Market Update 10.30.18 – Alrosa Joins Blockchain Pilot Program

Market News

Alrosa Joins Blockchain Pilot Program

The two largest diamond producing groups on the planet are now jointly testing a blockchain platform to track assets. Alrosa, which is the second-largest diamond producer after manufacturing giant De Beers, announced Monday it was joining the Tracr pilot program. The latter is a program De Beers is experimenting to determine how it may track the precious stones from their initial production to their ultimate retail location.

This system hopes to ensure that customers and trade participants can easily track a diamond’s provenance and confirm its authenticity. In particular, the press release notes, Tracr “is focused on providing consumers with confidence that registered diamonds are natural and conflict-free.”

Read the full report here.

Coincheck Reports $5 Million Loss In Q3

Coincheck, the Japanese cryptocurrency exchange that suffered a $520 million hack in January, has reported increased losses for the third quarter of 2018. Monex Group, the Japan-based brokerage firm that acquired Coincheck following the hack, has released its financial results for Q3.

The group’s crypto asset segment, which reflects the Coincheck business, brought in revenue of 315 million yen, about $2.8 million, between July and September. Notably, that number represents a 66 percent decline compared to the previous quarter, during which Coincheck made about $8.4 million in revenue.

Although the costs for the past three months in the crypto segment have been reduced, Monex said the consequence of the hack led to an increased loss, which went up from $2.3 million in Q2 to $5.25 million (588 million Japanese yen) between July and September.

Read the full report here.

60% Of Americans Want Crypto Treated As Fiat

A new survey by blockchain-oriented research firm Clovr showed that 60 percent of respondents think that cryptocurrency should be treated like fiat currency in political elections. In the course of its research, Clovr surveyed 1,023 eligible voters registered in the U.S. for their understanding of what impact virtual currency could exert on the political process. Per the survey, almost 60 percent of the voters surveyed answered that crypto and the U.S. dollar should be treated the same, while only 21 percent of respondents said the opposite.

63 percent of the voters identifying as Republicans assumed that crypto was secure enough to be deployed for political purposes, and 52 percent of Democrats suggested the same. In regards to Independent voters, only 45 percent were reportedly comfortable with donations in crypto.

Read the full report here.

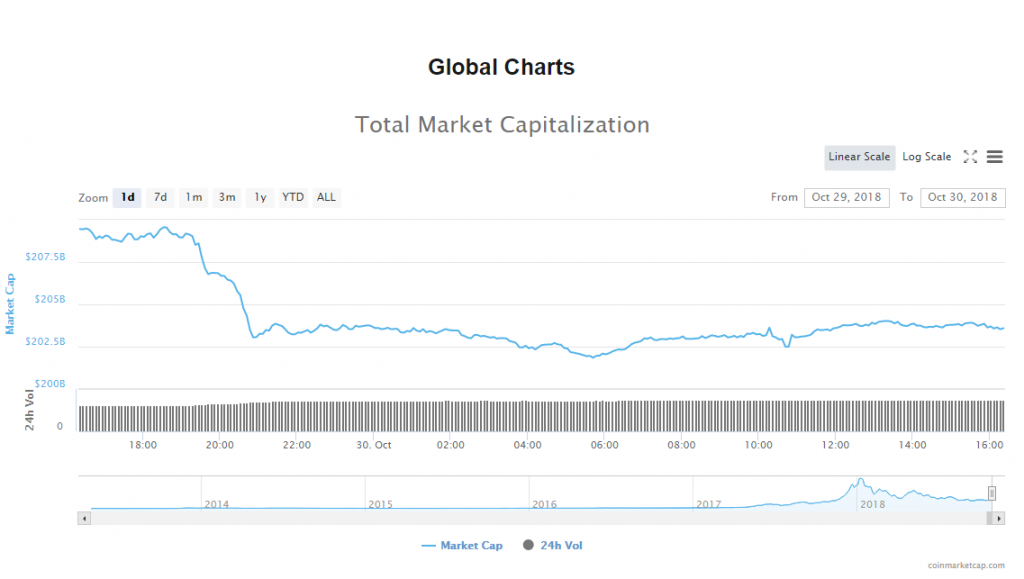

Total Market Cap: October 30

The volume of trade in the crypto market sat at $12.00 billion. The market’s capitalization, on the other hand, reached $203.50 billion.

Bitcoin Price Analysis: October 30

In the past 24 hours, Bitcoin fell 1.98% to trade at $6,346.57. The leading cryptocurrency’s trade volume trickled to $4.24 billion, while its market slid to $110.12 billion.

Ethereum Price Analysis: October 30

Ethereum’s price fell 3.46% to trade at $197.37. As for the altcoin’s trading volume, it reached $1.50 billion; whereas its market capitalization hit $20.31 billion.

State of the Top 10 Cryptocurrencies: October 30

In the past 24 hours, most prices plummeted. Meanwhile, Monero continues to dethrone TRON at the 10th spot.

- Bitcoin’s market price fell 1.98% to $6,346.57, and its value in the market is $110.12 billion.

- Ethereum’s market price fell 3.46% to $197.37, and its value in the market is $20.31 billion.

- XRP’s market price fell 3.17% to $0.443889, and its value in the market is $17.85 billion.

- Bitcoin Cash’s market price fell 4.72% to $417.63, and its value in the market is $7.28 billion.

- EOS’ market price fell 4.71% to $5.14, and its value in the market is $4.66 billion.

- Stellar’s market price fell 2.53% to $0.224749 and its value in the market is $4.25 billion.

- Litecoin’s market price fell 4.93% to $49.30, and its value in the market is $2.91 billion.

- Tether market price jumped 0.16% to $0.995582, and its value in the market is $1.82 billion.

- Cardano market price fell 3.64% to $0.069799, and its value in the market is $1.81 billion.

- Monero dethroned TRON at the 10th spot, but its market price fell 1.94% to $101.87, and its value in the market is $1.68 billion.