3 Simple Steps to Trade Cryptocurrency Derivatives on Bybit [Updated 2019]

Bybit is a global cryptocurrency derivatives trading platform that aims to give rivals Bitmex and Deribit a run for their money. BTC, ETH, EOS, and XRP perpetual futures contracts can be traded against USD on the Singapore-based Bybit, which was founded by a team with a strong Forex background. This experience has played into their decision to craft a platform underpinned by a robust trading engine that can serve 100,000 TPS. Coupled with a commitment to maintaining round the clock customer service via live chat, and Bybit has a few strings to its bow.

Poor customer service and sudden downtime are two of the biggest gripes among crypto derivatives traders. If Bybit can succeed where other platforms have failed in this regard, it has a chance of carving out a respectable market share. If you’re interested in seeing how Bybit stacks up against the competition, the following walk-through will show what the crypto derivatives platform has to offer.

Step 1: Getting Started

Head to Bybit.com and enter your email address and create a strong password. You’ll then be emailed a six-digit authentication code which is valid for five minutes. Enter it where prompted, together with your new login details and you’ll be taken straight to the BTC-USD trading screen with no messing around.

-

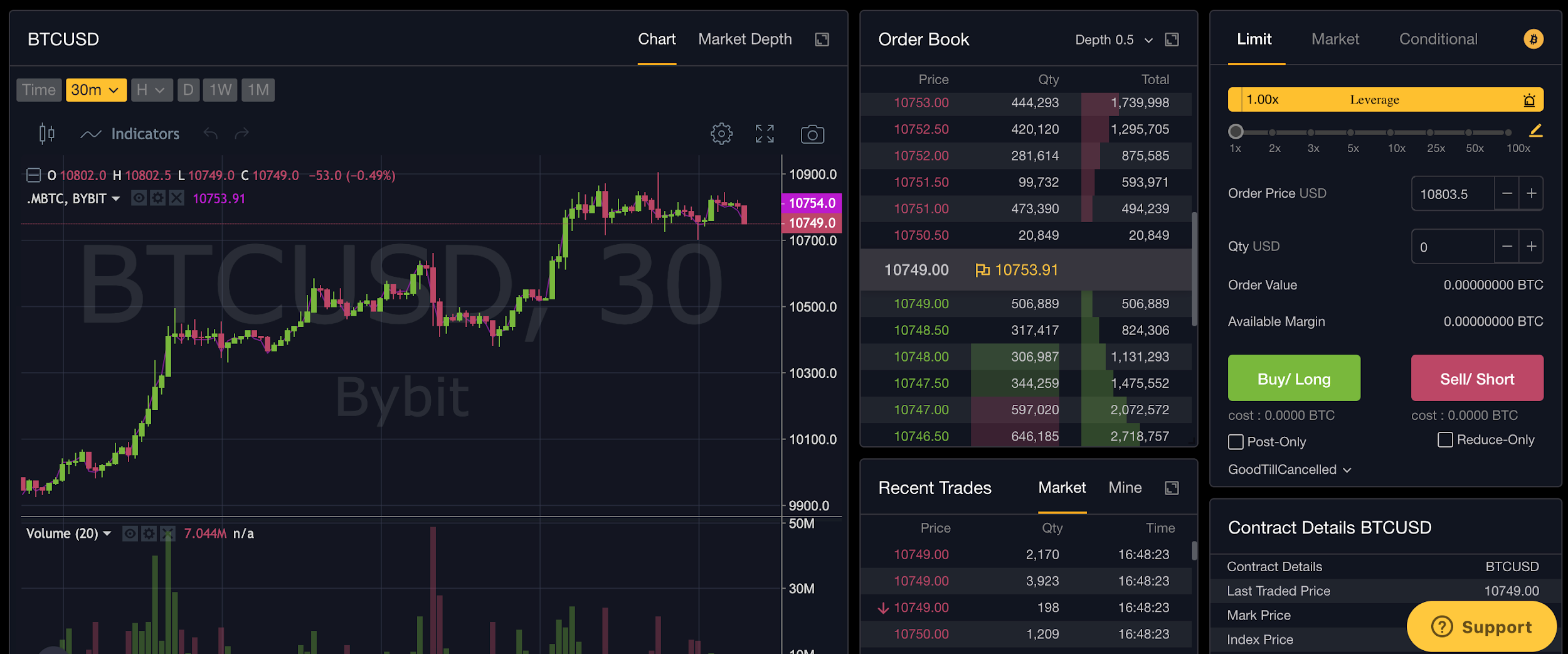

BTC-USD perpetual trading layout.

This is useful for future visits, but since this will be your first time on the site, you’ll need to deposit funds before you can trade and may also wish to adjust your security settings. It’s advisable that you set up two-factor authentication, which can be done by clicking the top-right menu button followed by “Account & Security” from the drop-down menu.

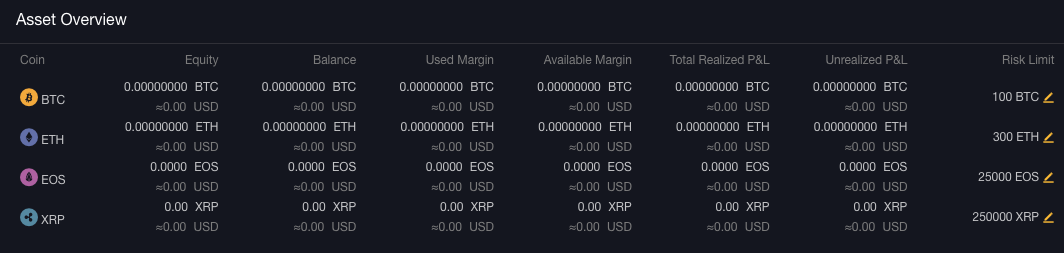

When you’ve done that, click the button marked “Assets” in the top left navigation menu. You’ll be shown the balance of your wallets (currently BTC, ETH, EOS and XRP), and when you click the corresponding “Deposit” button a wallet address will be created and displayed as a QR code as well as in text. Once you’ve deposited funds into your Bybit account and the transaction has confirmed on the network, you’ll be ready to begin trading.

Step 2: Finding Your Way Around

Click the “Trade” button found in the top left menu and you’ll be taken to the orderbook for the BTC/USD perpetual swap, which we’ll be using for the purposes of this walkthrough. If you’d like to trade a different pair, however, click on “BTCUSD Perpetual” in the top menu to see all of the available options.

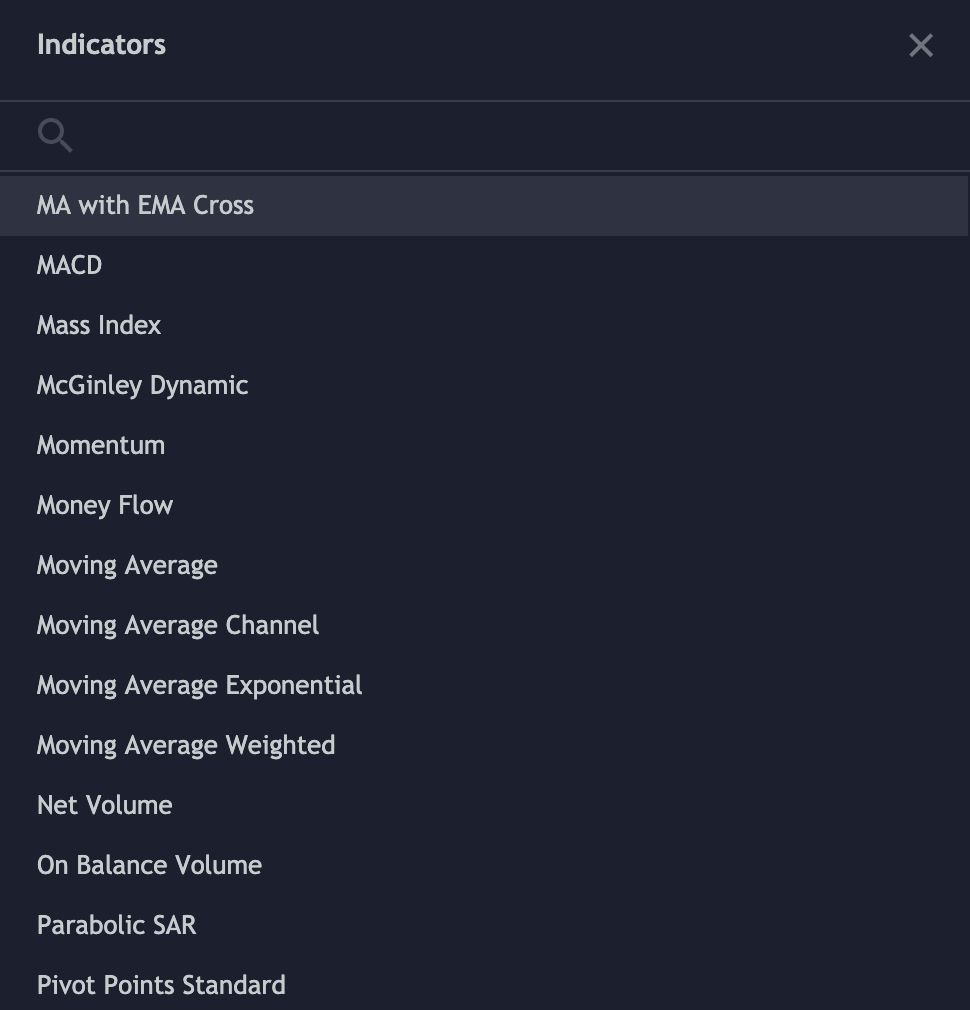

If you’ve traded cryptocurrency before, the Bybit interface should feel familiar. It’s more Binance than Bitmex: intuitive, with a clean and pleasing UX. The BTC-USD chart is displayed on the left, with the usual time intervals, ranging from a minute to a month. Thanks to TradingView integration, an array of technical indicators is available, while there are clearly marked buttons for viewing things like market depth. Volume is displayed in a bar graph below the main BTC-USD chart.

-

A handful of the many technical indicators available at Bybit.

The order book sits in the top center of the page, with sell orders denoted in red and buys in green. Below that, a separate central column displays recent trades. That just leaves two more columns to explore to the right of the screen: order settings at the top, and contract details below that, in this case for BTC-USD. Here you can adjust the type and size of the trade you wish to place, and apply leverage of up to 100x. You can set Limit, Market, and Conditional trades, and can go long or short on the asset in question.

Scroll further down the page and you’ll find, below the fold, two additional central columns and two side columns. In the right hand side bar, you can view recent market activity for the pairs listed on Bybit, and below that sits a Help section that includes a beginner’s guide and FAQ. That just leaves a section marked Asset Overview that runs across the bottom of the main column on the asset trading page. Here you can view the status of all of your open positions and balances including Available Margin, Used Margin, Total Realized P&L and Risk Limit.

-

The asset overview section displays the current status of all your active trades.

Step 3: Placing a Trade

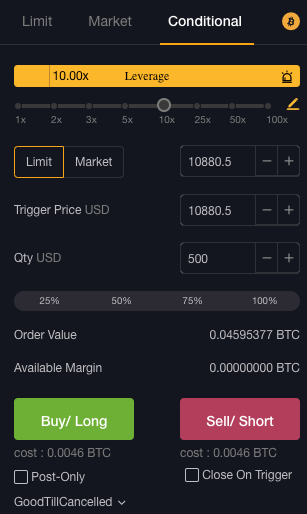

To place an order, navigate to the order execution box in the top right of the screen, where you can adjust your settings before going long or short by clicking the green or red buttons respectively. Most of the time you’ll want to set a Limit order, but there may be cases where a Market or Conditional order is preferable. In the case of the latter, for instance, you can set a buy for once BTC breaks through a key resistance area, or once it falls to a target support level.

Contracts are priced at 1 USD, which makes it simple to calculate your order size. Drag the slider below the yellow “Leverage” button to toggle from 1-100x leverage. As you do so, the cost of the order you’re about to place will be updated below the red and green buy/sell buttons. Before you place your order, check the Contract Details box, where you can view various metrics including the funding rate, which pays out every eight hours and which, at the time of conducting this review, was set at 0.01%. If your contract is still open when the next funding rate window opens, this is how much you’ll be charged to maintain your position.

-

In this example, a trade of 500 BTC contracts at $1 each is set with 10x leverage.

Finally, decide whether the type of order you wish to place is Good Till Cancelled (which is the default setting) or alternatively Immediate Or Cancel or Fill Or Kill. Then click the Long or Short button and your order will be executed, and its current status displayed in the Positions box below the BTC-USD chart.

And that’s it: you’ve successfully placed your first order on Bybit. If you’re new to trading crypto derivatives, be sure to familiarize yourself with the risks and rewards at stake, and be aware that in the event of sudden and adverse price movements, your position could be liquidated. For traders who know what they’re doing, however, and are seeking a reliable and responsive platform on which to execute leveraged orders, Bybit ticks the right boxes.