was created as a combined effort of financial professionals and experts in web-commerce with the goal of perfecting the online experience for retail traders.

eToro is a multi-asset platform which offers CFD and non CFD products. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.